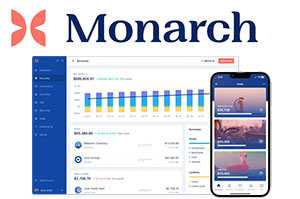

When contemplating signing up for a monetary administration instrument like Monarch Cash, it’s important to know what it gives and the way it compares to different choices available in the market. Monarch Cash serves as a complete platform, consolidating all of your monetary particulars, from varied banks and brokerages to property and liabilities, into one accessible location. This integration simplifies the method of monitoring your full monetary image, whether or not it’s budgeting, monitoring spending, or planning for the longer term.

In my Monarch Cash evaluation I’ll dive into the specifics of how this instrument operates and examines its strengths and weaknesses in comparison with its opponents. It’s essential to acknowledge that whereas Monarch Cash is a handy answer for managing advanced monetary landscapes, it’s not the one choice accessible. Understanding its performance and evaluating it with different related instruments will help you make an knowledgeable determination about whether or not it aligns together with your cash objectives.

This evaluation goals to supply readability on what to know earlier than signing as much as Monarch Cash, highlighting its distinctive options and the way they may profit your monetary administration methods.

Be taught Extra About Monarch Cash

What to Know Earlier than Signing as much as Monarch Cash

There’s a lot to know earlier than signing as much as Monarch Cash, as selecting the best budgeting instrument might make the distinction in your monetary future. We are going to look into all the advantages, drawbacks, pricing, in addition to notable opponents. However first, let’s begin with a little bit of background info.

What’s Monarch Cash?

Monarch Cash, based by Val Agostino, is a Silicon Valley startup that emerged as a brand new contender within the private finance administration area. Since its inception in 2018, the platform, developed by its co-founders and a workforce of expert software program engineers, was meticulously crafted behind the scenes earlier than making its public debut on the finish of 2020.

The platform stands out for its complete method to monetary administration. It integrates seamlessly with hundreds of banks and monetary establishments, permitting customers to simply monitor account balances, transactions, and investments. Monarch Cash’s design caters to a broad viewers, together with people, {couples}, households, and buyers, providing them a holistic view of their monetary standing.

Extra than simply monitoring funds, Monarch Cash is provided with instruments that help in setting and attaining quick and long-term monetary objectives, encompassing every part from budgeting for instant must planning for retirement and long-term wealth-building. The platform emphasizes readability in monetary administration, making certain user-friendly experiences backed by high-level knowledge safety. This method makes it a useful useful resource for individuals who search to steadiness instant monetary targets with long-term monetary planning.

Monarch Cash Advantages

Listed here are the principle advantages you possibly can anticipate from signing as much as Monarch Cash:

- Full Monetary Overview: Consolidates varied monetary instruments corresponding to financial savings accounts, bank cards, and investments into one platform, providing a complete snapshot of your funds. It additionally facilitates joint monetary administration for {couples} by permitting family members to entry shared monetary knowledge.

- Advert-Free Expertise: Ensures a distraction-free setting with no pop-ups or sidebars, making the monetary administration course of extra centered and environment friendly.

- No Upsell Coverage: Distinguishes itself by not recommending or promoting monetary merchandise, avoiding the frequent fintech follow of upselling, thus offering a extra clear person expertise.

- Collaboration Instruments for {Couples}: Designed with {couples} in thoughts, Monarch Cash permits a number of customers from the identical family to handle their funds collectively, with choices to customise which accounts and transactions are shared.

- In depth Account Syncing: Able to syncing with over 11,200 monetary entities, together with banks and brokerages, and integrates actual property values through Zillow Zestimate, providing a broad view of monetary property.

- Transaction and Money Circulate Monitoring: Gives instruments to trace and categorize transactions, create customized classes, and arrange tags for family members, aiding in efficient budgeting and spending evaluation.

- Objectives-Primarily based Planning: Includes a concentrate on setting and attaining monetary objectives, breaking down giant objectives into smaller, manageable duties, and contains visible rewards for reaching milestones.

- Funding Monitoring: Lately added function that permits customers to research their funding portfolio throughout varied brokers and accounts, although with some limitations in allocation monitoring and earnings monitoring from investments.

- Customizable Dashboards for Net and Cellular: Gives impartial customization for net and cell dashboards, giving customers flexibility to construct an optimum viewing expertise tailor-made to completely different units and conditions.

Monarch Cash Drawbacks

Now that I’ve established what Monarch Cash brings to the desk, let’s tackle some potential pitfalls it is best to know earlier than signing up:

- Value Concerns: The platform isn’t free, which can deter those that desire to not pay for monetary instruments. Regardless of this, the worth derived from its ad-free expertise, strong monetary recommendation, and knowledge privateness might justify the fee for a lot of customers. Monarch gives a 7-day free trial, permitting potential customers to guage its options earlier than committing to a paid plan.

- Restricted Cryptocurrency Choices: Monarch Cash presently solely integrates with Coinbase for cryptocurrency administration. This limitation means customers with numerous crypto portfolios may want to make use of extra instruments to handle their cryptocurrency investments absolutely.

- No Credit score Rating Monitoring: Regardless of its complete method, Monarch Cash doesn’t supply credit score rating monitoring. This omission is perhaps shocking for a platform that goals to supply an all-in-one monetary overview. Though many bank cards and platforms supply this service, its absence is a notable hole in Monarch’s choices.

- Lack of Invoice Cost Help: Monarch Cash operates with read-only knowledge, which suggests it doesn’t help invoice funds. This limitation might necessitate using extra instruments or platforms for customers who need an built-in answer for managing invoice funds alongside different monetary actions.

Monarch Cash Pricing

Monarch Cash supplies two distinct pricing plans to cater to completely different person wants. The primary is the Primary Plan, which is freed from cost. This plan gives elementary options like restricted financial institution connections, the power to set monetary objectives, and fundamental budgeting instruments. It serves as a place to begin for individuals who wish to discover the platform’s capabilities with none monetary dedication.

For customers looking for a extra complete expertise with full entry to all of Monarch Cash’s options, the Premium Plan is accessible. This plan is priced at $9.99 per 30 days, however a reduced fee of $7.50 per 30 days is obtainable for individuals who select to pay yearly, amounting to $89.99 per 12 months. The Premium Plan contains limitless financial institution connections and using each function the platform has to supply.

For these contemplating the Premium Plan, Monarch Cash gives a two-week free trial.

Monarch Cash Alternate options

If something you’ve learn to this point has made you resolve not to enroll to Monarch Cash, don’t fear, there are many high quality options to contemplate. I’ll begin my dive into the Monarch Cash options with Copilot. Copilot makes use of AI-driven insights to assist customers refine personalised spending patterns. This Monarch Cash vs Copilot article will clarify how.

If you’re studying this text, it in all probability means you want a funds, and that’s precisely what the subsequent competitor, YNAB, stands for. If you’re into zero-based budgeting or curious to study extra about it, YNAB may very well be your reply. This Monarch Cash vs YNAB article will get into the small print of zero-based budgeting and present how they stack as much as Monarch Cash.

One other competitor that I need to point out is Rocket Cash. Rocket Cash can be an awesome selection for customers that desire zero-based budgeting. Their negotiation function to seek out and remove undesirable subscriptions is one in every of their strongest differentiators. Right here is the Monarch Cash vs Rocket Cash comparability in case you are involved in diving deeper.

Monarch Cash is a comparatively new entrant into the non-public finance area in comparison with the subsequent budgeting app we are going to talk about, Mint. Mint has been praised for its monitor report of offering detailed insights into spending habits. If credit score monitoring is one in every of your fundamental targets, Mint is value a glance. My Monarch Cash vs Mint evaluation provides you with all the knowledge it’s worthwhile to resolve which platform is greatest.

The final different I believe you ought to be conscious of earlier than signing as much as Monarch Cash is a stalwart within the business, Quicken. In case your monetary scenario requires in-depth, detailed, monetary monitoring, Quicken has been a trusted selection since their launch in 1983. To take a look on the professionals and cons of Quicken, this Monarch Cash vs Quicken will cowl all of the fundamentals.

Ultimate Ideas

When exploring your choices for monetary administration instruments, it’s essential to contemplate what to know earlier than signing as much as Monarch Cash. This platform gives a mix of fundamental and premium options, catering to a spread of monetary administration wants.

It stands out for its complete monetary overview, customizable dashboard, and ad-free person expertise. To dive deeper into its options and decide if it meets your monetary administration necessities, Click on Right here.

Get Began with Monarch Cash