ridvan_celik

Introduction – the query that sparked this

This text might be a bit of totally different from my regular, high-quality dividend progress valuation-based articles. Lest you be upset, in case you learn by means of till the tip, or simply skip there, I’ve included a bonus part, with a list of the highest-quality dividend progress shares, and my evaluation of their present valuations primarily based on Historic and Future-derived truthful values, in addition to present analyst estimates.

Like with many moments of significance in my life, this chance to consider my present way of living offered itself when my excessive school-aged daughter requested me what I anticipate she thought was a easy query: “Dad, how do you spend money on shares?”

My speedy reply was what you would possibly anticipate, one thing alongside the traces of you’re too younger to fret about investing, it’s essential to be centered on grades and faculty and different extra vital stuff. Nonetheless, this query caught with me and saved coming again. It made me recall my investing schooling, and particularly how my journey was probably more durable than it actually wanted to be due to my lack of somebody to supply me with a easy basis. My circle of relatives did some issues nicely – educating me the significance of prudent dwelling, budgeting, and primary monetary acumen from an early age, nevertheless, my first forays into precise investing had been a lone affair.

Background – my early investing schooling

After I was in my early 20s and had my first good paying job that put me ready to have a bit of discretionary cash, I made a decision I wished to take a position a few of that cash. I knew that my dad and mom and grandparents did some investing, however once I would ask, I’d usually get the identical reply I initially gave my daughter, you’re too younger, you may have different issues to fret about, and possibly, extra considerably, investing is dangerous. So, I set out alone to find out about investing. This was the very early 2000s on the peak of dot-com mania.

The place did I flip for my investing schooling? I began watching CNBC and listening to the speaking heads. I additionally walked right into a random, strip mall monetary advisor workplace for assist. Moreover, I did pay some consideration to my notion of the corporate I labored for, and a few corporations that had been suppliers to that firm. This all resulted in me buying a excessive expense mutual fund from my new monetary advisor, opening a excessive expense brokerage account – as a result of I’d been advised that it was price the additional expense to get the higher service they supplied, and investing in three totally different particular person shares.

The mutual fund turned out to be a dud – efficiently pulling many charges from me for an extended time period, with out producing a lot in the way in which of tangible outcomes. The three shares included some inventory within the firm I labored for that produced a high-single digit return for me, and paid a pleasant dividend, whereas I owned it. The second inventory was in a provider for the corporate I labored for that I noticed an activist investor take a giant stake in on the speaking heads present, and which subsequently went by means of two bankruptcies, which successfully worn out my fairness. The third inventory was a expertise inventory beneficial by my monetary advisor, that through the dot-com bust misplaced about 80% of its worth and took many years to get better.

All advised, I misplaced a good portion of the preliminary cash that I invested. Trying again, this was a small amount of cash, and with hindsight, I’m glad I realized the teachings that I did, once I did, regardless of how arduous they had been on the time. These painful classes confirmed me the significance of being extra educated in investing. Additionally they supplied the primary foundations in my investing technique: valuation issues, high quality is vital, watch out who and what you take heed to, charges eat returns, dividends are good, and getting wealthy rapidly is extra probably luck than ability however getting wealthy slowly is a excessive likelihood consequence of a stable monetary and investing technique.

Going again to the query that despatched us off on this tangent, “Dad, how do you spend money on shares?”, as most dad and mom most likely want, I wish to share with my kids some insights that hopefully received’t take away all the chance for troublesome classes, however that will present a greater basis to construct upon than the speaking heads and strip mall monetary advisor did for me.

Technique – educating monetary and funding acumen

To assist my highschool and center school-aged kids study to spend money on a extra structured manner, I’ve devised a technique that I plan to observe with them to assist them alongside their journey. I’ll probably be receiving some bonus cash for a undertaking at work that has gone very nicely, and as a substitute of investing that cash in my very own accounts, I plan to take a position it of their monetary schooling, whereas educating them the next steps:

- Be taught primary private finance rules

- The mechanics of investing – opening and utilizing an funding account

- Deriving a listing of potential shares for additional investigation

- Straightforward evaluations of firm high quality

- Primary valuation rules – easy historic and future-looking valuation strategies

- Easy measures of threat

Be taught primary private monetary rules

My children don’t probably understand that they’ve already been attending the varsity of primary finance for a few years. That is an space that my dad and mom did nicely with for me, and that I’ve continued to observe with my very own children. This may not be a giant shock to many, however the faculty makes use of two practicums: dwelling inside your means, and dealing arduous.

We attempt arduous to set an instance for our children of dwelling inside our means, and we focus on it recurrently with them. We reside in a pleasant home, however have not upgraded with will increase in revenue. We drive good vehicles, however preserve them for a very long time, and carry out nearly all of the upkeep and repairs on them. For my driving-age daughter, it is a requirement for driving – studying methods to keep, and even restore her car. We put on good garments, however aren’t extravagant. If the children need the most recent fashions, we offer a manner for them to earn cash, and encourage them to purchase second-hand, or on sale.

Our children have additionally had chores since they had been younger. We do not purchase needs for them, aside from birthday and Christmas contributions, however do present a method for them to earn cash to save lots of for themselves. We even have helped them begin small companies, mowing lawns for neighbors, and babysitting. With the proceeds, along with saving for issues they need, we additionally require them to set small quantities apart for school and philanthropy.

Along with these practicums, I do imagine that extra formal schooling is vital. To assist with this facet of the technique, earlier than we transfer to the precise investing portion, I’ll require my children to learn two of my favourite private finance books: The Millionaire Subsequent Door by Thomas J. Stanley, and The Psychology of Cash by Morgan Housel.

The Millionaire Subsequent Door (themillionairenextdoor.com)

The Psychology of Cash (www.morganhousel.com)

I imagine that The Millionaire Subsequent Door does a superb job of highlighting the distinction between excessive web price and high-income life, and of displaying the distinction between being wealthy in look versus wealthy from a financially unbiased perspective. I imagine The Psychology of Cash follows on with this theme, however additional expounds on the significance of investing versus buying and selling – the thought of following a centered funding technique to accumulate wealth over time, versus making an attempt to get wealthy fast by means of hypothesis, timing, and momentum. Each of those are foundational to non-public monetary acumen, which I imagine is probably going much more vital than precise investing prowess.

The mechanics of investing

As soon as I really feel they’ve a basis in private finance, we’ll then transfer on to truly investing. I bear in mind one of many first hurdles I hit when making an attempt to determine methods to make investments, was even methods to do it. I ended up with a high-priced brokerage as a result of I didn’t know any higher and bear in mind being very intimidated by even opening an account. As such, a part of my technique in educating my children might be to stroll by means of opening an account.

I’ve appeared by means of a number of choices for what this ought to be and have determined that I’ll assist them open custodial brokerage accounts. We have already got 529 accounts arrange for them, and I don’t need these new investing accounts to be tied on to their future schooling, plus you may at all times do a 529 conversion rapidly and simply to realize that tax profit in case you do use it for schooling. There may be additionally the Roth IRA possibility, which has some pluses, however, in the end, I need these to be studying accounts, with out the strain of being for one thing particular, or with a selected timeline in thoughts.

For those who aren’t aware of custodial brokerage accounts, two sources of data that I discovered useful had been Vanguard’s clarification of the accounts they provide right here, and the reason from Investopedia right here.

Here’s a fast abstract:

Professionals

- Very versatile

- No tax affect if below revenue and reward limits

- No limits on contributions or withdrawals

Cons

- Relying on revenue, may affect taxes and future monetary assist

- Irrevocable – kids acquire full custody on the age of majority, and withdrawals previous to that have to be for the unique advantage of the minor

As a result of we plan to make use of this as primarily a studying software, and don’t plan for there to be important property in these accounts, we aren’t overly involved about potential tax implications (although I assume if the children transform investing geniuses, we might have to rethink). Additionally, as a result of we don’t anticipate these accounts to have important cash in them, we aren’t involved with the age of majority restriction. We would like the children to really feel like that is their cash that they get to manage and make investments, with out exceptions. We view this as an funding of their life schooling, greater than an funding of their direct funds.

Most brokerage corporations supply custodial brokerage accounts, and we’ll probably use Vanguard. I’ve all my accounts, the place I’ve a selection, with Vanguard as a result of I like their low charges, the possession construction that incentivizes effectivity and price focus, and the long-term funding strategy that they often espouse.

My ideas on this are most likely greatest summed up by the founding father of Vanguard, John Bogle who stated:

The place returns are involved, time is your pal. However the place prices are involved, time is your enemy.

The miracle of compounding returns is overwhelmed by the tyranny of compounding prices.

Deriving a listing of potential shares for additional investigation

The place to start out on this one? There are numerous sources and lists of nice corporations that it’s best to have a look at when deciding what to spend money on. You need to most likely not get your record from the speaking heads on TV, the frequent information headlines, and even out of your Uber driver, however the place do you have to get them?

My inclination for this train with my children is to have them begin with what they know. What corporations and types have they got good emotions about and really feel that they perceive?

Peter Lynch stated:

Your investor’s edge isn’t one thing you get from Wall Road specialists. It’s one thing you have already got.

You’ll be able to outperform the specialists in case you use your edge by investing in corporations or industries you already perceive.

The less complicated it’s, the higher I prefer it.

After they’ve thought of and listed a sequence of corporations or manufacturers that they like and be ok with, I’ll then share with them a couple of different lists of high quality corporations. I at all times like referring to the Drucker Institute rankings of America’s Greatest-Run Firms right here. I’m additionally a giant fan of David Van Knapp’s high quality rankings that FerdiS recurrently makes use of, equivalent to in his latest replace right here.

I’ll emphasize, as I share these lists, that for this preliminary foray into investing, I anticipate my children to stay with corporations that they already know one thing about and have heard of. Researching and studying about new corporations might be a longer-term investing alternative for the longer term. As soon as they’ve recognized someplace between 10 and 20 shares that they be ok with, we will proceed to the following steps.

Straightforward evaluations of firm high quality

Arguably some of the vital classes I really feel like I’ve realized over a few years is how vital it’s to spend money on corporations which might be top quality. As a long-term dividend progress investor, there may be nothing worse than taking a pay minimize as a result of an organization has needed to minimize their dividend. When this has occurred to me occasionally, in hindsight, I usually may have averted it as a result of the corporate was not as top quality because it ought to have been.

Peter Lynch stated,

Time is in your aspect while you personal shares of superior corporations.

Warren Buffett stated,

Time is the pal of a beautiful firm, the enemy of the mediocre.

To permit investments time to compound, they should have high quality corporations behind them that can stand the check of time. So, although the longer term is tough to foretell, these are the indications we will look to simplistically to get a really feel for the standard of the corporate.

The primary indicator of high quality I wish to search for is the credit standing. This isn’t foolproof, and never all corporations have one, however it is a good first-pass place to begin. For me, trying on the corporations that I’ve had good success with over an extended interval, I restrict my first move as Customary & Poor’s of A- or larger and Moody’s of A3 or higher. Each of those scores are accessible totally free with e-mail registration.

Moreover, Worth Line gives a Monetary Energy score for each firm that they cowl. I wish to search for a score of A or higher. Although Worth Line isn’t free, you may usually entry it by means of your library.

Morningstar gives Financial Moat and Capital Allocation scores for the shares they cowl. I exploit these extra for reference, however for these shares that don’t have a large moat, or exemplary capital allocation, I not less than ensure that I’m comfy with why. Once more, although Morningstar doesn’t supply these scores totally free, they will usually be accessed by means of your library.

Lastly, on a extra quantitative foundation, I like to take a look at least 5-year common and present Return on Fairness and Return on Invested Capital as indicators of aggressive power. These corporations which have excessive returns, and which were secure over an extended time period, which you’ll be able to decide by averages and present values, are probably top quality. I wish to see ROIC above 10%, and likewise wish to see ROE and ROIC which might be moderately shut collectively, since if ROE is way larger than ROIC, it may be an indicator that the corporate is counting on leverage to spice up returns, which might be an indication of threat or degradation.

Primary valuation rules – easy historic and future-looking valuation strategies

The place to go along with valuation? As all of us studying all these articles most likely admire, that is an intensive topic, with no apparent proper reply. The most effective we will hope to do is estimate probably outcomes with out probably having all the knowledge.

As Yogi Berra stated,

It’s powerful to make predictions, particularly concerning the future.

Nonetheless, by investing in high quality corporations with sustainable enterprise fashions over longer durations of time, we improve the probability of success.

As Warren Buffett stated,

It’s much better to purchase a beautiful firm at a good worth than a good firm at a beautiful worth.

Nonetheless, he additionally stated,

Worth is what you pay. Worth is what you get.

So how can we maximize the worth that we’re getting for the value that we’re paying?

John Bogle stated,

In the long term, investing isn’t about markets in any respect. Investing is about having fun with the returns earned by companies.

If we take into consideration why we’re investing to start with, we probably wish to put cash into an instrument that can use that cash to earn extra money for us than we might in any other case get. With investing in shares, we are actually investing in a enterprise. We wish to present cash to that enterprise, which it would then in flip make investments on our behalf to develop and produce future returns. Our expectation, as homeowners of the enterprise is that, for the funding we made, the enterprise will give us a share of future earnings and money flows.

With this in thoughts, the primary place I’d begin within the valuation studying journey is to consider present valuations in comparison with historic valuations. What does that imply although? If, by investing in a enterprise, we’re investing in a promise of future revenue and money circulation sharing, and if the value we pay dictates the share of these earnings or money flows, we wish to attempt to pay as little as doable for as a lot of a share as doable. One solution to assess that worth per share of profit is to take a look at pricing ratios versus historic averages. For the sake of first studying to take a position, we’ll deal with two of essentially the most direct ratios: the value to earnings (P/E) ratio, and the value to free money circulation (P/FCF) ratio. Earnings or revenue is the acquire that the corporate achieves by means of working the enterprise. Free money circulation very simplistically is the money left over after paying core bills. It’s a good indicator of how a lot cash the corporate has to pay again to traders.

So, how do you arrive at a valuation primarily based on these ratios? By evaluating the present ratio, often the Trailing Twelve Months (TTM) worth is used, to a historic common (I often use the 5-year common) – you may decide whether it is at present buying and selling at a premium (larger than) or low cost (decrease than) to the historic common. This isn’t excellent in that you would be able to’t be sure the inventory worth will revert to a imply. The corporate might be in decline, thereby deserving a decrease valuation, or it might be going by means of a legit turnaround, meriting a better valuation, however basically, this straightforward methodology, which could be very extensively used and subsequently considerably self-fulfilling, might be helpful to get an concept for truthful worth, or the value that you simply would possibly wish to probably pay, by ratioing the value to the relative distinction between the precise and common historic ratios.

One other very helpful, and common valuation to make use of particularly for dividend-paying shares is to match the present yield with the typical historic yield, and ratio the distinction to find out a possible truthful worth, like with the value ratios above.

That is all nice and nicely in case you imagine that historical past repeats itself, or that the funding will probably revert to the imply, however shouldn’t we additionally take into consideration what the inventory is probably going price primarily based on the longer term? The reply is, YES! With out entering into a number of the extra superior modeling that I truly use, and that I do know lots of you studying use, there are some easy methods to consider how the inventory is prone to carry out sooner or later.

First, the only supply I wish to go to for future-looking projections is analyst estimates for truthful worth or future costs. I don’t rely upon these completely, however they’re not less than an information level in my analysis. Sources equivalent to Looking for Alpha, Finbox, Morningstar, Worth Line, Tip Ranks, and Reuters are good sources. By evaluating the present worth to the truthful values or future costs from these sources, you may get a preliminary indication of how favorable the value could be towards future expectations. This can be a fast solution to discover probably favorably valued shares for additional evaluation. The decrease the present worth is in comparison with the estimate, the larger the margin of security might be for future returns. If the present worth is larger than the estimate, it might be a warning signal that it’s essential to watch for the valuation to come back again into line.

Second, many analysis experiences will record analyst estimates for long-term progress. Typically, the upper the projected progress, the upper valuation is prone to be as a result of traders are keen to pay extra for a rising share of future returns. In case your historic valuation appears affordable, and the projected progress is robust, that’s an indicator that primarily based on future projections, the valuation is affordable. To find out what might be thought of “robust” – I usually search for a progress price over not less than 7% (it is a actually unfastened rule of thumb), which is roughly in keeping with the market common, however then additionally have a look at the expansion price in comparison with historic projections. If the expansion price is in keeping with what has been projected traditionally, that could be a good signal. Whether it is larger, even higher. Whether it is decrease, you would possibly have to do some extra analysis to find out if the corporate could also be in decline, which implies the valuation will not be that enticing, or simply out of favor, by which case, it could be a hidden cut price. That is simpler stated than completed.

Third, going again to price-based ratios, the price-to-earnings progress (PEG) ratio, is commonly used to get an concept of how costly a inventory relies on future earnings progress. Typically, the decrease the PEG ratio, the much less you might be paying for that earnings progress.

Lastly, discounted money circulation evaluation is pretty sophisticated, and requires a number of estimates that may be troublesome to provide for a brand new investor (and even for us outdated traders), nevertheless, the idea is that by forecasting future earnings that an organization would possibly produce, and discounting them again to immediately’s {dollars} to account for inflation, after which placing in a price of return that you’re keen to simply accept, you may calculate a most worth it’s best to pay for these future earnings. Fortunately, there are good on-line calculators, and even good web sites, equivalent to finbox.com and gurufocus.com that can do the discounted money circulation evaluation for you and let you know what the reply is. They’ll even present the assumptions made as a part of the evaluation. It is usually probably that most of the analyst estimates above take into consideration a reduced cash-flow evaluation.

The ultimate facet of valuation it’s best to take into consideration is issue of security. This basically means as a result of we probably don’t know every part concerning the firm, what’s prone to occur to the corporate, and even about what is probably going going to occur within the broader market and financial system, we must always put an element of security towards the valuation that we provide you with. I usually use a 5-12% issue of security towards my valuations, to set the value I’m keen to pay, primarily based on how acquainted I’m with the corporate, and the way assured I really feel within the assumptions I needed to make within the valuations.

As soon as I’ve decided a traditionally derived truthful worth, and a future derived truthful worth, and utilized applicable security elements, I’ll then attempt to decide the last word worth I’m keen to pay. Earlier than I buy the inventory although, there may be another step I exploit.

Easy measures of threat

If we’ve good corporations that we perceive nicely, which might be top quality, and that we imagine are pretty valued, what extra do we want to consider earlier than we make investments our cash in these corporations? I wish to examine a couple of easy issues, since there may be at all times the chance there might be some surprises that I haven’t discovered myself.

First, I examine Looking for Alpha’s Issue Grades and Dividend Grades. I particularly deal with these areas within the grades which might be beneath common (C) because the grades are made relative to the sector of comparability. Simply because they’re low doesn’t essentially imply it isn’t worthy of my funding, however I attempt to verify the grade aligns with my understanding of the corporate, technique, and prospects.

Second, I learn latest articles on Looking for Alpha concerning the firm. I attempt particularly to search out articles on each side: the Bull (optimistic) aspect, to see if the explanations they suppose the corporate deserves funding match my very own, in addition to on the Bear (destructive) aspect, to see if there’s something I might need missed.

Third, I like to take a look at the present Quick Curiosity, which principally exhibits what number of different traders are betting the inventory will go down sooner or later, as a substitute of up. A excessive quantity right here (that is one other one the place evaluating to historic averages might be helpful) is usually a huge purple flag, and recommend you would possibly wish to watch for additional developments.

A well known secret practiced by essentially the most profitable traders associated to investing success and threat mitigation is to be a lazy investor. You’ll hardly ever time an funding completely. You should have investments that go down considerably after you purchase them. The worst factor you are able to do is to panic and promote your high-quality firm at a reduction to what you paid, the very best factor you may probably do is locate some extra money to purchase the corporate whereas it’s much more on sale – if it was that good of a deal while you purchased it, it have to be an excellent higher one now that it’s on sale. One of many largest destroyers of wealth, moreover extreme charges, is letting noise affect your investing selections, and subsequently turning into a dealer as a substitute of an investor.

Ken Fischer stated,

Time available in the market beats timing the market – virtually at all times.

Darcy Howe is attributed with saying,

[I]investing is sort of a bar of cleaning soap. The extra you deal with it, the smaller it will get.

Warren Buffett has usually stated,

Our favourite holding interval is without end.

Abstract

So, Dad, how do you spend money on shares? Investing isn’t very arduous, and opposite to what I used to be initially taught, is not even that dangerous, when you may have a technique and strategy it from the correct mindset. It does very a lot assist to have a stable monetary and funding basis. In the end, you might be shopping for a chunk of an actual enterprise that gives actual merchandise and / or companies. When you perceive the corporate, the corporate is top of the range, the shares are pretty priced, and the chance seems to be low, you may have probably discovered an important choice to put your cash to work. Maybe an important lesson although is the miracle of compounding. The longer you let a superb funding develop, the larger it would get, and it’ll get larger in a non-linear method. It typically takes an funding some time to end up. Peter Lynch suggests his greatest concepts take between three and 10 years to play out many occasions. So, until one thing drastic occurs to vary your preliminary opinion of the corporate, simply grasp on and benefit from the trip. The most effective batters and even the very best traders by no means bat 1000.

Bonus – Excessive-High quality Dividend Development Valuations Replace

Thanks for sticking with me for a simplistic primer in monetary and investing acumen. I’d love to listen to any suggestions or concepts you may have for serving to new traders study to take a position. I hope that my kids will discover this train of some worth, and that they are going to be on a stronger preliminary foothold than I used to be once I began my journey a few years in the past.

In the event that they do take up this problem and full the steps in my course of, I’ll write future articles about what they spend money on – I am truly actually myself to see if they supply me with a brand new perspective. I plan to supply little or no steering on the precise investments, simply on the method to select them. The one factor I plan to do as a part of managing their custodial account is to have them clarify to me any causes for making modifications. I wish to practice them to be long-term-focused traders, however I additionally don’t wish to rob them of studying by means of expertise.

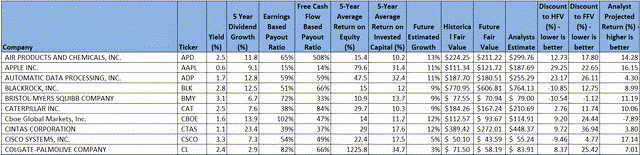

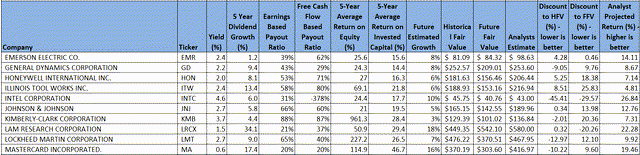

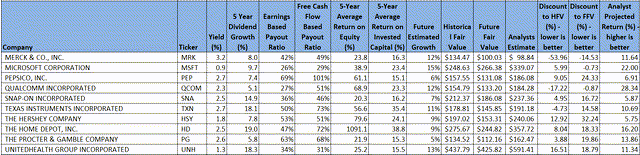

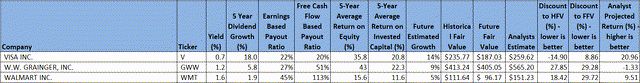

As a reward for sticking with me, I’m together with my most up-to-date evaluation of a number of the highest high quality, dividend progress inventory valuations for the shares I monitor, utilizing some extra subtle evaluation and modeling than mentioned above.

As I’ve described in earlier articles, I wish to calculate a good worth in two methods, utilizing a Historic truthful worth estimation, and a future-looking truthful worth estimation. The Historic Honest Worth is solely primarily based on historic valuations. I examine 5-year common: dividend yield, P/E ratio, Schiller P/E ratio, P/Guide, and P/FCF to the present values and calculate a composite worth primarily based on the historic averages. This provides an estimate of the worth assuming the inventory continues to carry out because it has traditionally. I additionally wish to perceive how the inventory is prone to carry out sooner or later, so make the most of the Finbox truthful worth calculated from their modeling, a Cap10 valuation mannequin, FCF Payback Time valuation mannequin, and 10-year earnings price of return valuation mannequin to find out a composite Future Honest Worth estimate.

Moreover, I collect a composite goal worth from a number of analysts, together with Reuters, Morningstar, Worth Line, Finbox.com, Morgan Stanley, and Argus. I wish to see how the present worth compares to analyst estimates as one other knowledge level, and as considerably of a sanity examine to my very own estimates.

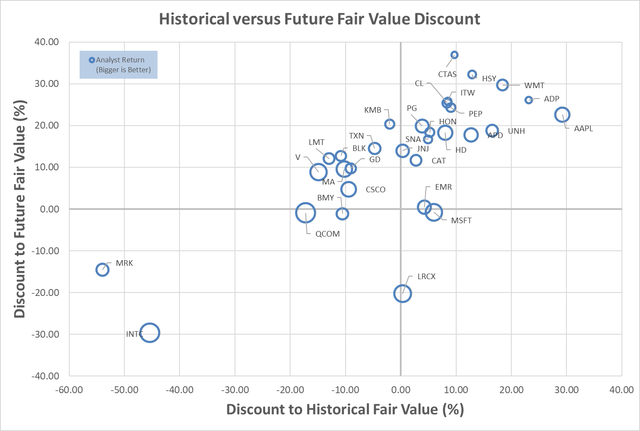

Plotting three variables on one plot is hard however utilizing a bubble plot permits us to visualise three variables by plotting the Historic truthful worth versus the Future Honest Worth on a regular x-y chart, after which use bubbles to signify the scale of low cost relative to analyst estimates.

Creator calculation of Historic and Future Honest Worth, analyst estimates

This chart is insightful when you perceive methods to interpret it. What we’re searching for are shares which might be buying and selling at a reduction to each the Historic Honest Worth and the Future Honest Worth. So, these shares which might be farther to the left, and farther to the underside, are probably the shares buying and selling on the largest low cost to truthful worth. This might be the underside left quadrant of the graph. Moreover, these shares with the most important bubbles are the shares which might be buying and selling on the largest low cost to analyst estimates, so in principle, shares within the decrease left quadrant that even have giant bubbles, ought to be very respectable candidates for funding.

Based mostly on the chart, Intel Company (INTC), Merck & Co Integrated (MRK), QUALCOMM Integrated (QCOM), and Bristol-Myers Squibb Firm (BMY), all seem like buying and selling at reductions to each Historic and Future Honest Worth estimates and could also be good candidates for additional investigation. Lam Analysis Company (LRCX) continues to be certainly one of my favorites, and likewise appears to be attractively valued. You’ll be able to learn concerning the extra in-depth evaluation I did on Lam Analysis right here, and get a really feel for my regular articles. It’s getting a bit of dated from a valuation perspective, however the technique and enterprise commentary are nonetheless related.

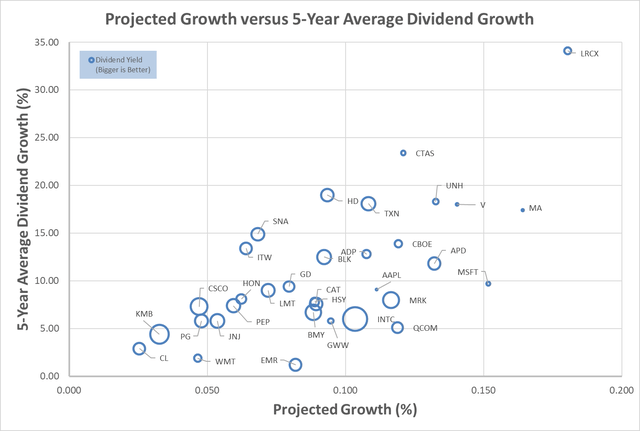

Being a dividend progress investor, I wish to search for these corporations which might be rising strongly, supply an affordable dividend yield, and likewise present the potential to proceed the dividend progress. Let’s have a look at one other chart that mixes these. The projected progress is a composite progress estimate primarily based on historic and future progress metrics together with: 5-year common EBITDA progress, EBITDA 5-year progress forecast, 5-year common dividend progress, 5-year change in shares excellent, Analyst long-term earnings progress forecasts, Ahead Price of Return forecast, and Internet Earnings to Shareholder progress price. I understand that that is fairly the assortment of inputs, however I exploit all of them as indicators of future dividend progress and sustainability.

Projected Inventory Development, Dividend Development and Yield (Finbox, Creator’s Evaluation)

To maintain you in your toes, with this chart, we now wish to have a look at the upper-right quadrant. We’re searching for these corporations which have the fascinating mixture of excessive dividend progress and excessive projected progress, so these farthest up and to the correct. Moreover, the scale of the bubble exhibits the relative present yield, with the bigger bubbles belonging to corporations with larger present yields. It isn’t an actual shock that many corporations with the best progress even have the bottom present yields, and decrease progress corporations are displaying larger present yields. Firms that don’t match this development may probably be overvalued (too small of a yield for the projected progress), corporations that don’t actually deal with their dividend, or corporations which might be at present undervalued (excessive progress coupled with excessive yield).

This chart additionally means that Bristol-Myers Squibb, Intel, and Merck might be particularly good candidates for additional investigation, combining affordable historic dividend progress, with good projected enterprise progress, and comparatively excessive yields.

Listed here are tables of all the above info, for those who desire tables:

Finbox, Looking for Alpha, Creator’s Evaluation

Finbox, Looking for Alpha, Creator’s Evaluation

Finbox, Looking for Alpha, Creator’s Evaluation

Finbox, Looking for Alpha, Creator’s Evaluation