E-commerce gross sales have skyrocketed as extra individuals store remotely, spurred by the pandemic. However this surge has additionally led fraudsters to make use of the chance to rip-off retailers and clients, based on David Sutton, director of analytical expertise at fintech firm Featurespace.

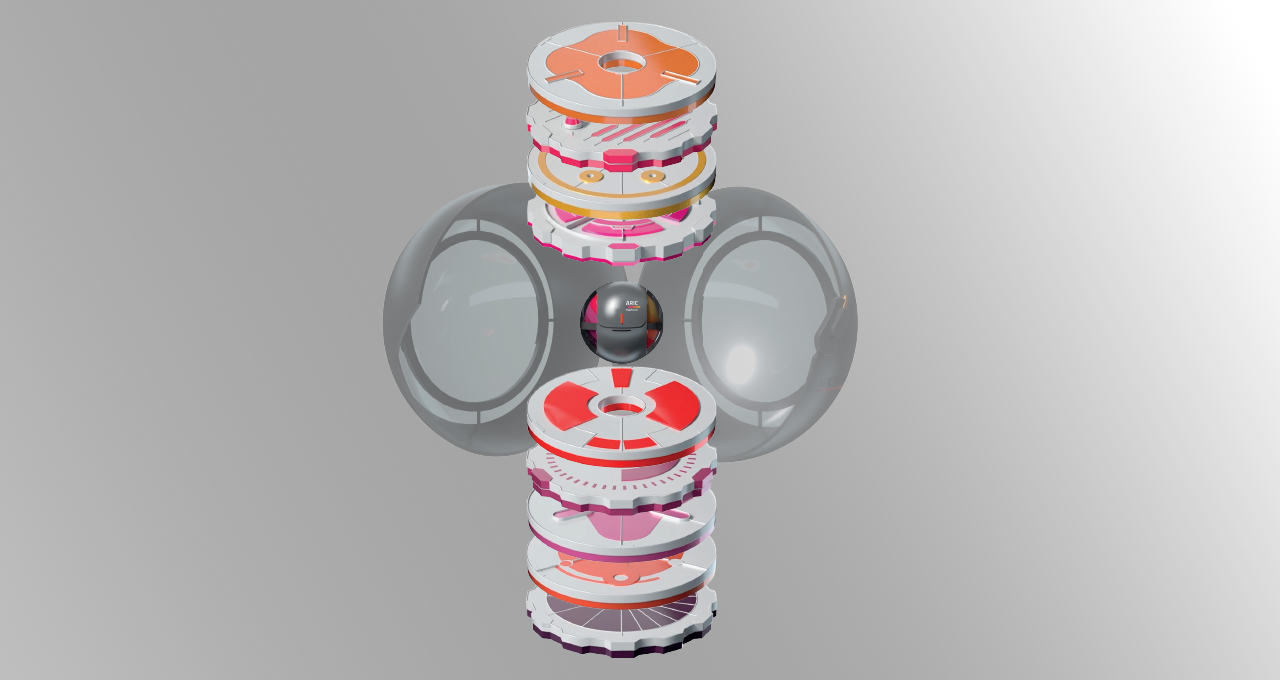

The corporate, headquartered within the U.Okay., has developed AI-powered expertise to extend the velocity and accuracy of fraud detection and prevention. Known as ARIC Threat Hub, the platform makes use of deep studying fashions educated utilizing NVIDIA GPUs to tell apart between legitimate and fraudulent transactional habits.

“On-line transactions are a primary goal for criminals, as they don’t must have the bodily card to transact,” Sutton stated. “With compromised card particulars available by the darkish internet, fraudsters can goal massive volumes of playing cards to commit fraud with little or no effort.”

ARIC Threat Hub builds advanced behavioral profiles of what it calls “real” clients by converging transaction and third-party information from throughout their lifecycle inside a monetary establishment.

Fraud prevention has historically been restricted by delays in detection — with clients being notified solely after cash had already left their financial institution accounts. However ARIC Threat Hub in lower than 30 milliseconds determines anomalies in even the slightest adjustments in a buyer’s habits. It compares every monetary occasion of a buyer to their profile utilizing AI-powered adaptive behavioral analytics.

The expertise is deployed throughout 70 main monetary establishments globally — and a few have reported that it’s blocked 75% of its fraud assaults, Sutton stated.

ARIC Threat Hub helps these establishments establish legal habits in near-real time — lowering their monetary losses and operational prices, and defending greater than 500 million customers from fraud and monetary crime.

Featurespace is a member of NVIDIA Inception, a free, international program that nurtures cutting-edge startups.

100x Mannequin Coaching Acceleration With NVIDIA GPUs

Featurespace acquired its begin over a decade in the past as a machine studying consultancy. It was rooted within the analysis of College of Cambridge professor Invoice Fitzgerald, who was trying to make a business impression with adaptive behavioral analytics, a expertise he created.

Utilized to the monetary companies trade, the expertise rapidly took flight.

“With this expertise, you might construct a deep studying mannequin that learns from and understands what kinds of actions an individual usually takes in order that it will possibly search for adjustments in these actions,” stated Sutton.

Up to now, it could take weeks for Featurespace to arrange and practice totally different deep studying fashions. With NVIDIA A100 Tensor Core GPUs, the corporate has seen as much as a 100x speedup in mannequin coaching, Sutton stated.

“In comparison with after we used CPUs, NVIDIA GPUs give us a extremely fast research-to-impact loop,” he added. “It’s electrifying to work with one thing that may have an effect that rapidly.”

Within the time that they used to run simply 10 trials, Featurespace’s researchers and information scientists can now run hundreds of assessments, which bolsters the statistical confidence of their outcomes, enabling them to deploy solely the most effective, tried-and-tested fashions.

Sutton stated even a 1% enhance in fraud detection found utilizing the deep studying mannequin may save massive enterprises $20 million a yr.

Featurespace usually makes use of recurrent neural-network architectures on information from streams of transactions. This mannequin pipeline permits a person’s new actions to be assessed by way of behavioral context realized from their previous actions.

Monetary Fortifications for All

Featurespace’s deep studying fashions have prevented all kinds of fraud, together with those who contain bank cards, funds, functions and cash laundering.

The ARIC Threat Hub interface is customizable, so clients can choose essentially the most appropriate subset of elements for his or her particular wants. Customers can then change analytics settings or evaluate suspicious circumstances. If upon evaluate a case is deemed to be a false constructive, the deep studying mannequin learns from its errors, growing future accuracy.

Featurespace expertise has been making a splash for fee processing firms like TSYS and Worldpay — in addition to massive banks together with Danske Financial institution, HSBC and NatWest.

As Sutton put it, “Featurespace is utilizing AI to make the world a safer place to transact.”

“Our work is what brings lots of people at Featurespace into the workplace each morning,” he stated. “If you happen to’re in a position to scale back the amount of cash laundering on the earth, for instance, you may flip crime into one thing that doesn’t pay as a lot, making it a much less worthwhile trade to be in.”

Featurespace will host classes on stopping fraud, cash laundering and cryptocrime at Cash 20/20, a fintech convention working Oct. 23-26 in Las Vegas.

Register free for NVIDIA GTC, working on-line Sept. 19-22, to study extra in regards to the newest expertise breakthroughs for the period of AI and the metaverse.

Subscribe to NVIDIA monetary companies information.