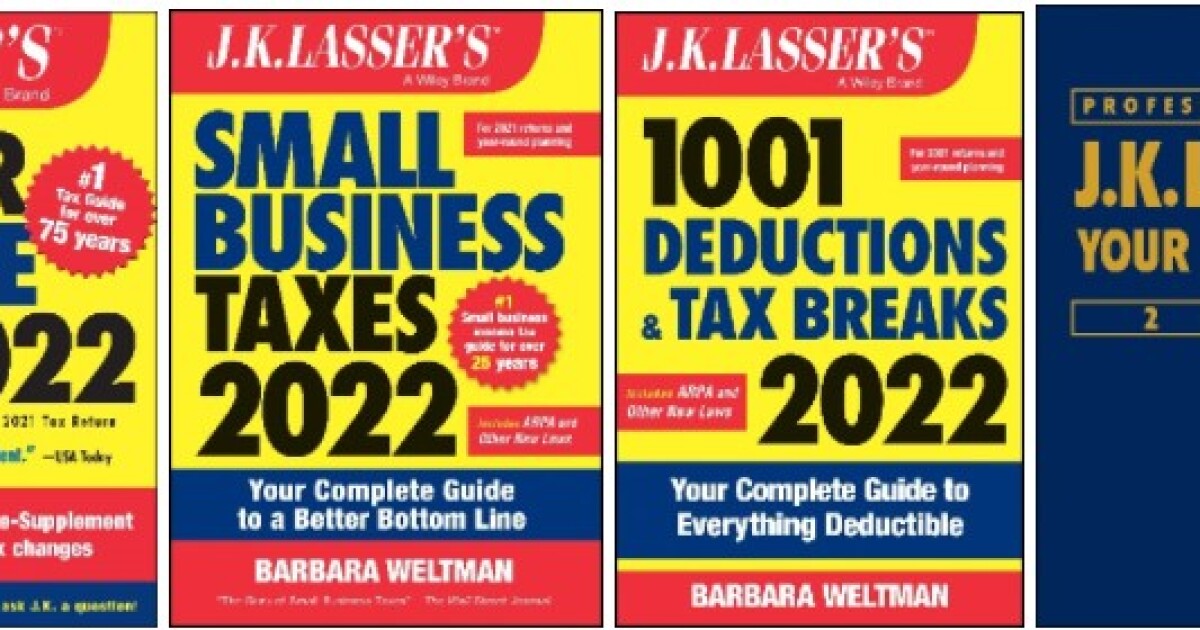

John Wiley & Sons has up to date its annual J.Ok. Lasser collection of tax guides with info for getting ready tax returns this 12 months.

The guides clarify the impression of a number of the latest adjustments to tax legal guidelines just like the American Rescue Plan Act (ARPA) and the Consolidated Appropriations Act, 2021 (CAA). The venerable publications have been round for over 75 years and are a well-known sight on bookstore cabinets.

J.Ok. Lasser’s Your Revenue Tax 2022, Skilled Version is aimed toward CPAs and different tax and accounting professionals and has been printed for over 65 years. The most recent version as been revised to replicate quite a few adjustments to the 2021 Tax Code and consists of citations and steering for accountants to assist purchasers file their taxes.

Different guides embody J.Ok. Lasser’s Your Revenue Tax 2022: For Making ready Your 2021 Tax Return, aimed toward self-preparers. The guide discusses the worksheets and kinds wanted for 2021 returns, and supplies essentially the most present recommendation on easy methods to maximize deductions and credit. J.Ok. Lasser’s Small Enterprise Taxes 2022: Your Full Information to a Higher Backside Line, by tax legal professional Barbara Weltman, helps small enterprise house owners make enterprise choices on a tax-advantaged foundation.

J.Ok. Lasser’s 1001 Deductions and Tax Breaks 2022: Your Full Information to Every little thing Deductible, additionally by Weltman, has been up to date to replicate the newest rulings and legal guidelines. Within the guide, Weltman solutions the commonest tax questions concerning deductions and credit to assist taxpayers preserve extra of their hard-earned cash.

J.Ok. Lasser’s Your Revenue Tax 2022, J.Ok. Lasser’s Small Enterprise Taxes 2022, and J.Ok. Lasser’s 1001 Deductions and Tax Breaks 2022 are all accessible now in each print and e-book format. J.Ok. Lasser’s Your Revenue Tax 2022, Skilled Version is scheduled to be printed on Feb. 2.