Almost two years in the past, I acquired an uncommon electronic mail at an deal with I hardly ever test anymore. The writer wrote:

I’m writing to you at this time as a result of The Nice Programs in partnership with Audible is exploring the opportunity of making a high-quality sequence on Monetary Independence. We consider that you could be be a superb candidate to show such a sequence. I’ve learn many articles at Get Wealthy Slowly and I am all the time impressed by your writing and the way a lot wonderful content material you create.

At first, I assumed this was spam. Earlier than I deleted the message, although, I checked the sender. Positive sufficient. The sender (and the message) was legit.

I wrote again:

Thanks for reaching out. I get a whole lot of requests for my time and usually flip them down. Not this one. I really feel like this can be a terrific concept and well-worth exploring. I’m a long-time fan of each Audible and the Nice Programs. I am not joking.

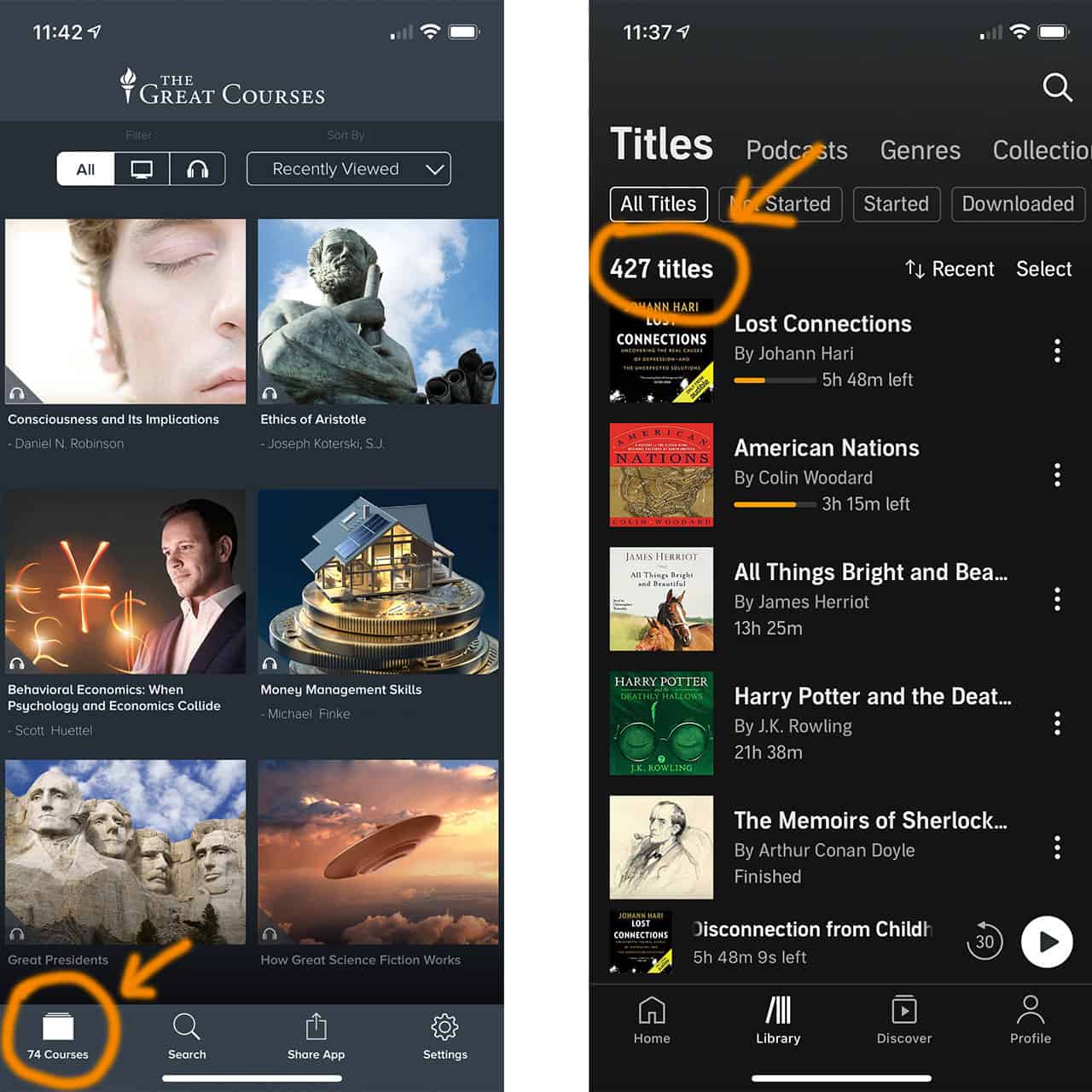

I included display captures to show that I owned 72 Nice Programs and almost 372 audiobooks from Audible. These numbers have since grown, naturally.

Discussions ensued, a contract was created, and in December 2019, I started the work of making a five-hour, ten-part course on monetary independence and early retirement. I completed that course final April. I recorded it in Could. And final month, in the end, The right way to Obtain Monetary Independence and Retire Early made its means into the world!

FIRE in 40,000 Phrases

Writing a weblog about monetary independence and writing a course about monetary independence are two various things. A weblog is open-ended. It is private. It is casual. However a challenge for Audible and The Nice Programs? Nicely, that kind of challenge has constraints and requires a unique tone.

You of us all know that I’m on a personal-finance journey. You all know that I am continuously studying about cash, and that my understanding and opinions have a tendency to alter with time. With this kind of challenge, although, I’ve to current myself as an skilled. The data I present must be self-contained in a single neat little package deal.

On this case, I had some very particular parameters.

The course needed to be roughly 40,000 phrases in size, and the entire needed to be divided into ten smaller “chapters”. Why 40,000 phrases? As a result of 40,000 phrases is roughly 5 hours when learn aloud. Primarily, my job was to encapsulate a very powerful sides of economic independence in ten half-hour (4000-word) lectures. So, that is what I did.

I additionally needed to resolve who the course was for. Was this meant for people who already knew about FIRE (monetary independence and early retirement)? I am not the most effective individual to supply deep, technical recommendation (as you properly know), so I made a decision in opposition to that. I made a decision to focus on of us who have been FI-curious: those that has heard in regards to the ideas however wanted a crash course in what FIRE entails.

Ultimately, I adopted the next define:

- Lecture one — What’s monetary independence? I begin the course by discussing the distinction between monetary independence and early retirement. I additionally spend a while speaking about how society has programmed most individuals to consider cash in just one means. However there are different methods to method private finance.

- Lecture two — The facility of goal. Naturally, I then dive into my pet topic: discovering goal. In case you’ve learn GRS for any size of time, you understand precisely what this lecture incorporates. That is my core message.

- Lecture three — The facility of revenue. With the philosophy out of the way in which, I discover the numbers behind monetary independence and eaerly retirement. I speak about web price, saving fee, and extra.

- Lecture 4 — Spend much less. The fourth lecture explores frugality and the ability of saving on the massive stuff, akin to housing and transportation.

- Lecture 5 — Enhance your earnings. After speaking about spending, I speak about earnings. Whereas many of the materials on this course is new, this explicit lecture sticks intently to my standard speil about incomes extra. (However with extra assets included.)

- Lecture six — Your wealth snowball. As soon as I’ve defined how the hole between incomes and spending creates a “revenue”, I then share the most effective methods to utilize this revenue: a debt snowball (in case you’re in debt) and a wealth snowball (as soon as your debt is gone).

- Lecture seven — Investing for early retirement. The seventh lecture was, by far, essentially the most troublesome to put in writing. How within the hell do you compress all of investing into 4000 phrases? It will probably’t be achieved — however I attempted. (After which I despatched individuals to learn The Easy Path to Wealth by J.L. Collins haha.)

- Lecture eight — How a lot is sufficient? Subsequent, I discover the components that have an effect on how a lot you want to save for retirement, together with life expectancy, inflation, withdrawal charges, and extra.

- Lecture 9 — Obstacles on the highway to monetary independence. I spend the ninth lecture addressing issues that folks encounter after they pursue monetary independence — and providing attainable options to these issues.

- Lecture ten — Constructing a wealthy life. Lastly, I discover what occurs when you obtain monetary independence and/or early retirement. I urge listeners to construct a wealthy life.

As I stated, I did my finest to cowl the core ideas of the FIRE motion. I made a deliberate resolution to maintain the course as non-technical as attainable, which most likely comes as no shock. And, when attainable, I explored the psychological and philosophical implications of wealth.

Due to the restrictions of this challenge, I could not cowl sure pet matters of the FIRE group: journey hacking (which really has zero to do with FIRE anyhow), well being care (which is vital!), backdoor Roths, etcetera. Nor might I dive deep into any given matter. There simply wasn’t area.

Ultimately, although, I am pleased with the course I created. To my thoughts — and I do know I am biased — this challenge is the most effective introduction to monetary independence and early retirement accessible. I am not joking.

If you wish to share this idea with mates or household, I consider this course is a good way to do it.

An Intro to FIRE

Probably the most troublesome a part of creating this course was recording it. Early final Could — whereas uncertainty about COVID nonetheless raged — I spent two days at an area recording studio, studying my phrases aloud. It was powerful!

I am a talkative fellow, however I’ve by no means needed to really learn for hours on finish. It is harder than you would possibly anticipate. By the top of the second day, I felt like my mouth was stuffed with marbles. Plus, I anxious and anxious and anxious that my supply was horrible. (And, within the months since I recorded the course, I’ve had second ideas about two sentences that I remorse together with haha.)

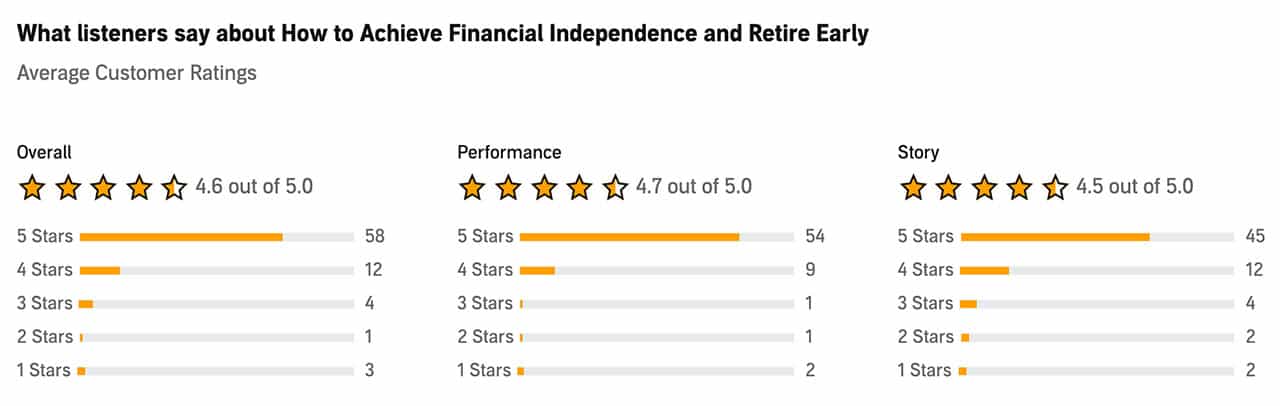

So, my greatest worry was that folks would hate my “efficiency” of the stuff I might written. A lot to my shock, that hasn’t been the case. The truth is, my efficiency is the highest-rated a part of the course. Whuh?!?

Prepared for some math nerdery? Good, as a result of you are going to get it.

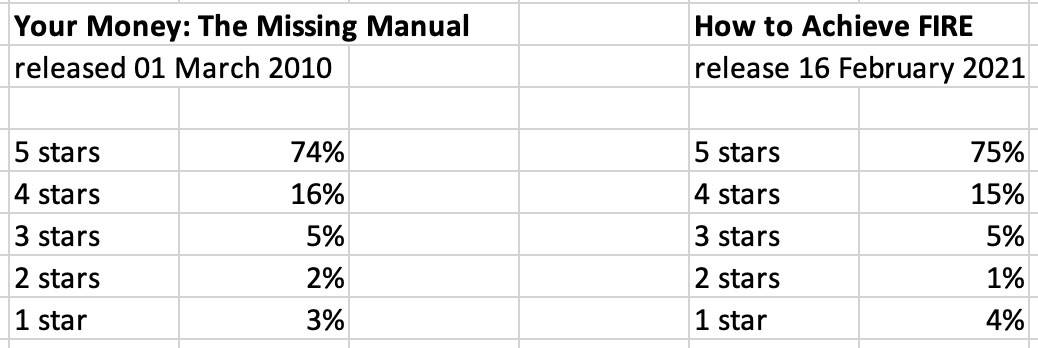

Your Cash: The Lacking Handbook was launched on 01 March 2010. Within the eleven years since, the guide has acquired 86 scores at Amazon. The right way to Obtain Monetary Independence and Retire Early was launched on 16 February 2021. Within the 5 weeks since, the course has acquired 77 scores at Audible.

What amuses me, although, is that the breakdown of those scores is almost equivalent. Have a look:

Persistently, 5% of oldsters don’t love my massive tasks. One other 5% discover them to be meh. And — thank god — 90% appear to love them.

Anyhow, my Audible course is out! I am pleased with it. I feel it is a superb intro to the core ideas of the monetary independence and early retirement motion. I hope it proves helpful for many individuals.

As proud as I’m of this course, and as a lot as I hope it helps individuals, I might be remiss if I did not level out that I first explored these fundamental concepts in The Cash Boss Manifesto, which stays accessible as a free PDF. The Audible course is way more complete and options my newest ideas on every topic, after all, however that free PDF is an effective useful resource for people who cannot (or do not need to) purchase the course.