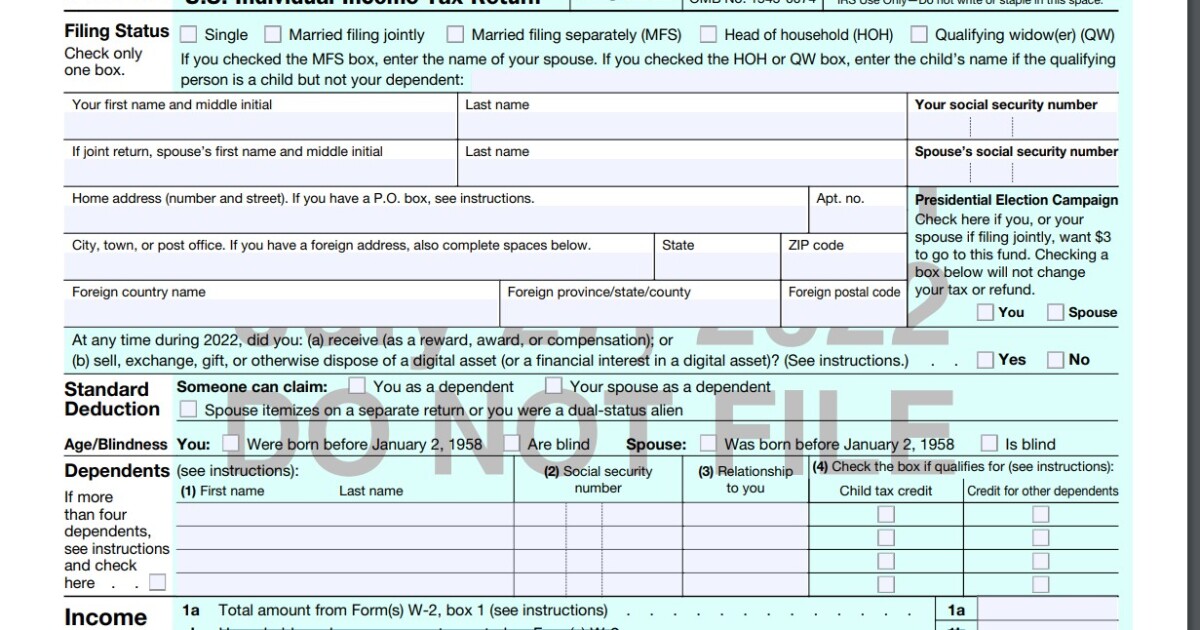

The Inner Income Service has launched a draft model of the Kind 1040 for subsequent tax season, with an expanded query about digital currencies, now known as digital property, together with different modifications on drafts of that kind and associated kinds and schedules.

Final tax season, the query was: “At any time throughout 2021, did you obtain, promote, change, or in any other case eliminate any monetary curiosity in any digital forex?” The draft kind for tax yr 2022 says, “At any time throughout 2022, did you: (a) obtain (as a reward, award, or compensation); or (b) promote, change, present, or in any other case eliminate a digital asset (or a monetary curiosity in a digital asset)? (See directions.)” Presumably, that is to embody different types of digital property apart from cryptocurrency, comparable to nonfungible property, or NFTs, a lot of which rose quickly in worth final yr earlier than seeing sharp declines. Presumably there will likely be extra detailed directions forthcoming from the IRS.

The Wandering Tax Professional weblog features a abstract of among the modifications within the kind in addition to among the different schedules. Blogger Robert Flach famous that the “2022 Schedule A seems to be precisely the identical because the 2021 Schedule A.” He discovered that Line 1 to report wages, salaries, suggestions, and so on, from Kind W-2 has expanded to 10 “sub-lines” to individually report a mess of varied forms of wage-based revenue. These embrace family worker wages not reported on Kind(s) W-2, tip revenue not reported on line 1a, Medicaid waiver funds not reported on Kind(s) W-2, taxable dependent care advantages from Kind 2441, line 26, employer-provided adoption advantages from Kind 8839, line 29, wages from Kind 8919, line 6, different earned revenue, and a nontaxable fight pay election.

“Line 6c below the reporting of Social Safety advantages has been added as a checkbox to point the taxpayer is making a ‘lump sum election’ for Social Safety reporting,” Flach wrote.

Line 12b from final yr for claiming the “non-itemizer” charitable deduction has been eliminated, he famous, because the deduction has expired and isn’t obtainable this tax season. Equally, the sub-lines for Line 27, the place the Earned Revenue Tax Credit score is claimed, have been eradicated because the expanded EITC provisions below the COVID aid laws have ended. Nonetheless, not less than one byproduct of the COVID aid laws, Line 30, which was used final yr for the Restoration Rebate Credit score continues to be on the 2022 Kind 1040, nevertheless it’s labeled “Reserved for future use.”

Flach famous that the ultimate model of the shape is more likely to differ from this preliminary draft model, particularly if Congress passes retroactive tax laws late within the yr, because it usually does.

The draft model of the 1040 is accessible right here, and different draft kinds and schedules might be discovered right here.

Schedule 1, Further Revenue and Changes to Revenue, seems to have a number of further traces added for subsequent yr below Further Revenue, together with scholarship and fellowship grants not reported on Kind W-2, nontaxable quantity of Medicaid waiver funds included on Kind 1040, line 1a or 1d, pension or annuity from a nonqualified deferred compensation plan or a nongovernmental part 457 plan, and wages earned whereas incarcerated.