Right here’s what we all know.

- Swift’s Eras Tour is about to gross about USD$2.2 billion this 12 months within the U.S. alone.

- She has dozens of worldwide dates for her Eras Tour booked.

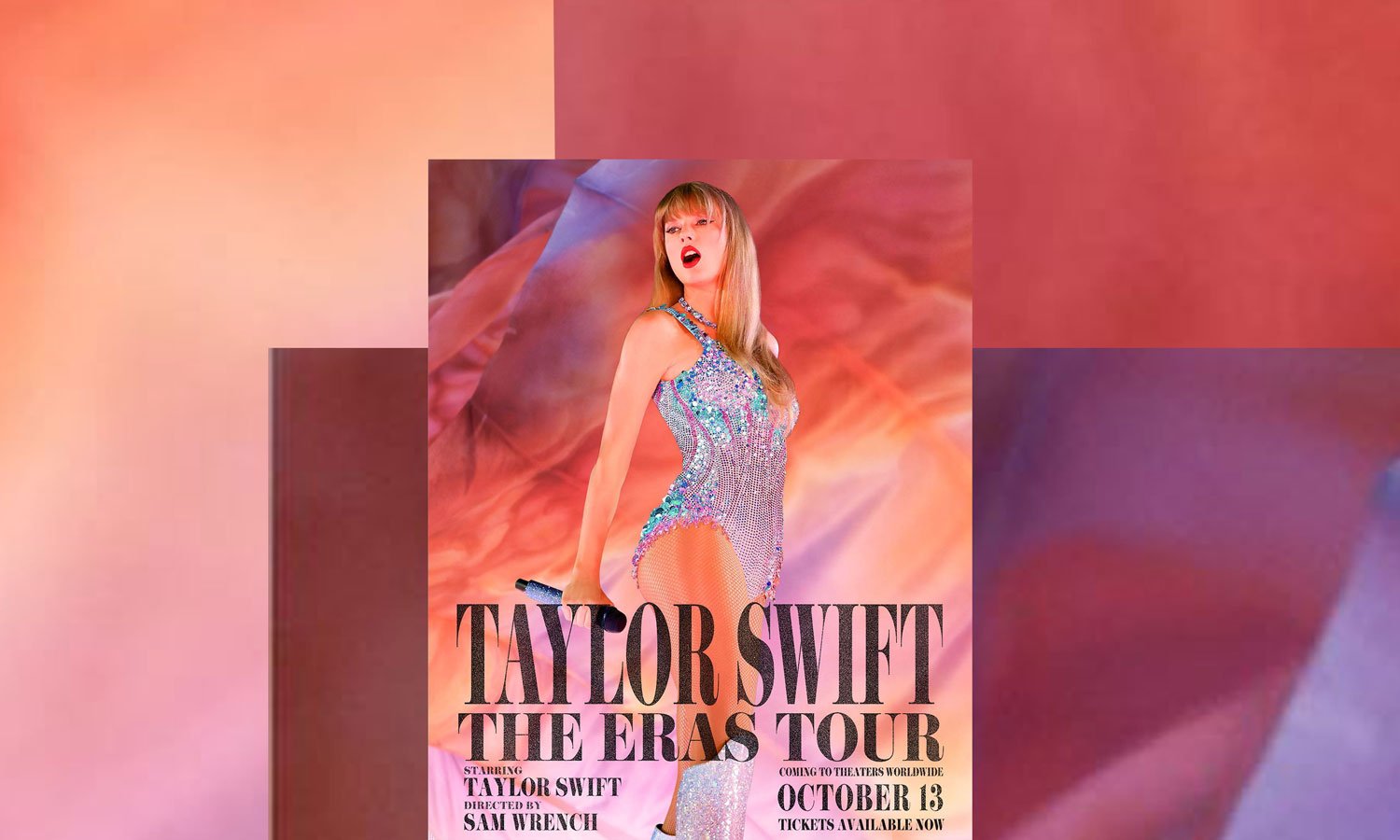

- The Period Excursions film is anticipated to gross over USD $100 million.

- Again in 2019, the publishing rights for her first six albums offered for between USD $300 million and $450 million.

- Swift then re-recorded all that music. Finally, she created extra standard music, and now possesses a list that could possibly be price considerably greater than the worth of her first six albums.

So, if we are saying that the “Taylor Swift Co.” is about to herald about USD$three billion in revenues in 2023, not counting streaming revenue. (We don’t know the way a lot she makes every year from streaming, however it needs to be a good quantity, contemplating what her previous albums offered for.)

Then it follows that utilizing a really conservative one-and-a-half occasions the price-to-sales ratio, Swift’s market cap could be about USD$4.5 billion.

Now, that stated, her revenue margins are lots increased than, say, Algonquin or fellow backside TSX-dweller Gildan Activewear (GIL/TSX). That will imply we might most likely increase that ratio a bit. It’s additionally price mentioning that the “Taylor Swift Co.” would haven’t any loans, and therefore, no sensitivity to increased rates of interest (one thing AQN buyers may cherish for the time being).

EqVista.com recommends a price-to-sales for the films/leisure trade of three.68. At that a number of, Swift Co. is price over USD$11 billion. That not solely places Swift above Algonquin and Gildan, however it might put this hypothetical firm nicely into the TSX60, and price greater than Hydro One.

Sure—”Taylor Swift Co.” could possibly be price greater than the corporate that delivers electrical energy to nearly all of Ontario’s properties!

Whereas it may be robust to justify that form of a number of given the truth that Swift can’t tour without end (might she?) and that her revenues will possible go down within the years to return, I might say that if Swift had been an organization, I might worth her lifetime earnings as greater than the 60th largest firm in Canada, and consequently she could be a part of the TSX 60 index.

Travis Kelce jerseys noticed a virtually 400% spike in gross sales after Taylor Swift attended his sport, TMZ reviews. pic.twitter.com/53VzvT81E7

— Pop Base (@PopBase) September 25, 2023

Sure, it’s free: The Canadian Monetary Summit

In case you missed it, we launched the 2023 speaker lineup for the Canadian Monetary Summit this previous week. Registering for the Summit is totally free and you may click on right here for extra particulars.