Tax season is over, and our telephones are ringing with CPAs telling us they don’t seem to be going to undergo one other tax season, asking themselves, is it time to promote? This occurs yearly. Whereas we sometimes see an uptick in acquisition exercise all through the summer season, fact be advised, as enterprise resumes at a traditional tempo, most homeowners ultimately abandon the thought of promoting. Another choice for CPAs is succession planning.

Usually, enterprise homeowners have invested years — usually, a long time — of time and vitality into creating and rising practices into profitable companies. Over time, many CPA follow homeowners supported their purchasers’ plans for succession, but usually haven’t had time to assume and plan that future for his or her enterprise.

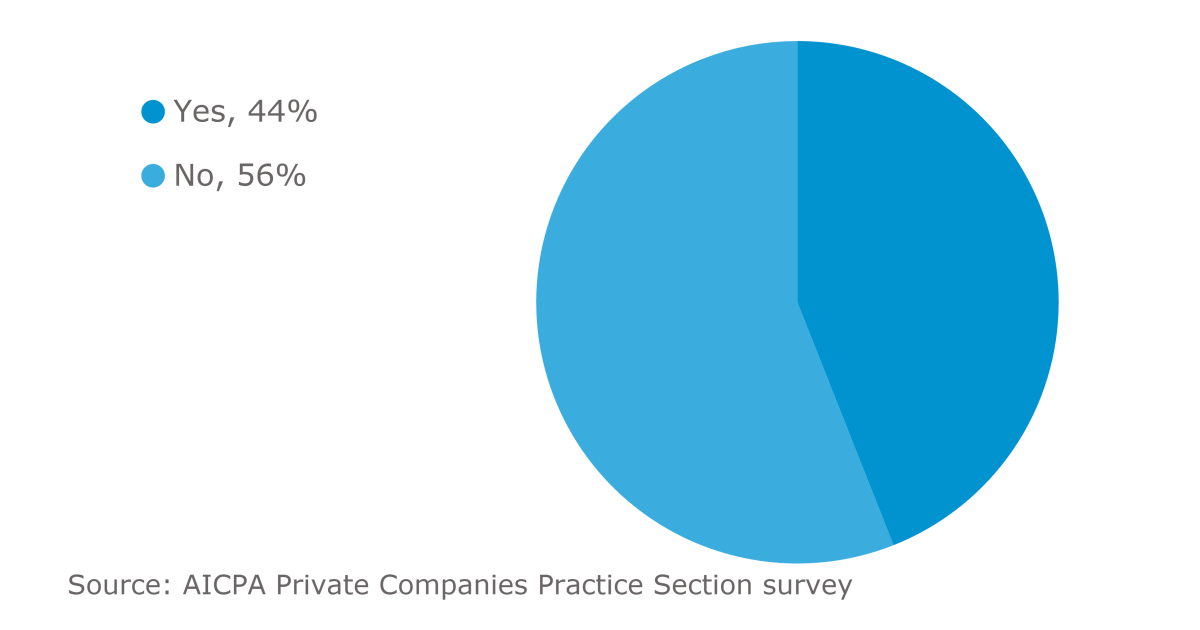

Once we get these calls from exhausted homeowners at the moment of 12 months, our crew asks about their plans for succession and private monetary planning for long-term stability. The important thing query we ask is: As you counsel your purchasers in regards to the significance of enterprise transition planning, are you additionally creating a technique in your personal optimized exit?

Throughout these conversations, most purchasers say they like an inner succession plan. House owners say they’re searching for somebody on their crew with management and enterprise expertise who may buy the follow, making a seamless transition for workers and purchasers. This takes thought and cautious planning to make sure success within the quick and long run. Right here’s why.

A consumer in his early 60s purchased out his companion by means of a mixture of a mortgage and earn outs to develop into the only proprietor. He was prepared to steer, handle and develop the enterprise. Nonetheless, shortly after the acquisition, he all of a sudden handed away and he didn’t have a succession or continuity plan in place. With out a direct plan, a licensed tax skilled engaged as a part of a continuity plan, and authorized documentation, the follow was dealt with by his private property and sadly all the follow dissolved.

What’s in a succession plan?

A succession plan is a written plan, or a contract, used when a enterprise proprietor retires, or a companion decides to dissolve their follow. The planning half is a journey, not a one-time occasion. It permits the proprietor to retire or proceed to be concerned with the follow, probably at a lesser or completely different capability. It outlines who, what, when and the way succession will occur.

Who?

Step one is to find out who would be the successor(s), and if that successor is inner or exterior. Maybe a member of the family can also be a CPA and would make a great successor. I like to recommend homeowners assume by means of the qualities they wish to see in the one who would take over the enterprise. Possibly one other CPA involves thoughts.

Don’t instantly share concepts. As an alternative, assume by means of the steps concerned and what a transition may appear like by way of timing, coaching, speaking, deal construction, consumer migration, employees engagement and funds. The one who can take your follow to the following iteration and proceed to develop the agency with out you doesn’t need to have the identical enterprise expertise you because the founder wanted. When it comes time to attract up paperwork or perceive how monetary consideration for the sale might be funded, seek the advice of with authorized and lending professionals as wanted.

When, what and the way?

Three keys to a profitable succession plan are timeline (when), fee (what) and communication (how).

- When will you retire? Create a timeline with succession steps concerned. What are the steps concerned to maneuver the long run proprietor right into a management place? Does the long run proprietor want improvement coaching in sure areas, for instance? How would that occur? The additional prematurely plans are made, the smoother the transition.

- What’s the construction of the sale? Work with a lender to find out the construction of the sale. After you receive a valuation, contemplate how a lot upfront money you prefer to at closing in comparison with how a lot you’re prepared to have structured as a observe or earnout fee for a number of years.

- How will you talk? Take into account how and while you would notify staff and purchasers of the transition, even when the transition is a decade away. Staff respect realizing a frontrunner’s imaginative and prescient for his or her future.

As a ultimate step, the brand new future proprietor also needs to put their succession plan into place. As Benjamin Franklin wrote, “On this world nothing might be mentioned to make certain, besides dying and taxes.” Having a transparent imaginative and prescient and plan for a enterprise’ succession in each the short- and long-term creates enterprise worth, however extra importantly peace of thoughts that the follow will endure by means of decade after decade of tax seasons.