I get plenty of questions on cash. These questions are inclined to range primarily based on the asker and her wants, however there’s one query I get extra typically than some other: “What’s a protected funding with a excessive return?”

For the previous decade or so, I’ve had no reply to this query. Financial savings accounts and certificates of deposit are protected, certain, however they’re not engaging investments. For the reason that Nice Recession of 2008/2009, rates of interest have remained shockingly low. That is by design. The federal government does not need you parking your cash in a financial savings account. They need that cash out circulating within the economic system.

Over the long run, the inventory market presents wonderful returns. However when persons are asking for “protected” investments, they’re wanting keep away from short-term volatility, which implies shares are out of the query. (And stuff like Bitcoin and treasured metals are much more out of the query!)

At the moment, nonetheless, whereas catching up on my weblog studying, I stumbled upon a hyperlink from Michael Kitces’ weekly roundup for monetary planners. The story he shared blew my thoughts. Writing in The Wall Avenue Journal, Jason Zweig explains the protected, high-return commerce hiding in plain sight. (This text is behind a paywall.) That protected, high-return commerce? U.S. authorities Collection I financial savings bonds.

These inflation-adjusted bonds are at present yielding 3.54% yearly!

Zweig writes:

Economists say there’s no such factor as a free lunch, however I bonds supply a assure from the U.S. authorities you could get better your unique capital plus any will increase within the official price of residing alongside the best way. The one catch is that this isn’t an all-you-can-eat buffet: The utmost buy is $10,00Zero per 12 months per account holder (except you have chose to take your tax refund within the type of an I bond).

Mockingly, the much less you earn and have to take a position, the extra highly effective a device I bonds are.

As a result of I used to be unfamiliar with I Bonds, I spent a few hours studying about them immediately. I feel I’ll start including them to my funding portfolio. You may wish to additionally. Let me share what I’ve realized.

The Fundamentals of I Bonds

Collection I financial savings bonds (or just “I Bonds”) are inflation-indexed bonds with a variable rate of interest. That variable charge contains two parts.

- A hard and fast charge. On the primary enterprise day in Could and the primary enterprise day in November, the U.S. Treasury adjusts this mounted charge for brand spanking new bonds. However as soon as you buy a Collection I bond, this mounted charge by no means adjustments. If the mounted portion of your I Bond is 2.10% once you buy it, it’s going to stay 2.10% for thirty years (or till you promote it).

- A variable charge listed to inflation. This charge additionally adjusts in the beginning of Could and November. It is primarily based on adjustments to the Client Value Index. Presently, the “semiannual inflation charge” (because it’s formally recognized) is 1.77%, which interprets right into a 3.54% annual charge.

The mounted charge and variable charge parts are added collectively to generate the present composite rate of interest. As a result of inflation can go detrimental (a.okay.a. deflation), the variable charge may also go detrimental. When that occurs, the present yield in your I Bonds can fall under the mounted charge. Nevertheless, curiosity on these bonds can by no means yield under zero. They will by no means lose worth.

Curiosity compounds each six months. I Bonds are exempt from state and native taxes, however they’re topic to federal revenue tax once they’re redeemed.

Does that each one sound sophisticated? It is not, actually.

If you purchase a Collection I bond, you lock in your mounted charge. Then, each six months, the variable charge adjusts primarily based on inflation.

Presently, the mounted charge on Collection I financial savings bonds is zero p.c. Actually, the mounted charge has remained under one p.c on all Collection I bonds issued since Could 2008. Why then would you think about including them to your portfolio? As a result of regardless of the low mounted charge, this stuff nonetheless out-earn financial savings accounts and certificates of deposit.

Now, having stated that, money you set into these bonds is so much much less liquid than the cash you set into the financial institution.

- You need to maintain the bond for at the least one 12 months. You completely can not redeem a Collection I bond till it’s twelve months outdated.

- You may redeem the bond after one 12 months. But when you have not held the bond for at the least 5 years, you lose the newest three months of accrued curiosity.

There are a few different drawbacks you might want to find out about. First, you’ll be able to solely purchase I Bonds electronically from Treasury Direct. (That is an official U.S. authorities web site, so it is protected. Or needs to be.) Second, you are solely allowed to buy $10,00Zero of I bonds every year.

Did I say “solely”? I lied. Type of. You are additionally allowed to buy I Bonds together with your revenue tax refund. Doing so permits you to purchase as much as $5000 extra in I Bonds every year. And bonds bought this manner are paper bonds, not digital.

There are different minor stuff you may need to find out about these funding autos. If you would like extra information, try the official Collection I Financial savings Bond FAQ. (And you may additionally like this desk evaluating I Bonds to TIPS, Treasury inflation-protected securities.)

I Bonds by the Numbers

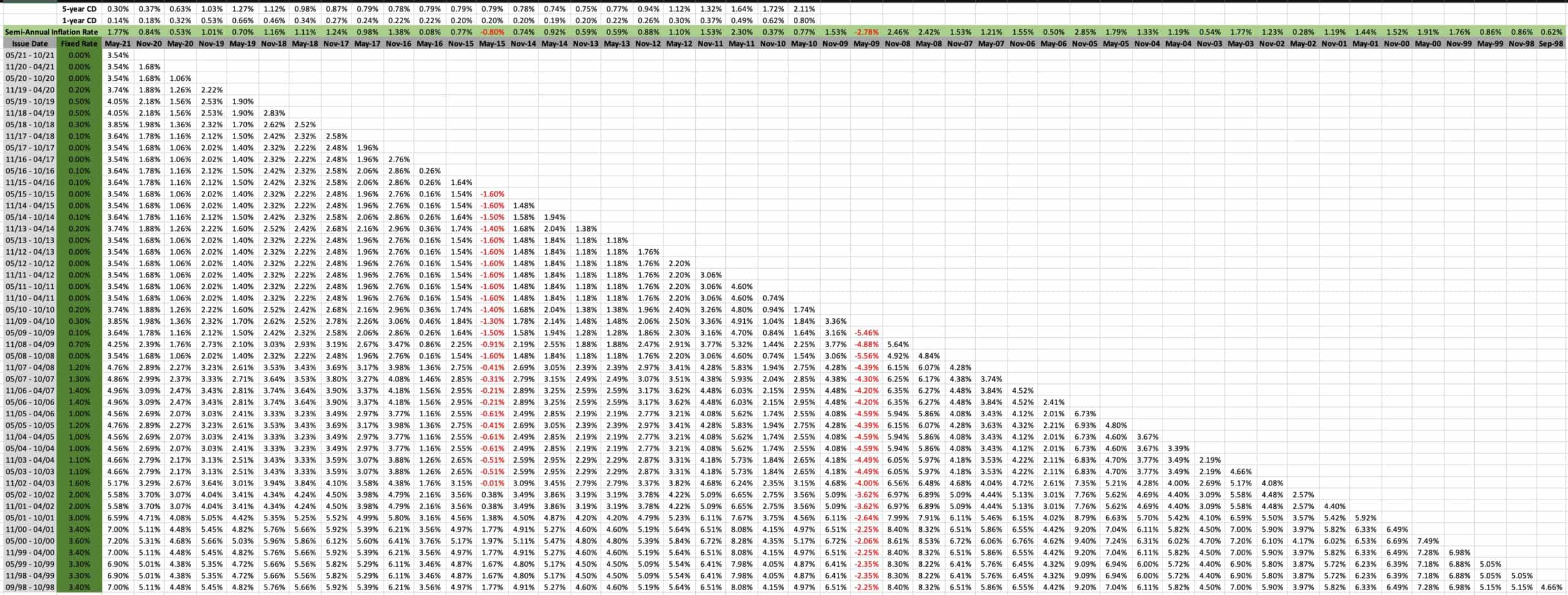

As a result of I am a cash nerd — and since I used to be curious — I created a spreadsheet that paperwork historic Collection I bond yields since they had been launched in September 1998. (That is primarily based on the official desk from Treasury Direct, however I’ve made it prettier and straightforward to replace sooner or later.)

It is a extensive spreadsheet, so it’s going to be unreadable right here on this display. You will need to open the picture in a brand new tab. (Clicking on the picture ought to try this for you.) Even then, you could must manually re-adjust the picture measurement to have the ability to learn it.

Here is the best way to learn this spreadsheet.

- Every row tracks the rate of interest on Collection I bonds issued for dates in that vary. For instance, the “05/08 – 10/08” row tracks how the rate of interest has modified on bonds issued between Could and October of 2008. The primary quantity in every row (the “mounted charge” within the inexperienced column) exhibits the everlasting mounted charge for the bonds issued throughout that point interval. For the “05/08 – 10/08” bonds, that mounted charge was 0.00%.

- Every column tracks semi-annual adjustments to rates of interest. The Treasury adjusts charges on (or quickly after) Could 1st and November 1st. The highest line of every column exhibits the official inflation charge used to calculate complete bond yields. So, you’ll be able to see that the “Could-08” column signifies that the semi-annual inflation charge was 2.42% (that means annual inflation was 4.84%), and the remainder of the column exhibits efficient charges for varied bonds.

- I’ve additionally tried to compile historic knowledge on common certificates of deposit charges. I have never discovered a supply I belief and love for this information, although, so am open to suggestions. (I would additionally wish to discover a supply for historic financial savings account knowledge. I have been looking for years and have by no means discovered something I like.)

Taking a look at this spreadsheet, you’ll be able to see that I Bonds do not at all times outperform five-year certificates of deposit — however they normally do. And there have been a few events when even a one-year CD has provided a greater yield for a couple of months.

The Backside Line

I’ve by no means bought a financial savings bond. That is about to vary.

I like the thought of utilizing I Bonds as a car for medium-term investing — saving for a home, saving for faculty training, and so on. In case your time horizon is longer than 5 years however shorter than, say, fifteen years, these are a sexy choice, particularly if it is cash you can not afford to lose. Proper now, I like them higher than a financial savings account or CD!

For longer time horizons, and for cash with which you’ll be able to take better danger, you are higher off investing in index funds. Collection I bonds will not earn as a lot as shares over the long term. Not primarily based on historic averages, anyhow. However that is not the purpose. These bonds aren’t meant for rising your nest egg. They’re meant to maintain your nest egg protected.

Even when these do not enchantment to you now, you must control Collection I bonds to see the place their mounted charges go. In the event that they creep as much as the three-percent vary (as they did 20+ years in the past), they are a terrific deal.

Replace: Chris Mamula at Can I Retire But? simply revealed an article that compares two inflation-protected authorities bonds: Collection I Bonds vs. TIPS. Helpful information there, if this form of funding pursuits you.