Roofstock is an actual property investing platform based in 2015. Therefore, whereas it is not precisely brand-new, it hasn’t been round almost so long as America’s oldest companies. And folks know that when a enterprise has been round since earlier than World World I, for instance, it is a identify they’ll belief.

Maybe extra to the purpose for traders, although, is having a observe report of success. When a brand new funding service is launched, it does not all the time have a observe report to point out it is a legit funding alternative.

These are the considerations we’ll discover on this publish about Roofstock.

What’s Roofstock?

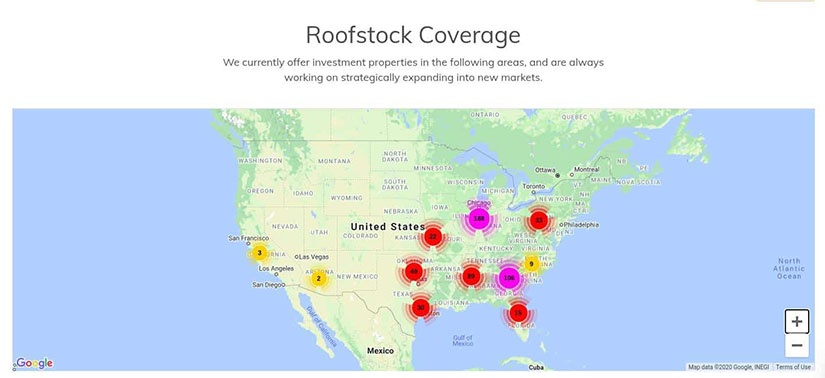

Roofstock is an actual property investing platform based mostly in Oakland, California. Its emphasis is on single-family houses, and it helps traders by dealing with almost the entire legwork usually concerned with shopping for funding properties. Roofstock has properties in over 40 properties throughout the U.S.

The Zacks Trade Overview for actual property growth confirmed an funding return of over 35% in the summertime of 2021. Whereas it has cooled since then, actual property is perennially a robust funding.

As we element in our Roofstock evaluation, Roofstock streamlines the whole course of, Roofstock not solely removes many of the work, but additionally makes it simpler for newer, inexperienced traders. In spite of everything, there’s a whole lot of paperwork concerned, and that’s to say nothing of managing your funding properties.

To assist with all this, Roofstock acts as a single platform the place you should buy funding properties; then, Roofstock does the remainder of the give you the results you want. The properties on its market are already occupied, and you may see the funding returns for every of them. Annualized returns might be larger than 35% for some properties.

What Providers Does Roofstock Provide?

Roofstock affords an actual property market and a subscription that permits traders to traders to purchase property shares. Listed here are the providers Roofstock affords:

- Roofstock: purchase and promote occupied funding properties

- Roofstock One: purchase shares in properties beginning at $5,000

- Lennar: purchase new-construction houses from Roofstock’s associate, Lennar

Roofstock does not cost a subscription for its providers; as an alternative, it makes cash by charging a price on the sale of properties on its platform. That price is assessed as 0.5% of the acquisition value or $500—whichever is increased.

Shopping for and promoting funding properties on Roofstock is way the identical as shopping for them by yourself besides that Roofstock makes the method a lot simpler. Nevertheless, that signifies that the minimal funding is the price of whichever property you need to purchase. That could possibly be effectively underneath $100,000, or it may be over $1 million.

Roofstock additionally connects you with lenders when you want financing. That course of is much like taking up a mortgage with every other lender, that means you’ll seemingly want a minimal of a 20% down cost.

Is Roofstock Protected?

Nobody needs to spend money on a platform they do not know is protected and reliable. Fortuitously, Roofstock goes to nice lengths to make sure their properties are protected and absolutely vetted.

The Roofstock assure comes with a number of protections to assist make sure you will not lose your funding. First, Roofstock arranges a complete property inspection with a third-party vendor. Then, Roofstock opinions the inspection completely to make sure the property meets its excessive requirements, resembling obligatory repairs not being extreme and HVAC compliance.

Roofstock additionally ensures there aren’t any points with the title or disclosure and that lease funds are present.

Roofstock additionally has two ensures to offer you peace of thoughts: a 30-day money-back assure and the lease-up assure. Whereas the previous is self-explanatory, the lease-up assure applies to vacant houses bought by Roofstock. With this assure, in case your funding property is just not occupied inside 45 days, Roofstock can pay you 75% of the market price for lease. It would proceed to take action for as much as 12 months.

Roofstock Eligibility Necessities

If you wish to spend money on Roofstock properties, there aren’t any necessities to make use of Roofstock’s fundamental service. If you wish to use Roofstock One, although, you should be an accredited investor.

To be an accredited investor, you have to have at the least $200,000 in revenue ($300,000 for {couples}) for the previous two years or have a web price of $1 million or extra. In case you do not meet both of those necessities, don’t fret as a result of you possibly can nonetheless use the Roofstock market.

Able to Get Began?

If you wish to begin investing on Roofstock, anybody can begin utilizing the service. There aren’t any necessities to get began as an investor; the one requirement is having the capital to spend money on Roofstock properties.

A part of the Roofstock service is connecting you with lenders, however their necessities will probably be a lot the identical as every other lender. That features placing 20% down for a standard mortgage.

That mentioned, when you really feel you might be prepared to start out investing, head over to Roofstock and begin shopping properties.