Company tax departments are having a tough time discovering and retaining expertise with the fitting abilities, and utilizing the info they’ve out there.

Over half of Fortune 500 company tax departments aren’t making use of their tax knowledge to organize for numerous eventualities, together with M&A, audits and predictive modeling, in keeping with a brand new survey from KPMG.

The Large 4 agency surveyed 300 C-suite leaders at firms valued at $1 billion or extra, and located they are not actually leveraging tax knowledge to assist align with environmental, social and governance technique (68%), put together for or reply to audit inquiries (64%), inform decision-making for M&A (65%), inform total enterprise technique (60%), or do predictive modeling (56%).

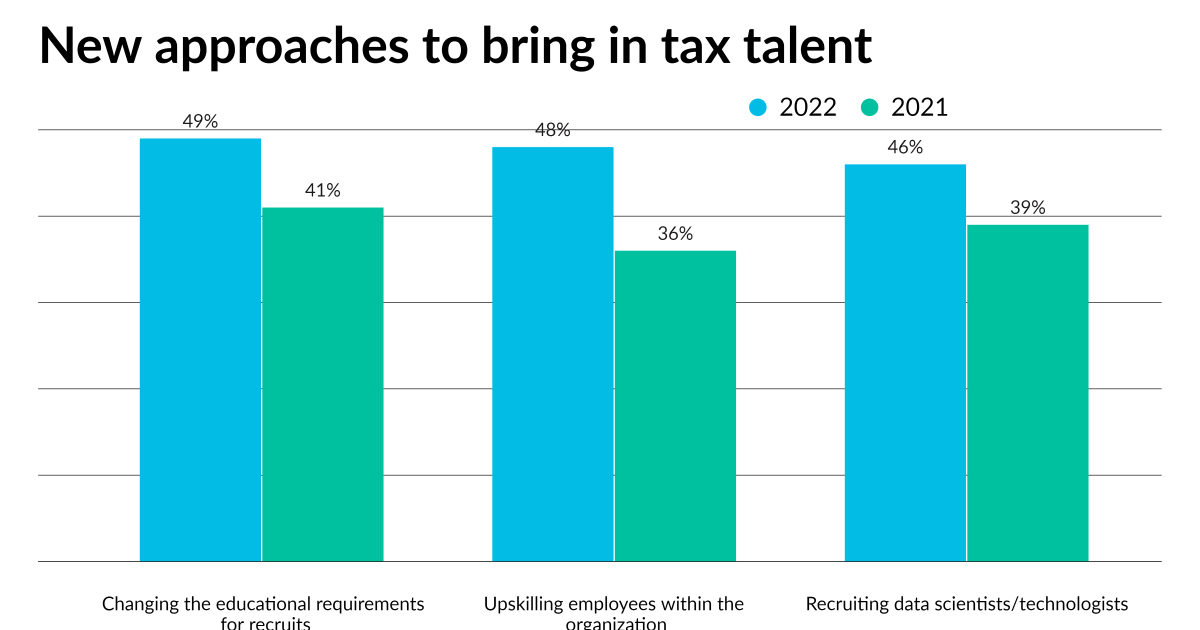

One of many predominant issues has been discovering and preserving expertise, with 79% of the respondents saying it has been tough to retain tax expertise this previous yr, whereas 53% indicated it has been tough to recruit expertise with the fitting talent set. Fewer of the C-suite executives polled mentioned they’re prepared to outsource or co-source their tax division in 2022, at 43%, in comparison with 65% in 2021. As a substitute, 48% are extra inclined to upskill workers, a rise of 12 proportion factors from 2021. To usher in new tax expertise, 49% of the respondents mentioned they’re altering the tutorial necessities for recruits this yr, in comparison with 41% final yr.

“The massive takeaway, to sum it up, is change,” mentioned Greg Engel, vice chair of tax at KPMG, throughout a Twitter Areas occasion Wednesday. “It simply appears to be the continuous quantity of change we have seen in tax departments at firms. It is each what’s taking place with the instruments and the talents of their groups, the demographics of their groups are altering, after which we have got quite a lot of challenges within the market with tax reform and ESG and various outdoors influences inflicting the tax departments to essentially take into consideration the place they’re headed and what they should do with their instruments and their individuals.”

Almost half the respondents (46%) this yr ranked coding as the highest talent wanted to make sure at present’s tax division stays aggressive, in contrast with 28% in 2021, whereas 70% ranked scaling applied sciences corresponding to cloud, knowledge analytics and visualization as essentially the most related for tax expertise to know and use. Two-thirds (66%) of the respondents ranked rising applied sciences corresponding to synthetic intelligence, blockchain, metaverse and quantum computing because the second most essential, adopted by an understanding of spreadsheets and databases at 58%. Most leaders (57%) nonetheless choose to rent tax professionals who’re capable of study know-how versus tech professionals who can study tax.

“There’s an overriding message {that a} abilities hole inside our tax occupation is rising,” mentioned Brad Brown, chief know-how officer for tax at KPMG. “I believe that is pushed as we’re beginning to see the function of know-how taking middle stage. The C suite is basically struggling not solely to seek out expertise however to seek out the fitting abilities inside that expertise.”

Company tax departments are additionally investing in additional numerous hires, with a slight 54% majority of survey respondents setting targets for outreach to underrepresented teams in 2022 (up eight proportion factors from 2021), and the same 55% majority indicating their organizations are recruiting from nontraditional faculties and universities this yr (however that is up 10 proportion factors from 2021). In the meantime, an 83% majority of the respondents are seeing extra feminine candidates and hires be part of the occupation in comparison with earlier years, whereas 72% are noticing extra candidates and hires coming from underrepresented teams.

Regardless of the recruiting challenges, firms aren’t essentially prepared to usher in outdoors assist to take care of their tax obligations.

“One of many issues that actually stood out for me was the C-suite’s willingness to outsource or co-source their tax division yr over yr,” mentioned Rema Serafi, nationwide managing accomplice for tax at KPMG. “One factor is obvious: The Nice Resignation didn’t spare our occupation within the consulting trade nor did it spare tax departments. The very fact is that company tax departments are nonetheless going through a big expertise dilemma. Despite the fact that greater than two-thirds of the respondents had issue retaining expertise prior to now yr, and 81% are seeing much less expertise be part of the occupation total, we nonetheless noticed yr over yr a 22% drop over 2021 within the C-suite’s willingness to outsource or co-source.”