Sunday night, Kim and I made a suggestion on a home. The Greenwood Place (as we’ll name it) was listed at $649,000. We provided $677,777 escalating to $777,777; no repairs required; and a $50,000 appraisal hole waiver.

Our provide was not accepted.

That is proper: Two months after promoting our residence — and three months after starting to seek for the following place — Kim and I’ve waded again into this loopy housing market. We’re unsure how lengthy this course of will final (or what the result might be) however we’re ready to be looking for many weeks, if not months.

Each our mortgage dealer (Michael S.) and our real-estate agent (Michael Ok.) inform us we’re doing issues precisely proper for this market.

- Kim and I each have credit score scores over 800. “Every thing seems to be unbelievably good right here,” Michael S. informed us in June. “That is superb. Good credit score.”

- We have offered our earlier home and are at the moment renting a spot whereas we seek for one other. This enables us to make provides with out residence sale contingencies.

- We’re prepared to take calculated dangers to extend the power of our provides, however we’re not prepared to compromise our monetary well being in doing so. “You’ll be able to borrow $850,000 all day lengthy,” Michael S. informed us. “You’d in all probability have zero issue qualifying for $1 million.” We do not need to borrow one million {dollars} although as a result of doing so would severely compromise our different targets.

All the identical, there aren’t many houses in the marketplace proper now. Demand far outpaces provide, which is driving costs up and creating insanely aggressive conditions. It does not matter whether or not we’re doing every little thing proper. We’re nonetheless going to run into of us who could make money provides at greater than $128,000 over a $649,000 asking worth.

Our plan? Be affected person. Stay vigilant. We needn’t purchase a house for the time being — and, the truth is, maybe it might be finest if we did not — however we need to be ready to pounce if/once we discover the correct place.

At this time, I need to share a little bit of our thought course of as we try to purchase a house in 2021.

The place We’re Beginning From

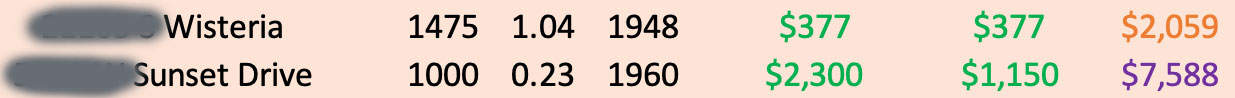

At present, Kim and I are paying $2300 to hire a 1000-square-foot residence in a pleasant, walkable neighborhood on the south facet of Portland. We prefer it. (True story: Two days in the past as I used to be strolling the canine, a neighbor stopped me. “Is your title J.D.?” he requested. “I have been watching your YouTube movies!” First time anyone has acknowledged me from my tiny YouTube channel haha.)

This $2300/month hire fee is comfy for each of us. Kim does not have the intensive retirement financial savings that I do, however she’s in good condition in comparison with most individuals. She will be able to afford $1150 monthly for housing. And whereas she (and I) would like to have a decrease housing fee, she’s prepared to go as excessive as $1200 monthly.

Our present housing state of affairs leaves me swimming in cash. That is the way in which it feels, anyhow.

You see, one of many causes I wished to maneuver was as a result of I might managed to cripple my month-to-month money circulation. I had an excessive amount of invested in our home. I owned it outright. One-third of my internet value was locked into the house and could not be used for different issues — equivalent to shopping for meals.

Once we owned the house on Wisteria, my month-to-month housing bills have been $377 for taxes and insurance coverage. (Kim had no housing bills. The house was mine.) Primarily based on my non-retirement investments and financial savings, I had a month-to-month price range of $2059 to get me to age 59-1/2 (at which era I may entry retirement accounts). That $2059/month price range was far under my precise spending, which averaged about $4200/month.

By promoting the house and shifting into this rental, a tremendous factor occurred. Although my month-to-month housing bills jumped from $377 to $1150, my after-housing month-to-month price range elevated from $2059 to $7588 — all as a result of I now have a pile of money in my checking account.

This improved money circulation is 100% as a result of we I now not have $500,000+ locked up on residence fairness. It is in my checking account. Sure, a few of it is going to quickly be in residence fairness as soon as once more (we hope) as a result of we’ll use it for a down fee on the following place. However I am going to retain a large chunk of that to bridge the hole between at present and 25 September 2028, once I flip 59-1/2.

So, at present I really feel like I am swimming in cash. As a substitute of operating a $2100 month-to-month price range deficit, I’ve a $3300 surplus. I’m, as soon as once more, financially impartial.

That is our start line. As we hunt for houses, I preserve a operating spreadsheet that (amongst different issues) tracks my projected month-to-month price range for every residence. In reality, this month-to-month price range is my number-one consideration in buying a house.

Choosing a Metropolis

I’m fifty-two years outdated. Up to now thirty years, I’ve bought 4 houses — and I am about to purchase a fifth. My homebuying habits are virtually completely aligned with the American common. Householders have a tendency to remain in a single place for about seven or eight years, on common.

In different methods too, my homebuying habits have been typical. If I am not cautious, as an example, I can get wrapped up within the emotional facet of the method.

When my ex-wife and I purchased our hundred-year-old farmhouse in 2004, I used to be 100% motivated by emotion. There was nothing logical in regards to the resolution. When Kim and I bought our most up-to-date residence in 2017, we allowed emotion to over-ride logic to our detriment.

This time round, I am attempting to be logical and deliberate. After 4 years in a home that proved problematic, and within the midst of a housing market that appears to have gone mad, I need to make a good move.

So, my full-time “job” for the previous couple of months has been house-hunting. I am not saying that my course of is ideal (nor relevant to everybody) however it’s a hell of much more logical than any of my previous residence purchases.

To start with, Kim and I spent twelve full days over the last three months driving throughout western Oregon and western Washington looking for a spot to stay. We would steadily dedicate weekends to driving throughout each states (with the canine in our laps), exploring small cities and asking ourselves, “Might we stay right here?”

We love Portland — regardless of what some media shops would have you ever imagine, it has not turn out to be a wretched hive of scum and villainy — however the place has grown too massive for us. Each of us grew up in small cities. We wish a slower-paced life-style with out the entire chaos of an enormous metropolis.

Whereas there are a number of cities that attraction to us, in the end we have determined to maneuver to Corvallis. Corvallis is a city of roughly 60,000 on the base of Oregon’s coastal mountain vary. It is an hour from the Pacific however nonetheless very a lot of the Willamette Valley, the agricultural area the place I grew up. It is residence to Oregon State College. It is the #1 biking city within the state (even forward of Portland!) and has simply sufficient stuff to do to maintain us blissful.

After we selected Corvallis, we made an effort to spend a while there. We would pack up the canine on Saturday mornings, drive ninety minutes south, then spend a number of hours exploring the town. We preferred it — loads. Even so, we have been having a tricky time getting a really feel for the neighborhoods.

Enter our real-estate agent, Michael Ok. Someday it occurred to me that perhaps I may “outsource” studying Corvallis neighborhoods. Looking out YouTube, I stumbled upon this video of a Realtor narrating a driving tour of the city.

This helped us each a lot that we contacted the narrator to ask if he’d take us on as shoppers. He agreed. For the previous two weeks now, we have been working collectively to discover a appropriate location.

Crunching the Numbers

As you’ve got in all probability heard, there aren’t many homes on the market proper now. I haven’t got the precise figures, however my reminiscence tells me that the U.S. housing stock is about half what it usually is. Which means pickings are slim. And whenever you’re looking for a spot in a smaller metropolis like Corvallis, pickings are even slimmer.

Nonetheless, there are perhaps a dozen new listings every week that meet our standards. Michael Ok. has set us up with an automatic software that emails us when houses come in the marketplace that match what we’re in search of. Plus, I spend hours every day on Zillow trying on the different houses that come up on the market — simply in case, ?

What kind of filter are we utilizing? Properly, we have set an higher restrict of $800,000 — keep in mind that our mortgage dealer informed us we may borrow $850,000 “all day lengthy” — and we’re in search of locations bigger than 1500 sq. toes on no less than one-tenth of an acre. Like I mentioned, I exploit Zillow to seek out attainable suits that slip via this internet.

Of the houses that come to market and make it via our filter, perhaps half of them are locations we’re really taken with: the value is appropriate, the home and yard look well-suited for our life-style, and so forth.

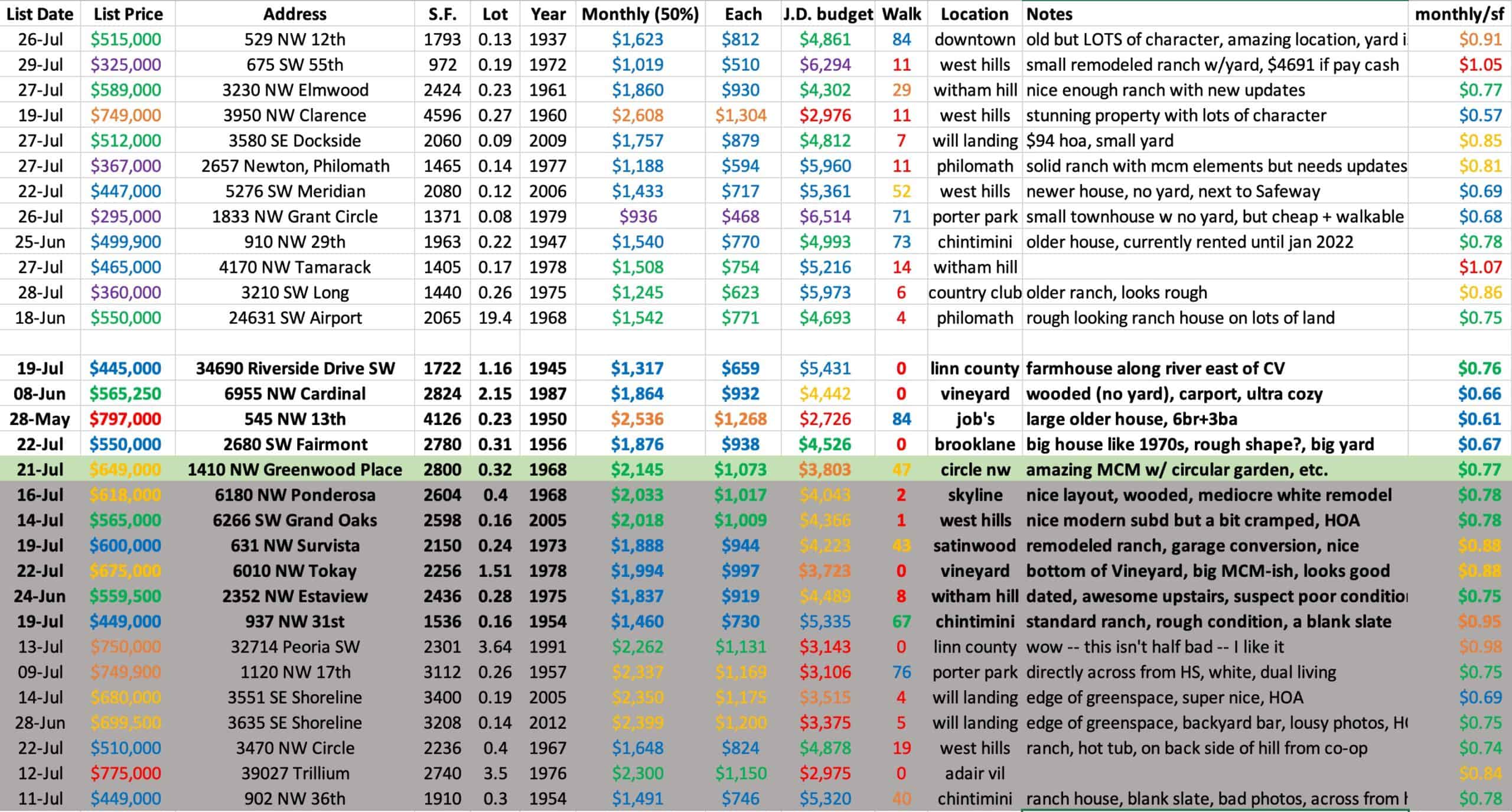

I put all of those matches right into a spreadsheet that appears one thing like this [click for larger view]:

As you possibly can see, my spreadsheet solely tracks a handful of stats, however these are the stats which might be most essential to me. I do not monitor bedrooms and bogs, as an example, as a result of our filter already screens for these. (Plus, I determine sq. footage is an inexpensive proxy for beds and baths.)

Listed below are the variables that matter most to me when trying to find a home:

- Worth, in fact. However worth is not the one monetary consideration, nor crucial. I do not need to overpay for a spot, in fact, however I have a look at the down fee (and eventual fairness) as a switch of belongings. I am not spending $300,000 if I purchase a $300,000 home. I am merely transferring cash from money to actual property. (The cash misplaced to curiosity, nevertheless, is certainly an expense.)

- Measurement of the house. Once more, this serves as a proxy for different issues, such because the variety of bedrooms and bogs.

- Lot measurement. Kim and I like a big yard. We acknowledge, nevertheless, that we’re not going to seek out an acre of land in the course of a metropolis. Nonetheless, it is good to have this quantity helpful.

- 12 months the house was constructed. I need to know when a house was constructed for quite a lot of causes. The constructing date can provide me a tough thought of attainable upkeep considerations. Plus, it is also information for the fashion and structure of the home.

- I’ve three columns of numbers associated to the month-to-month price of the home. The “Every” column is most essential to Kim. This reveals her share of the housing fee every month. The “J.D. price range” column is most essential to me. The “J.D. price range” quantity assumes that I am utilizing my financial savings to make a 50% down fee, then calculates what my month-to-month price range can be after my share of the housing fee. (Bear in mind: this quantity is $7588 in our present rental and it was $2059 at our final home.)

- Stroll Rating. I like a walkable neighborhood. Stroll Rating is not good for my state of affairs — I do not care if I am shut to a faculty — however it’s shut sufficient. My important concern is that I am inside a simple stroll of a grocery retailer. It is a large deal to me. Strolling distance to a park can be good too.

- Location. During which neighborhood is the home situated?

- Notes. It is a catch-all for information like obvious situation of the house, HOA charges, and so forth.

In observe, crucial merchandise within the spreadsheet is the “J.D. price range” column. No joke: I have a tendency to recollect the entire different particulars in regards to the varied homes. Given my notoriously poor reminiscence, that is one thing of a shock.

As you possibly can see, I’ve color-coded every little thing too. I am utilizing good ol’ ROYGBIV, with pink being the “unhealthy” finish of the spectrum and violet being the “good” finish. This enables me to look on the spreadsheet and know, say, that the Grant Circle home provides me a tremendous price range however the Clarence home would put me in virtually the identical monetary predicament as the house we simply offered. (That Grant Circle home seems to be good on paper, does not it? It isn’t. It is a rental that is seen some powerful love previously.)

A couple of different fast notes: Properties listed in daring are houses we have seen in particular person. Shaded traces signify houses which might be beneath contract, so are now not obtainable. And that one inexperienced line? Properly, that is the house we made a suggestion on.

Making an Supply

Kim and I’ve seen eleven houses now. A few these appeared superb in photographs however weren’t good matches in particular person. Most have been common. However one — the Greenwood home — was superb. it was an virtually good match. (Why virtually good? To begin with, worth. Second, walkability was marginal.)

We toured the Greenwood home on Saturday afternoon. We beloved it. As we drove round Corvallis the remainder of the day, we mentioned whether or not or not we must always make a suggestion. “I believe it may be out of our worth vary,” I mentioned. “It isn’t going to promote for $649,000. You heard Michael. He referred to as it an ‘atomic potato’. He thinks it will go for a lot, way more.”

“I do know,” Kim mentioned. “However do not you suppose we would remorse it if we did not no less than attempt to make a suggestion?”

“Sure,” I mentioned. “We would remorse it very a lot.”

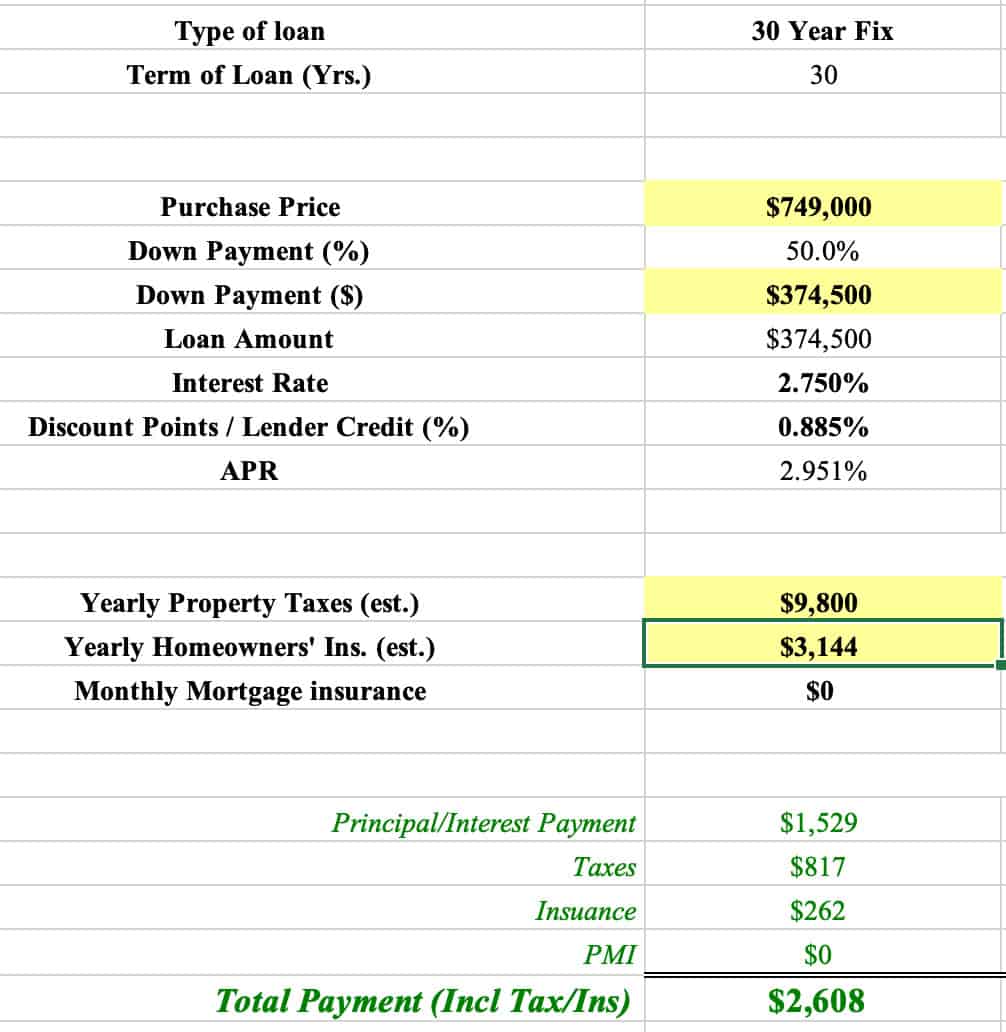

That night, we met with Michael to go over paperwork. Then I spent most of Sunday operating the numbers via different spreadsheets. (What? You thought I had just one?!?)

Whereas I’ve my private spreadsheet for monitoring properties, the spreadsheet that really issues most is the one from Michael S., our mortgage dealer. This file permits us to make projections utilizing precise numbers equivalent to down fee, property taxes, and present rates of interest.

If we alter any one of many variables within the mortgage worksheet, we alter our projected monetary obligations. As you possibly can think about, this may result in many, many permutations of month-to-month funds and down funds.

Usually talking, Kim and I are planning on doing the next: I’ll make a 50% down fee from the money I’ve readily available after promoting our final place. She and I’ll then break up the month-to-month mortgage fee 50/50. This could work for 95% of eventualities we’re exploring.

To ensure that us to make a suggestion on Greenwood, nevertheless, we needed to break free from our commonplace plan. Our default assumptions would lead me to creating a $325,000 down fee on the $649,000 record worth, then my month-to-month price range can be $3803. However we knew that Greenwood wasn’t going to promote for $649,000. It’d promote for one thing extra. (Most likely way more.)

Finally, we figured we needed to provide no less than $100,000 over asking. Fortuitously, the sellers have been permitting escalation clauses, which meant we may provide $750,000+ with out risking that we might overbid anybody else by, say, $30,000.

After a lot inside debate (and even some exterior dialogue with Kim), I made a decision I might be prepared to purchase this home if I may hold my projected price range at about $3800 monthly. That is shut sufficient to my present spending that I felt okay with it. Worst case, I might discover a part-time job to cowl the hole, proper?

By Sunday night, I might provide you with a suggestion quantity: $777,7777 with a $250,000 down fee. This could give me my $3800/month price range assuming Kim was prepared to pay $1200 monthly towards housing (which she was). With at 50% down fee? Properly, then my price range can be $900 decrease every month. Nonetheless higher than on the home we simply offered, however lower than what I would like.

Why a goofy quantity like $777,777? For enjoyable. I am not joking. Actual-estate transactions are lethal uninteresting affairs. I believe it is enjoyable to spice them up with numbers like this. (Plus, we thought it would ship a constructive sign to the sellers.)

After I purchased my condominium on the river in 2013, I intentionally provided 4.01% over asking worth as a result of it was unit #401. The promoting agent later confided that the house owners had seen the quantity and that it performed a small however essential function of their resolution to promote to me.

The provide we submitted on Sunday evening regarded like this:

- We provided a $677,000 beginning worth — $28,000 over asking. However our provide escalated in increments of $7,777 as much as a high worth of $777,777. We have been providing to beat different provides by $7,777 as much as our restrict.

- We agreed to “no repairs”. We would nonetheless carry out an inspection, which might enable us to bow out of the deal if we discovered one thing catastrophic, however we would not ask the vendor to do any repairs.

- We included a $50,000 appraisal hole waver. If our provide was accepted at $760,000 however the residence appraised at $720,000, I’d make up that $40,000 distinction with my money reserves.

The subsequent 36 hours have been painful for Kim. She had turn out to be emotionally invested in the home. Whereas I hoped we might win the bidding struggle — our agent himself wrote one different provide for the home! — I used to be surprisingly cool and picked up about the entire thing.

Shifting Ahead

Michael Ok. referred to as on Tuesday morning. He did not beat across the bush. “Your provide wasn’t accepted,” he mentioned with out preamble (which I appreciated). “I am just a little shocked. You wrote a robust provide.”

Proper now, we do not know what number of provides Greenwood acquired and we do not know the quantity of the profitable bid. We cannot know that till the place closes in a number of weeks. However we’re dying to know the way way more we would have liked to supply with a view to purchase the place.

Finally, nevertheless, we’ve got no regrets. We all know that we made the best provide we probably may. There was nothing extra that we may have carried out with out compromising our different monetary targets. We’re at peace with this consequence.

Now, although, it is again to househunting. We have already lined up a few residence excursions for tomorrow afternoon. The locations look promising — and one in every of them is less expensive than the Greenwood place! I reamin hopeful that we’ll discover a good residence in Corvallis with a walkable neighborhood, a yard for our animals, and area for Kim to do yoga and gardening.

Nonetheless, part of me is aware of we have solely been at this for 2 weeks. The parents who purchased our home in Could had been searching for ten months. The market is loopy proper now, with way more consumers than sellers.

Who is aware of? Possibly I will be writing provide recaps via the winter and into subsequent summer season. However I positive hope not!