Round 15 years in the past, I sat down at my eating room desk in Wellington and started writing the primary strains of code for a start-up that might finally change into Xero. In recognition of that anniversary, I’ve been reflecting on these early days, and the way a easy concept to rework financial institution reconciliation modified the sport for accounting and helped construct the worldwide small enterprise platform you see in the present day.

Financial institution reconciliation continues to be one in all our most cherished options of Xero, and a core a part of our imaginative and prescient to automate routine duties, so you’ve gotten extra time to give attention to what issues most. So in the present day, I believed I’d share a behind the scenes have a look at the place we began, a few of our newest enhancements, and why we’re investing in machine studying to supercharge your financial institution reconciliation sooner or later.

The early days of Xero

In fact, financial institution reconciliation has been round longer than Xero. For a whole lot of years, evaluating two units of data to ensure the figures are right has been a core bookkeeping process. Again then, you’ll manually enter a bunch of payments and invoices into an accounting system, then run your eye down your financial institution assertion to seek out the related transaction and tick it off.

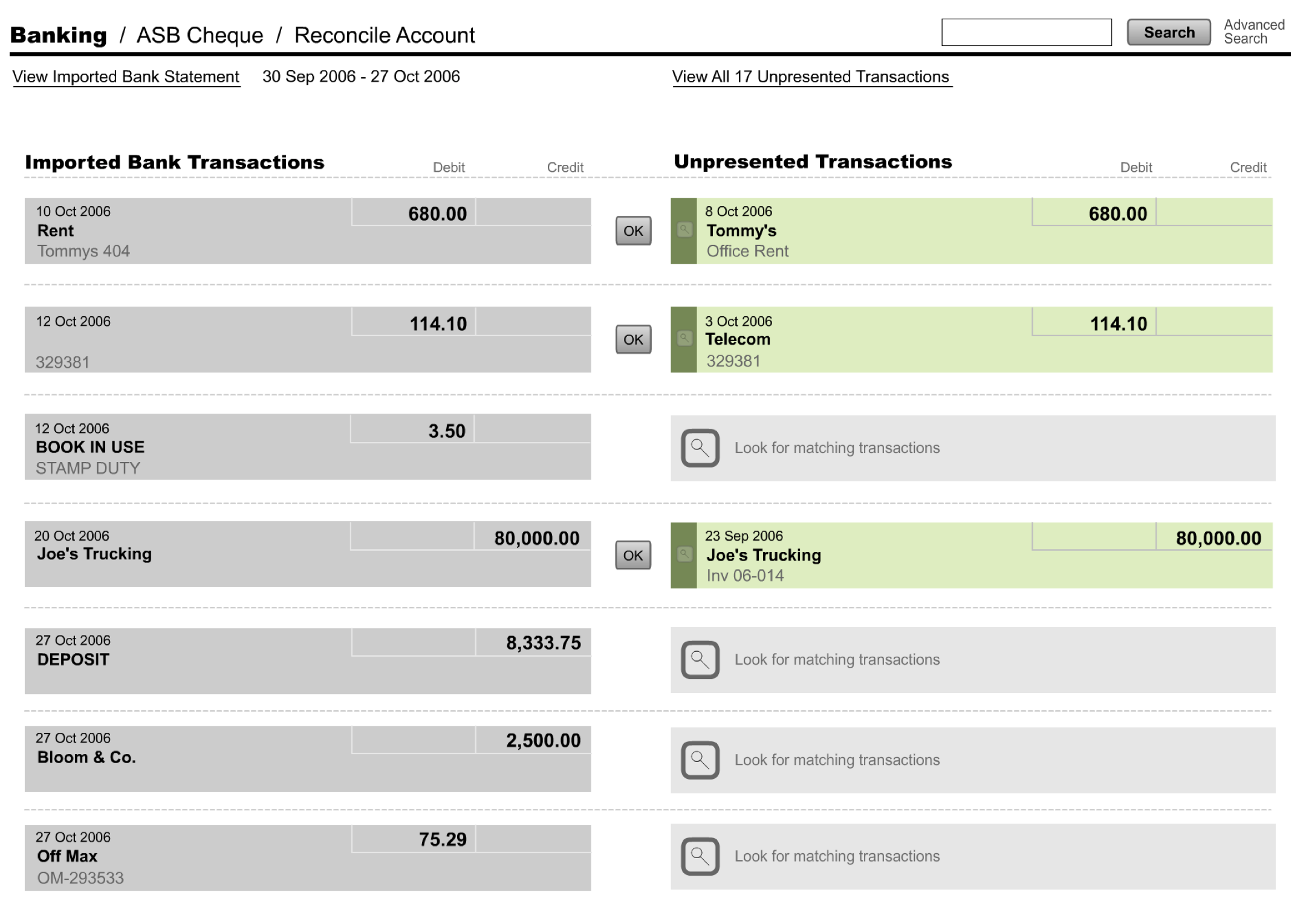

What we did after we created Xero was completely rethink that idea. We began by basically creating an identical recreation, together with your Xero transactions (payments and invoices) on one facet, and assertion strains out of your financial institution on the opposite. We might then do the match for you, or can help you shortly add transactions on the fly. No one had ever achieved this earlier than. It was a completely new means of endeavor a really conventional bookkeeping process, and it’s what made Xero stand out from day one.

The primary model of financial institution reconciliation, launched in February 2007

Since 2007, we’ve continued to put money into financial institution reconciliation and enhance the expertise for our prospects. Actually, chances are you’ll discover within the coming days that your financial institution reconciliation web page has a contemporary new look. However we’re not simply targeted on aesthetics, we’re additionally enhancing the engine that makes it work so effectively, that can assist you full your reconciliation quicker than ever.

Partnering for fulfillment

The early days had been ones of pure discovery. None of us had constructed accounting software program earlier than, so every part was up for debate. However all of us agreed on one factor—the success of financial institution reconciliation would rely upon the accuracy of the info that was entered. And that knowledge began with what was already within the checking account.

The important thing to unlocking this was to get as near real-time entry to that financial institution knowledge as we might. That’s why we partnered with ASB Financial institution in New Zealand, earlier than Xero even went reside.

Whereas our strategy to reconciliation was distinctive, in actuality the true innovation was the financial institution feed. On the time, nobody else had each day financial institution feeds, and it turned our subsequent huge milestone—the power to ingest knowledge instantly from banks and floor it in the course of the financial institution reconciliation course of. It meant prospects might tick the inexperienced field with out having to manually discover a match or create a transaction.

Xero now has 300+ connections to banks and monetary providers companions all over the world, and we’re including new financial institution feeds every year. As we proceed to increase the attain of our partnerships and enhance the standard of our financial institution feeds, our algorithms discover it simpler to recollect transactions and counsel higher matches in the course of the reconciliation course of.

As soon as Xero was capable of usually digest knowledge from banks, we targeted our efforts on creating financial institution guidelines. These guidelines robotically categorise transactions that happen regularly (like parking bills), to assist reconcile money transactions. In contrast to the unique model launched in 2010, now you can see the main points of every rule in your financial institution guidelines record, with out having to click on edit. We’re additionally releasing a brand new search instrument quickly, which can assist you discover and handle the appropriate financial institution rule in seconds.

Predicting the longer term

Know-how has come a good distance since I first began Xero’s financial institution reconciliation expertise at my eating room desk. We proceed to take a position closely in machine studying capabilities, so our algorithms not solely keep in mind the actions you took prior to now to reconcile transactions, however may counsel what actions chances are you’ll wish to take sooner or later.

The primary milestone on this journey is a brand new characteristic that we not too long ago launched, known as switch memorisation. It’s a strong characteristic that enables Xero to recollect the account you transferred cash to, so it could counsel the identical account when an analogous transaction happens sooner or later.

However the actual magic—one thing I’m actually enthusiastic about—is how we’re utilizing predictive algorithms to counsel the contact and account code for transactions created in the course of the financial institution reconciliation course of (ones that aren’t based mostly on an current invoice or bill). I’m going to be daring and say after we crack this, it’ll be the most important factor we’ve achieved up to now in financial institution reconciliation at Xero.

Our groups have already launched the beta model of this characteristic to a small group of shoppers, and hope to launch it extra broadly quickly. At first, it’ll positively impression a really small proportion of your transactions. However over time, as our algorithms be taught which matches are right, you’ll discover an actual distinction. I can’t wait to see the enhancements within the breadth and accuracy of our solutions, and the way a lot time it’ll prevent on the finish of the day.

The journey continues

After 15 years, a lot at Xero has modified. And but, a lot has stayed the identical. Our imaginative and prescient hasn’t modified—we at all times wished to make life higher for individuals in small enterprise, their advisors and communities all over the world. The idea of financial institution reconciliation hasn’t modified both. And but, the guide course of that was once the norm appears so archaic now.

We frequently use financial institution reconciliation as a metaphor for innovation at Xero, and I stand firmly behind that. It’s what made Xero the corporate it’s in the present day, however we’re not achieved but. We’re continually attempting to make this factor everyone knows and love higher, with ongoing funding and innovation that may proceed to avoid wasting you time, and assist your corporation thrive. Watch this area.