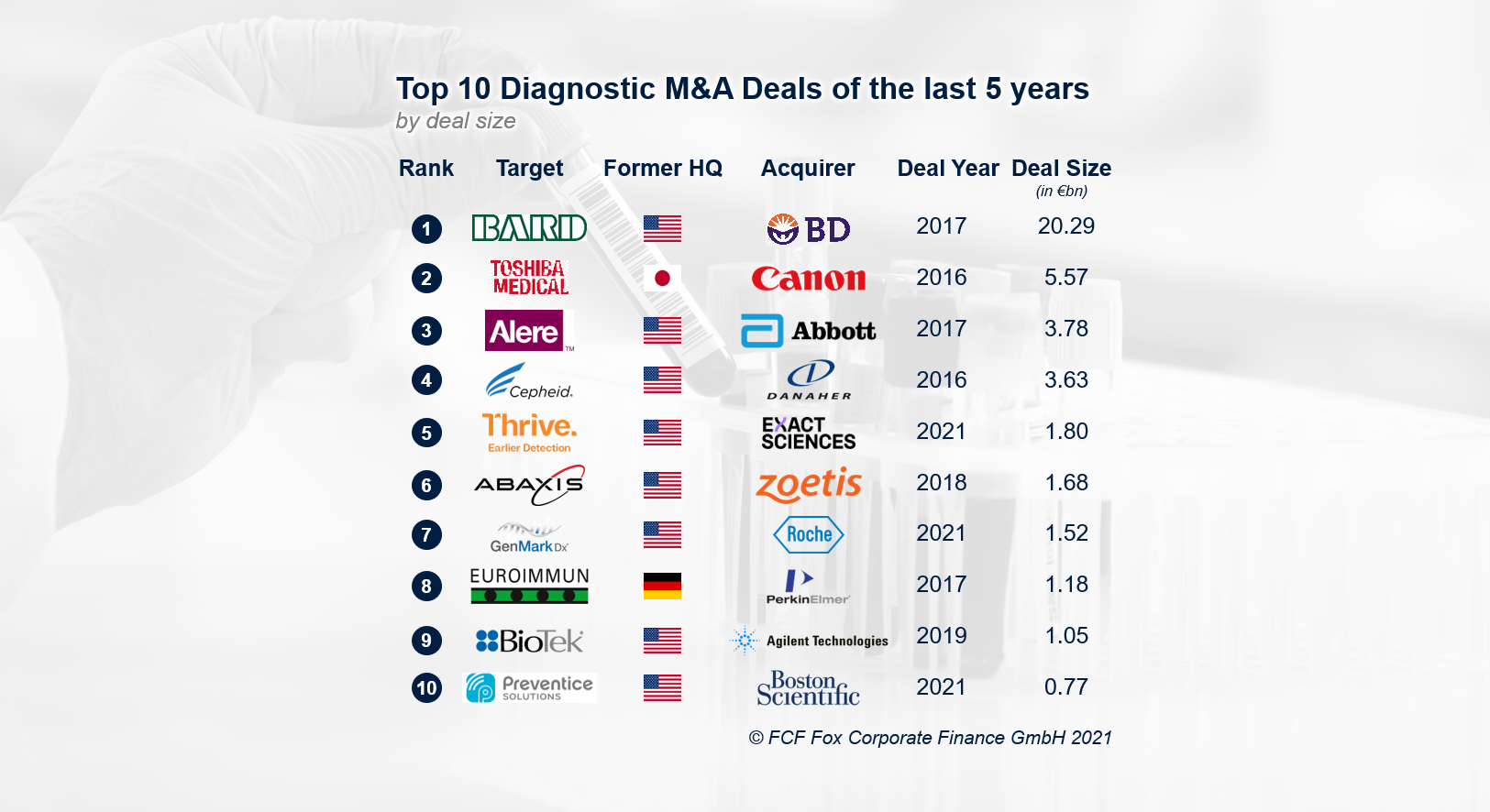

The highest 10 diagnostics M&A offers of the final 5 years (by deal dimension) vary from EUR 0.8bn to EUR 20.3bn, with a mean deal dimension of EUR 4.1bn. The most important deal by far was the acquisition of C. R. Bard by Becton, Dickinson and Firm in December 2017 for EUR 20.3bn.

The rating is dominated by US targets, solely two targets have been situated outdoors of the US. The acquisition of Japanese Toshiba Medical Techniques by Canon Medical Techniques in December 2016 for EUR 5.6bn is ranked second and the acquisition of German diagnostics firm Euroimmun by PerkinElmer in December 2017 for EUR 1.2bn is ranked eighth.