The Tax Cuts and Jobs Act of 2017 had nearly no impact on decreasing compensation of high executives at corporations regardless of guarantees on the contrary, in response to a brand new examine.

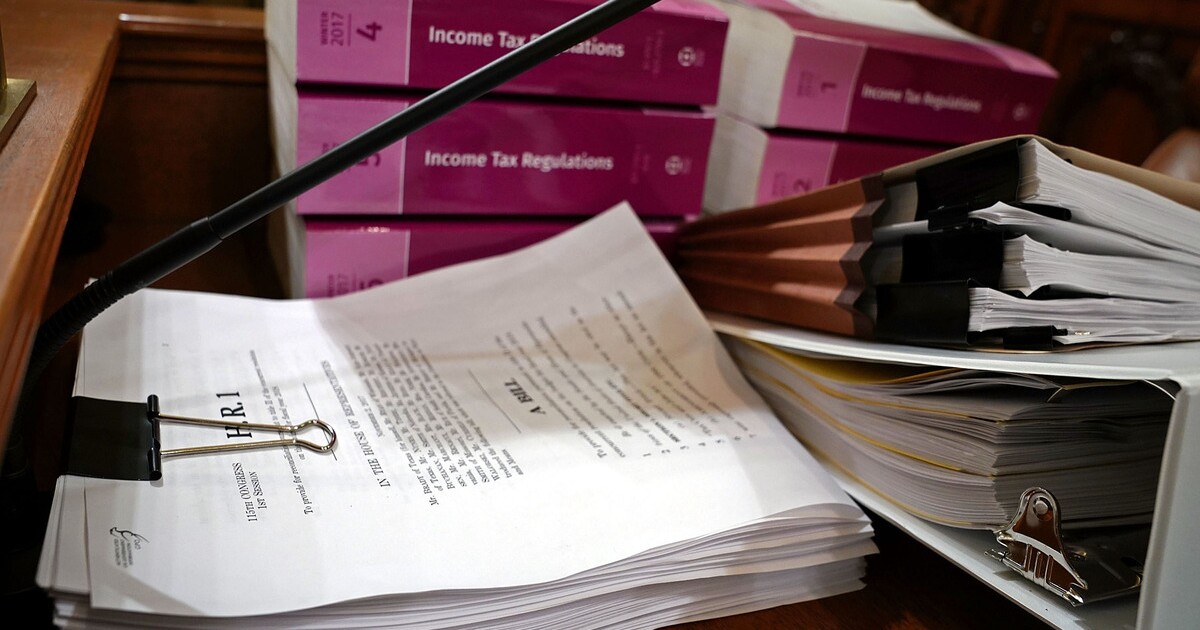

The examine identified that one of many many provisions of the wide-ranging tax reform package deal that was pushed by Congress by Republicans through the Trump administration was imagined to curb CEO pay by repealing a long-standing exemption that enabled corporations to deduct massive quantities of certified performance-based pay. Nonetheless, the brand new analysis discovered the change has had little affect, with CEO pay both staying the identical or rising after the TCJA made it extra expensive to award executives with excessive ranges of compensation.

One of many purported targets of the laws was to maneuver top-executive compensation away from stock-based compensation and efficiency pay that would result in an emphasis on short-term outcomes and towards cash-based mounted compensation.

For the educational examine, a bunch of professors at Indiana College, the College of Texas and the Chicago Sales space Faculty of Enterprise checked out CEO pay packages earlier than and after the tax coverage change, however discovered no proof that corporations affected by the regulation modified their complete compensation, compensation combine or pay-performance sensitivity.

“It’s very politically amenable proper now to say they’ll tax these companies and these executives and it should scale back earnings inequality, however our analysis — and that of others — means that taxes are simply not a sufficiently big stick to alter the construction or the magnitude of govt compensation,” mentioned Bridget Stomberg, affiliate professor of accounting and a Weimer School Fellow on the IU Kelley Faculty of Enterprise, in an announcement Monday. “We discovered no statistical results, which is counter to what Congress meant. We seemed very exhausting and see no proof of a discount in CEO pay.”

The examine seems on-line within the journal Modern Accounting Analysis. The opposite authors are Lisa De Simone, an affiliate professor of accounting on the College of Texas’ McCombs Faculty of Enterprise; and Charles McClure, an assistant professor of accounting at Sales space. Stomberg and De Simone additionally co-host the podcast “Taxes for the Lots.”

They identified that since 1994, publicly traded corporations had been typically topic to a $1 million-a-year cap on the quantity of top-executive compensation they may deduct from taxable earnings, however an exemption permitted them to deduct extra if the pay was linked to the corporate’s efficiency. Within the 2017 tax reform package deal, Congress diminished the company tax price to 21% from 35% and eradicated the exemption, limiting the deductibility of sure extremely compensated staff to solely $1 million.

Within the paper, Stomberg and her colleagues used a set of greater than 40 exams to look at adjustments in govt compensation from fiscal years 2017 to 2018, when the tax guidelines took impact. They employed a management pattern of corporations working beneath fiscal years, which had been affected later than corporations working beneath calendar years. They then scrutinized compensation in 2019 and 2020.

“Even three full years after the regulation took impact, we did not see any proof of a discount in CEO pay,” Stomberg said.

The outcomes counsel that taxes are usually not one of many important components behind govt pay and that tax regulation could also be comparatively ineffective at curbing govt compensation in response to earnings inequality. The discovering additionally has coverage implications as some lawmakers in Congress suggest a federal company tax surcharge linked to the CEO pay ratio. On the native stage, the cities of Portland, Oregon, and San Francisco have applied enterprise taxes linked to CEO pay ratios, which additionally has been proposed by a minimum of eight states.

“If Congress’ elementary assumption in regards to the relative significance of taxes within the design of govt compensation is overstated, its skill to shift present compensation practices by adjustments in tax coverage can be doubtless overstated,” mentioned the researchers. “Our outcomes and people from prior research counsel will increase in companies’ price of govt compensation do little to scale back its quantity. As a consequence, policymakers ought to rethink whether or not adjustments to the taxation of govt compensation are a viable path in the direction of addressing the perceived problems with extreme govt pay and inequality. Though our outcomes communicate solely to the results of the TCJA, we consider our outcomes can inform the broader debate on the efficacy of tax regulation to affect govt compensation.”