The whole worth of goodwill impairments recorded by U.S. public corporations greater than doubled in 2020 throughout the first 12 months of the COVID-19 pandemic, in accordance with a brand new research, and the identical might occur once more this 12 months as geopolitical tensions rise.

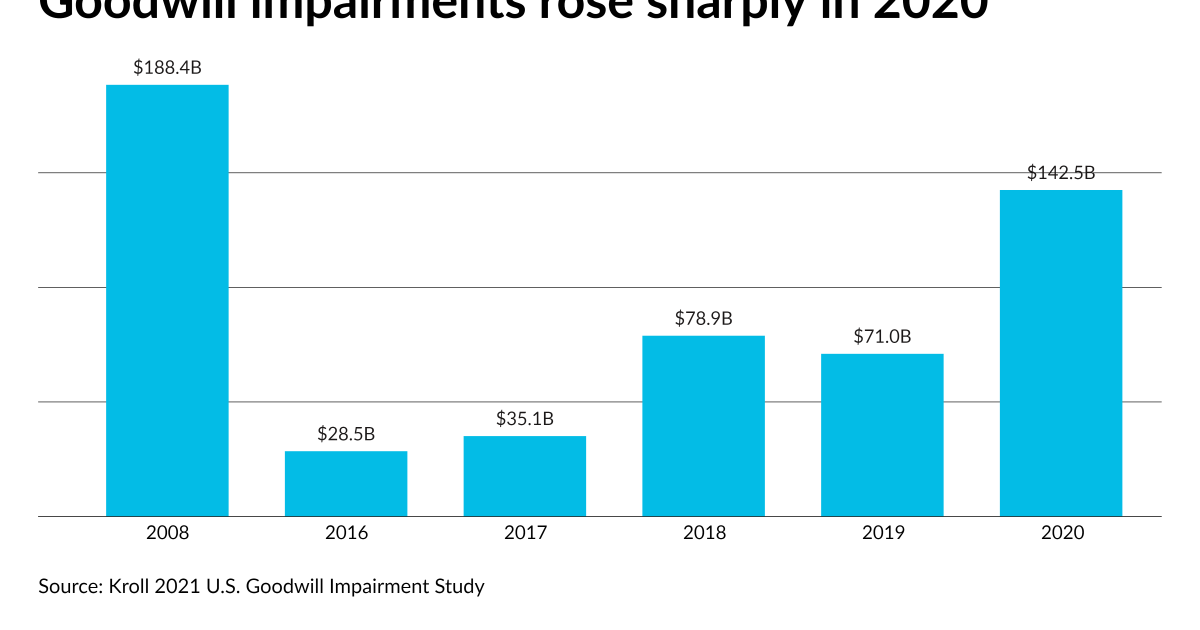

The research, launched Thursday by Kroll’s Valuation Advisory Providers follow, discovered complete goodwill impairments surged from $71.zero billion to $142.5 billion between 2019 and 2020 amid the pandemic, however the quantity fell wanting the $188.four billion degree in 2008 at the start of the worldwide monetary disaster. The variety of goodwill impairment occasions additionally elevated 45%, from 318 in 2019 to 462 in 2020, however that determine was nonetheless under the 502 occasions noticed in 2008. Common goodwill impairment per occasion rose to $308 million in 2020, the second-highest degree for the reason that document in 2008 of $375 million.

The findings point out that the accounting fallout from the worldwide pandemic has not been as drastic as seen throughout the monetary disaster, as markets rapidly recovered and lots of corporations noticed big earnings because of beneficiant authorities stimulus packages. Fast actions from the Federal Reserve and the U.S. authorities restricted the magnitude of goodwill impairments that in any other case most likely would have been noticed, notably when in comparison with 2008 ranges.

“Unprecedented ranges of fiscal and financial help allowed many companies to bounce again from the plunge in financial exercise that adopted the COVID-19 outbreak, with the S&P 500 index recovering dramatically from its low level in March 2020,” mentioned Carla Nunes, managing director in Kroll’s Workplace of Skilled Follow and a Kroll Institute Fellow, in an announcement. “In keeping with these developments, our preliminary knowledge for 2021 factors to a pointy reversal in goodwill impairment exercise.”

Eight out of the 10 industries analyzed within the annual research noticed their goodwill impairment improve or stay at comparable ranges in 2020, apart from the buyer staples and well being care sectors. Power goodwill impairment surged almost five-fold to an all-time excessive of $41.7 billion, as a result of plunging international oil demand and different occasions that led to a collapse in oil costs. The communication providers business skilled a document variety of impairments in 2020 and an mixture impairment quantity of $27.5 billion, the best degree seen since 2007. A number of corporations continued to wrestle with intense competitors and modifications in shopper preferences, additional exacerbated by COVID-19 associated points, reminiscent of content material creation delays and venue shutdowns.

Goodwill impairment within the monetary and actual property sector skyrocketed 43-fold to $19.1 billion in 2020, the best degree since 2008, as shuttered properties squeezed actual property corporations, whereas a rise in credit score losses and additional declines in rates of interest (introduced on by COVID-19 financial insurance policies) led to a compression in monetary establishments’ margins.

This 12 months, buyers could also be focusing once more on goodwill impairment as an necessary issue of their evaluation. Geopolitical dangers from Russia’s invasion of Ukraine are dampening international financial prospects, whereas inflationary pressures are prompting the Federal Reserve and different main central banks to boost rates of interest. The ensuing improve in the price of capital and the potential deterioration within the international financial outlook may effectively increase goodwill impairments once more in 2022.

Each the Monetary Accounting Requirements Board and the Worldwide Accounting Requirements Board are discussing a change in goodwill accounting, transferring away from impairment to solely amortization, however many buyers want to see a unified method from each FASB and the IASB, in accordance with a survey launched final December by the CFA Institute (see story).

“Normal-setters should carry out an applicable cost-benefit evaluation and be certain that any change will meet the standards (i.e., enhancing the decision-usefulness of economic statements) earlier than making a monetary reporting change,” mentioned a report on the survey by Sandy Peters, senior head of economic reporting coverage on the institute. “At the moment, the FASB is trending towards a transfer to amortization with a 10-year default amortization interval, and the IASB is transferring towards retaining impairment with an enchancment in disclosures.”

Normal-setters in addition to buyers might want to maintain a detailed watch on the goodwill impairment numbers this 12 months. “Sturdy and well timed details about goodwill impairments of U.S. corporations has by no means been extra necessary to buyers than it’s at the moment,” Nunes mentioned in an announcement. “U.S. corporations confronted an exceptionally excessive degree of uncertainty created by COVID-19 and the following financial disaster, which prompted important modifications to their earnings outlook and related threat. The impairment ranges recorded because of the pandemic reveal that the present goodwill impairment-only mannequin captures the modifications in enterprise outlook, as meant by accounting requirements.”