FCF Fox Company Finance GmbH is happy to publish the brand new “Industrial IoT Enterprise Capital Report – 2022”.

The report is a part of the “FCF DeepTech Collection”, which is a quarterly sequence of experiences monitoring European enterprise capital funding developments inside 4 principal DeepTech verticals.

Key findings are:

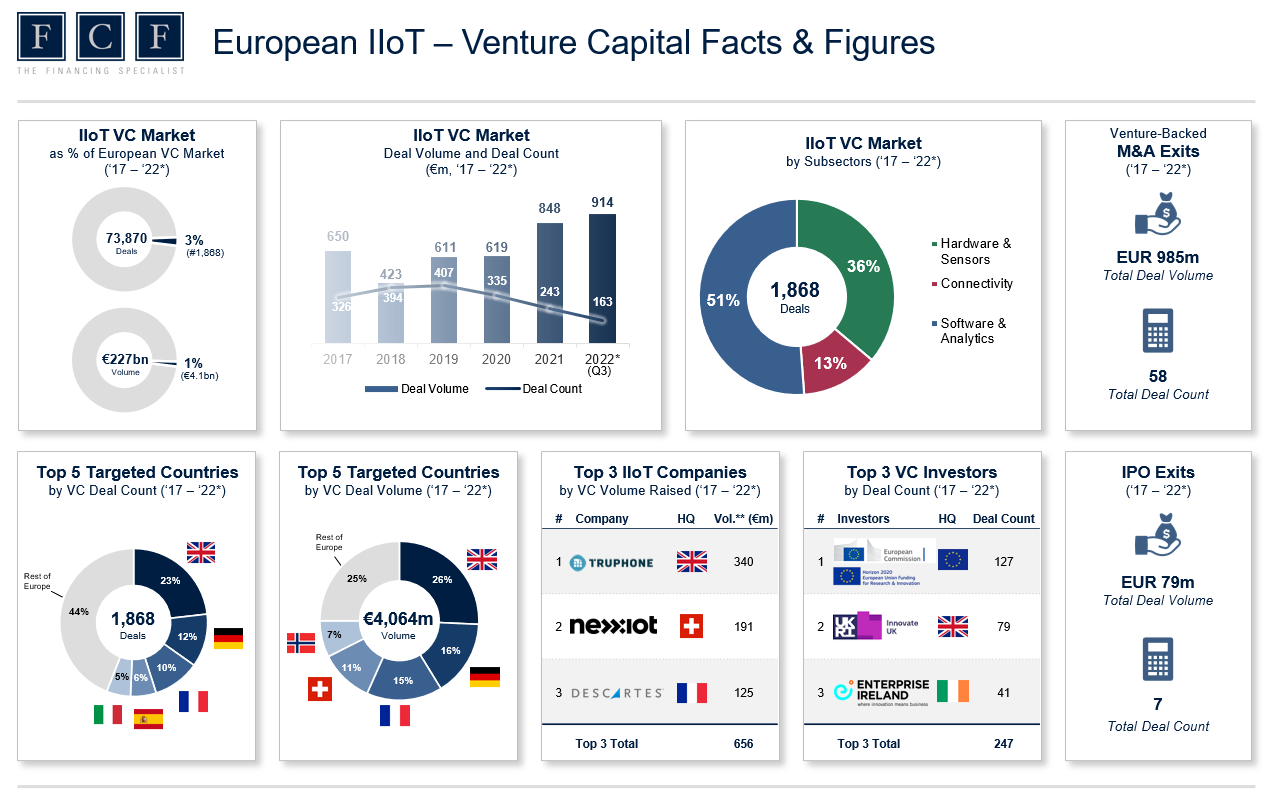

- The event of enterprise capital investments in IIoT start-ups is twofold: On the one hand, funding volumes have elevated from €650m in 2017 to €914m in YTD Q3 2022, whereas however the variety of offers is steadily reducing since 2019 (407 in 2019 vs. 163 in YTD Q3 2022). The decline within the variety of rounds began earlier than the final cooling of the enterprise capital market since about early 2022 and the however growing volumes point out that the sector efficiently holds its floor towards slumps in different verticals.

- The maturity of the sector is growing: The excessive quantity in 2022 is especially as a consequence of three mega offers (KINEXON with €119m, Descartes with €107m, Nexxiot with €102m). That is additionally an indication of the upper maturity of the sector, as mirrored by larger common and median deal volumes in addition to a reducing share of seed & early-stage offers over time.

- UK IoT startups had been in a position to entice the most important quantity of funding: With a quantity of €1.0bn in 2017 – Q3/2022, IoT startups from the UK are forward of Germany with €632m and France with €627m. The UK additionally dominates when it comes to the variety of offers (GB 433, DE 217, FR 192 offers) and likewise has the most important deal to indicate (Truphone, €286m). This displays the tendency in direction of a stronger start-up tradition within the UK, the place innovation extra typically comes from start-ups. Significantly within the case of “Industrial IoT”, the massive industrial firms dominate the innovation matter in Germany and France.

- M&A as exit possibility clearly forward of IPO: Within the interval 2017 – Q3/2022, 58 startups exited by way of M&A, whereas solely 7 went public. The biggest IPO was Astrocast with a quantity of €44m (€306m IPO market cap). The exit within the type of an organization sale is in fact notably pronounced in a sector resembling “Industrial IoT”, as many enterprise fashions and applied sciences of start-ups provide excessive synergy potentials for strategic consumers.

To entry the total report, please click on right here.

By Florian Theyermann and Mathias Übler