The letters that the Inside Income Service has been sending to taxpayers in regards to the quantities they acquired on advance funds of the Baby Tax Credit score could have outdated data.

The IRS started sending data letters to taxpayers final month in regards to the Baby Tax Credit score funds and requested taxpayers to avoid wasting the letters to make use of after they fill out their 2021 tax return (see story). Nevertheless, together with the beginning of tax season on Monday, the IRS has relaunched a revamped web site for the Baby Tax Credit score with up-to-date data on the quantities to make use of with tax returns (see story). Taxpayers and practitioners are being requested to make use of the data there. The letters could include outdated data, particularly for taxpayers who’ve moved or if their test or direct deposit funds was undeliverable.

“If taxpayers have questions or issues in regards to the data of their letter, they’ll additionally go to IRS.gov and look on their on-line account and search for the data on IRS.gov,” mentioned Ken Corbin, chief taxpayer expertise officer on the IRS and commissioner of the IRS’s Wage and Funding Division, throughout a information convention Monday. “We’re nonetheless trying into among the data we’ve heard in regards to the notices not being right. We don’t imagine this can be a widespread downside, and as quickly as we get by taking a look at that, we’ll put some extra data out that will likely be useful to the taxpayers and to you to share again with them.”

Leaders of tax skilled organizations have been warning the IRS in regards to the issues they’re seeing, particularly with automated penalty notices going out to taxpayers when the IRS remains to be coping with a backlog of thousands and thousands of unprocessed tax returns.

The issue with the inaccurate Baby Tax Credit score letters is probably going so as to add to the complications of what’s already shaping as much as be a difficult tax season. The IRS stopped sending the advance month-to-month funds on the Baby Tax Credit score on December 15, and Congress is at odds over whether or not to increase the funds this yr with the Construct Again Higher Act at the moment stalled within the Senate.

“How massive of an issue will this be?” mentioned Steve Mankowski, co-chair of the Nationwide Convention of CPA Practitioners,” throughout a press convention Tuesday to debate the issues of a coalition of accounting and tax practitioner organizations with IRS backlogs and automatic penalty notices. “At a latest IRS assembly, they got here out and instructed us they began sending these letters December 14, which was sooner or later earlier than the December 15 funds have been being made, in order that knowledge wasn’t even on the letters that have been despatched out. I imagine it was round 50 million that have been being despatched out all instructed. There’s a good portion that doesn’t embrace the December data, after which there’s at all times the difficulty of fogeys that will alternate youngsters in several years. Some could have gotten the cash, and a few could have gone to the incorrect associate, so there’s a whole lot of points probably at hand right here.”

It’s unclear what number of taxpayers and preparers will learn about going to the web site for the proper data when they’re instructed to make use of the data within the letters they’ve acquired. “It’s actually troublesome to gauge how a lot the positioning goes for use as a result of there’s a whole lot of points with logging onto the positioning,” mentioned Mankowski.

The IRS could now must ship out a follow-up letter or get the phrase out to the tax skilled neighborhood in regards to the issues. “I believe right here is a chance the place one thing went incorrect and among the letters are incorrect,” mentioned Larry Grey, authorities relations liaison on the Nationwide Affiliation of Tax Professionals, throughout the press convention. “The query being, is there a chance for the IRS to speak the difficulty as a result of proper now the probabilities are there are going to be extra errors? If I’m a taxpayer and I take a look at my checking account, that might not be right. The Letter 6419 may not be right. To know what the reply is that this yr, in contrast to in prior years, I can exit to a taxpayer account. I nonetheless should undergo validation and there would be the precise reply. My greatest concern is folks not realizing the letter could possibly be incorrect. What’s the IRS doing? They know the inhabitants. What are they doing to ship out a observe up letter or a observe up communication to cease creating an even bigger backlog within the coming season? The people who get this want it. It’s for youngsters. It’s not massive company America. These are dwell folks in real-town America, so I believe there’s a chance that could possibly be missed by efficient communication to a recognized inhabitants.”

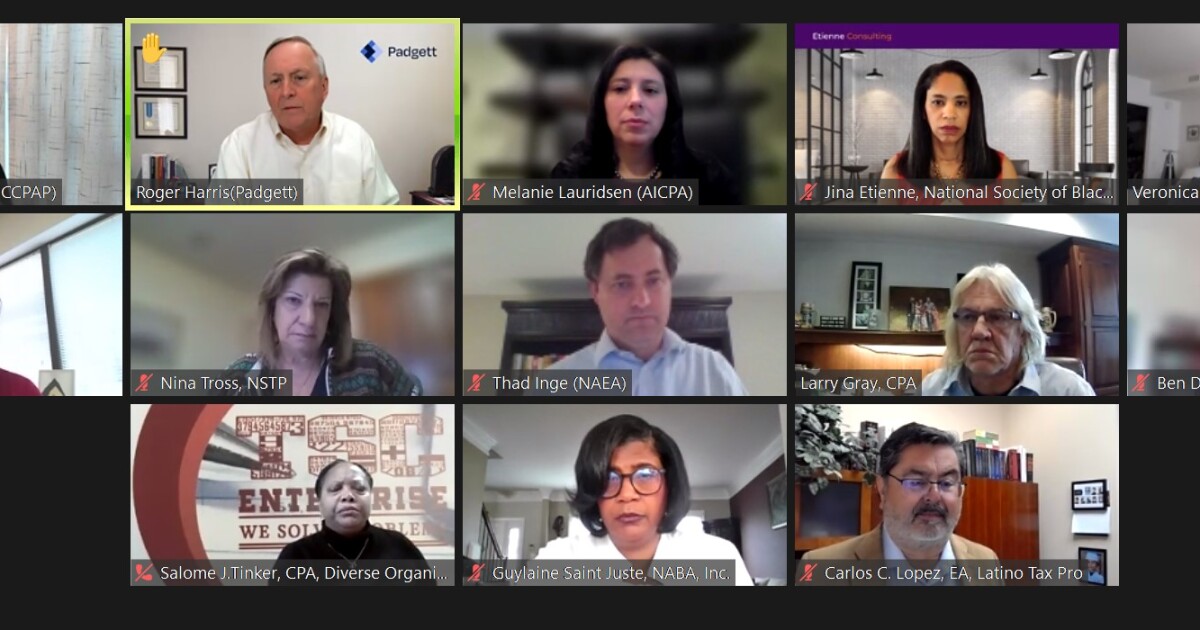

Earlier this month, the coalition of 11 accounting and tax skilled teams despatched a letter to the IRS urging it to discontinue the automated notices, supply affordable trigger penalty waivers, align requests for account holds with the time it takes to course of penalty abatement requests, and supply taxpayers with focused aid from penalties (see story). The group consists of the American Institute of CPAs, Latino Tax Professional, the Nationwide Affiliation of Black Accountants, the Nationwide Affiliation of Enrolled Brokers, the Nationwide Affiliation of Tax Professionals, the Nationwide Convention of CPA Practitioners, the Nationwide Society of Accountants, the Nationwide Society of Black CPAs, the Nationwide Society of Tax Professionals, Padgett Enterprise Providers, and Prosperity Now

The coalition of accounting and tax teams is hoping the IRS will likely be extra delicate to taxpayer service points regardless of the various challenges it’s dealing with this tax season with the pandemic, employees shortages and funding shortfalls.

“We’re asking the IRS to take a commonsense strategy to customer support,” mentioned Guylaine Saint Juste, president and CEO of the Nationwide Affiliation of Black Accountants, throughout the press convention, which was held on Zoom. “The taxpayer in the end is the shopper, and I believe we are able to all agree, both our companies or our associations represented in these Brady Bunch squares, if we operated on this method, we might run out of enterprise. Sadly there isn’t a one on the IRS out of enterprise. What we’re asking, although, is a commonsense strategy to good customer support, taking good care of taxpayers, significantly essentially the most susceptible communities, in order that they’ve entry to the sources that they want and may make sure that they adjust to the legislation.”

The IRS has been having an particularly onerous time with processing paper tax returns. “With COVID, we noticed an inflow of individuals making an attempt to get aid for the EIDL [Economic Injury Disaster Loans] or the PPP [Paycheck Protection Program],” mentioned Salome Tinker, chair of the AICPA Various Group of Companies Advocacy Committee. “A few of them we needed to deliver them into the fold, if you’ll, of compliance, which required them to file not solely their present tax return, but in addition again taxes. A part of their again taxes may need solely been filed with paper, and we discovered circumstances the place a few of our constituents didn’t get the cash as a result of the again tax that was wanted to qualify for EIDL or PPP didn’t get processed as a result of the tax return didn’t get processed. We might suppose that if the IRS might put extra methods in place to repair the issue of counting on paper, that may additionally assist.”

Expertise could also be a barrier for a lot of dad and mom who could should depend on the Baby Tax Credit score internet portal to get the proper details about their advance funds.

“In case you look extra broadly on the minority neighborhood, the Black and Brown and Asian communities throughout the USA, we’re in an ideal storm,” mentioned Jina Etienne, chair of the Nationwide Society of Black CPAs. “All 4 of those suggestions will help with that. Those that are decrease earnings usually tend to be our gig staff and 1099 contractors. We all know they’ve extra sophisticated tax returns. The aid provisions are inherently complicated and so they usually require help and assist. Many of those taxpayers, as many as 40% of their tax returns are ready by themselves. Oftentimes they don’t have entry to the know-how to have the ability to e-file. We all know that as many as 60% of minorities are unbanked in the USA, which may create complexity on high of that for issues like direct deposits and digital funds. The assorted issues affecting these minority communities might be addressed and resolved considerably by adopting the suggestions which might be being made right here. The influence of penalties, the flexibility to observe up, merely calling the IRS for help for somebody in considered one of these communities, they don’t essentially have the capability to remain on maintain for so long as two hours due to their job, due to their scenario, due to their entry to know-how. The impacts are broad, not solely on the minority companies, however on the minority taxpayers throughout the nation.”