Robotic course of automation has turn into a obligatory expertise for a lot of accounting companies which are attempting to realize extra effectivity because the workers turns into tougher to seek out throughout the ongoing pandemic.

Corporations like Deloitte are more and more counting on RPA expertise and exhibiting shoppers how they will obtain extra with an already overburdened workers who’re desperately attempting to maintain up with the workload throughout the tense pandemic. “RPA is the right here and now type of expertise that organizations are using,” stated Brian Cassidy, audit and assurance companion and reliable AI chief at Deloitte.

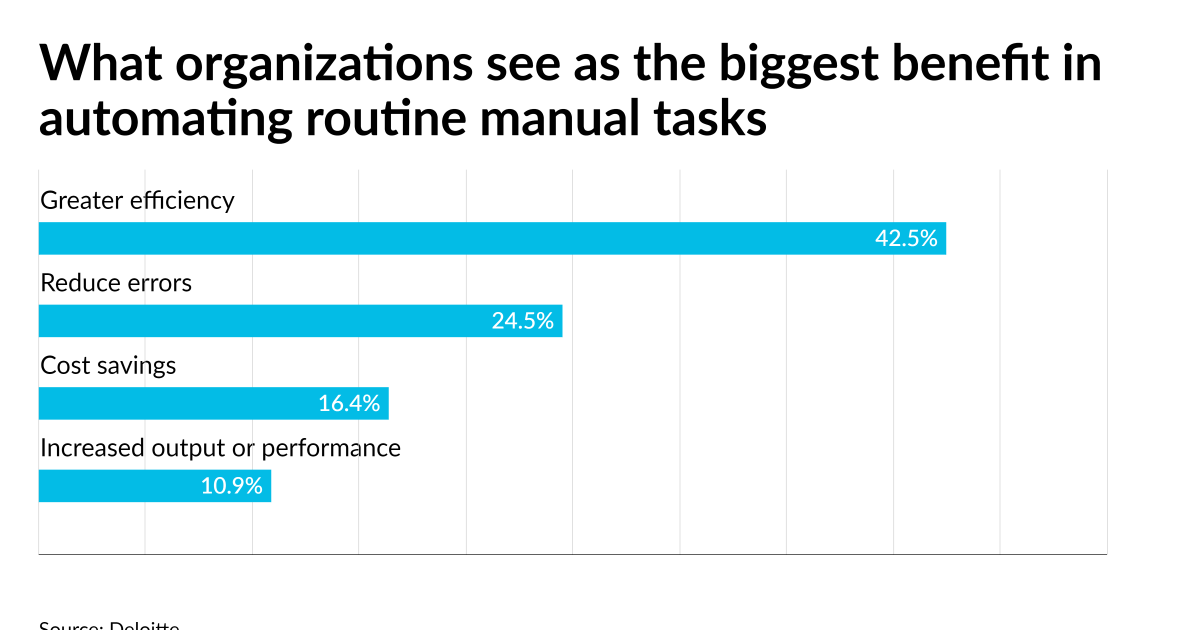

He participated in a panel dialogue of expertise consultants from the agency at Monetary Executives Worldwide’s Present Monetary Reporting Insights convention final month. They requested attendees what they noticed as the best good thing about automating routine handbook duties of their day-to-day job, and the best choice was higher effectivity (42.5%), adopted by scale back errors (24.5%), price financial savings (16.4%), and elevated output or efficiency (10.9%).

RPA is getting used at the side of different applied sciences similar to synthetic intelligence, blockchain and digital belongings by companies like Deloitte. “Within the blockchain and digital belongings, normally you’re using expertise to drive effectivity, to drive price financial savings, to drive higher expertise resourcing,” stated Cassidy. “These are a number of the causes you’d usually make use of applied sciences. Within the digital asset house you’re really using a blockchain to get entry to a digital asset like cryptocurrency. You consider the lifecycle of rising applied sciences, and also you begin with RPA and go to blockchain and then you definitely get to synthetic intelligence, which might be essentially the most in infancy stage at organizations, however has the best progress charge.”

AI is more and more working its manner into organizations, as anyone who begins to write down an e mail or textual content message typically finds now because the gadget tries to finish their ideas for them. AI is exhibiting up extra in accounting as effectively.

“Once we take into consideration that rising expertise pattern, as accountants and auditors, we at all times get advised that we’re wanting backward at monetary reporting statements,” stated Cassidy. “The historical past has already occurred. It’s performed. As accountants and auditors we are attempting to be ahead pondering. There are rising applied sciences inside that maturity cycle of RPA into blockchain and into synthetic intelligence. When you consider these applied sciences, they do construct on one another a bit of bit, however they’re totally different and distinct. RPA, for instance, is normally a part of synthetic intelligence, however the place we’re headed with synthetic intelligence is organizations utilizing synthetic intelligence in a human decision-making capability.”

Corporations are additionally getting extra acquainted with digital belongings as their shoppers discover using cryptocurrency similar to Bitcoin or Ether for funds or investments.

“If you wish to be a part of investments in digital belongings — and choose your digital belongings: crypto, Ether, no matter it’s — you want to be a part of the blockchain,” stated Cassidy. “That’s the one manner it really works. So the will to have that asset in your books is what’s driving the expertise. However you want to acknowledge that not one measurement suits all once you’re coping with crypto. Simply have a look at the regulatory atmosphere. The regulators, like FASB and the SEC are all speaking about crypto, however no person has made a key differentiation or put a line within the sand on something. Everybody remains to be taking that knowledge in. It’s understanding these info and circumstances that may impression your total group, and due to this fact with this rising expertise you most likely have to lean on advisors that will help you with this as a result of it’s a really difficult and rising subject.”

Corporations and their shoppers want to pay attention to the dangers of such applied sciences, nevertheless. “Whether or not you’re speaking about RPA, blockchain, digital belongings, or AI, rising applied sciences do present many advantages to individuals of their day-to-day life throughout the monetary reporting provide chain community stakeholders, however in addition they include danger,” stated Cassidy. “Along with your roles and obligations within the monetary reporting construction of a company, it’s understanding these dangers and mitigating these dangers that’s actually helped to generate long-term worth for organizations. The very last thing you need to see is a blip up or a blip down as a result of one thing went improper or didn’t go proper. What I might say is that these rising applied sciences have to have danger and governance round them in organizations and there’s a key position for audit professionals and advisors to determine these dangers, put constructions in place to assist organizations mitigate stated dangers in order that when they’re implementing inside a company, it finally ends up beginning to generate long-term worth quickly.”

Accountants are additionally these superior applied sciences to assist shoppers with the growing demand for environmental, social and governance reporting. “ESG is a subject that everyone is speaking about,” stated Cassidy. “Everyone focuses in that ESG dialog on the E, environmental. I take into consideration our occupation, as an total group, licensed public accountant, the aim we’re attempting to mitigate is danger to the P, the general public. So, we discuss ESG and governance. We discuss controls and governance, and what are we attempting to do it for? We’re attempting to do it to assist the general public good in some type or vogue, whether or not that be in organizations and shareholders or whether or not or not it’s in how they impression the general monetary reporting panorama, for patrons, customers, auditors. It’s the final P in public. Whereas perhaps in AI, for instance. machines and laptop techniques will take the place of an individual doing a sure job, however that particular person doesn’t disappear. They transfer on to doing one thing else. However that doesn’t additionally imply that governance of that system disappears. We nonetheless have to guarantee that the pc techniques are placing out the proper data. It’s actually governance, and why the auditors are concerned due to the P in public, as a result of that’s what we do from a occupation standpoint.”