The Inside Income Service’s Felony Investigation unit has been working with the Justice Division to uncover billions of {dollars} in fraud associated to pandemic aid applications.

The division, also called IRS-CI, mentioned Thursday it has carried out 840 tax and money-laundering investigations tied to COVID-19 fraud, totaling greater than $3.1 billion, by Sept. 30. The Division of Justice has additionally been working to research and prosecute pandemic aid fraud and on Tuesday introduced new prison expenses, convictions and sentences associated to COVID fraud and misuse of CARES Act funds.

The IRS-CI investigations embody a big selection of prison exercise, together with fraudulently obtained loans, credit and funds in addition to tax credit.

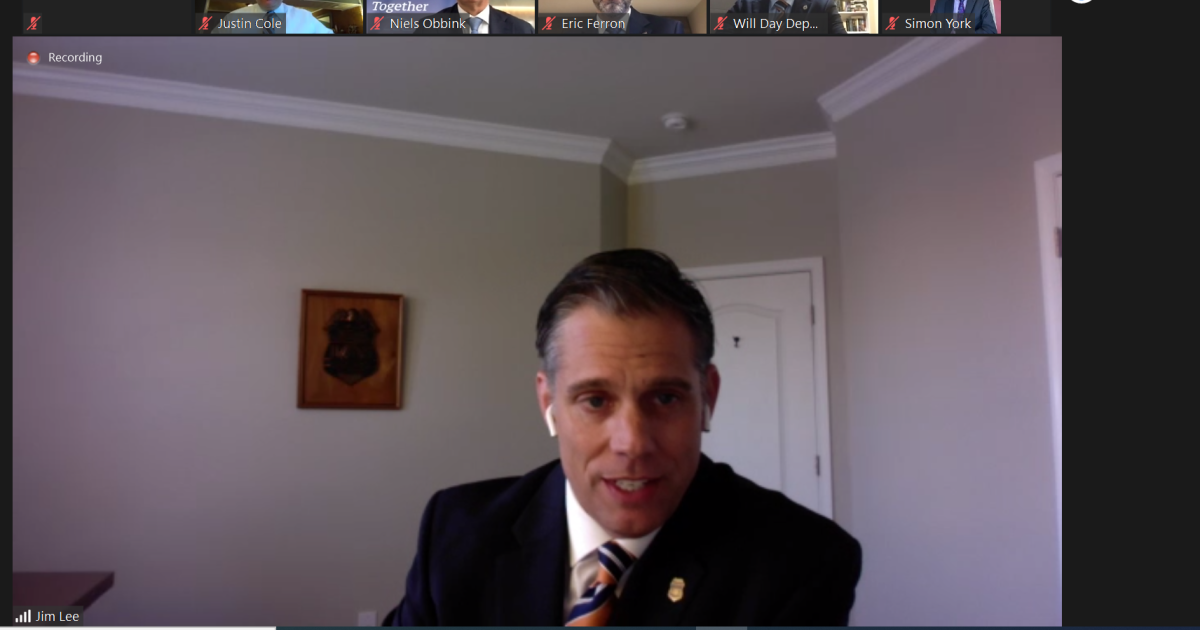

“These funds had been meant for people and companies whose lives had been upended by an unprecedented pandemic,” mentioned IRS-CI Chief Jim Lee in a press release. “Our particular brokers purpose to do proper by the American folks and make sure that those that misused these funds face justice for the crimes they dedicated.”

IRS Felony Investigation chief Jim Lee throughout a web-based press convention of the Joint Chiefs of World Tax Enforcement, or J5.

The Justice Division introduced a lot of instances Tuesday that IRS-CI helped examine, together with two folks in California who had been indicted on fraud and cash laundering expenses in reference to a scheme to acquire $15.9 million in CARES Act funds by submitting 41 fraudulent Paycheck Safety Program mortgage purposes and 13 fraudulent Financial Harm Catastrophe Mortgage purposes on behalf of firms they owned and managed. In one other case in Florida, a person pleaded responsible final month to financial institution fraud and cash laundering as a part of a scheme to fraudulently acquire $544,900 in PPP and EIDL funds.

In one other set of instances in Georgia, 13 defendants had been sentenced since early 2021 and one other 5 pleaded responsible for his or her roles in a scheme to fraudulently acquire over $12 million in PPP and EIDL funds. After the PPP mortgage proceeds had been deposited of their companies’ financial institution accounts, the defendants distributed the funds by a collection of transactions geared toward disguising the origins of the funds and the way the funds had been spent. They used the PPP mortgage proceeds to buy luxurious items and autos, amongst different objects.