Pakistan is dealing with a extreme overseas change disaster. The State Financial institution of Pakistan (SBP) has successfully stopped banks from retiring letters of credit score or opening new ones in the event that they don’t have sufficient overseas change of their very own to do the identical.

The reason being the central financial institution’s foreign exchange reserves are too low to let banks and monetary markets work usually. Solely exterior debt repayments are being managed by some means. (On 16th December SBP’s foreign exchange reserves fell to a brand new low of $6.116 billion, barely sufficient to cowl even 5 weeks of merchandise exports).

Companies, already combating power woes, proceed to protest over foreign exchange management measures. Foreign exchange charges quoted routinely within the interbank and open markets have turn into irrelevant. Since {dollars} are too arduous to seek out, the one related charges are the “going charges”. Banks and foreign exchange firms are promoting {dollars} at “going charges” to these prepared to buy, however solely when {dollars} can be found.

Nothing may be achieved to make sure non-debt-creating foreign exchange inflows within the brief time period. Not even a fraction of the exterior financing hole of billions of {dollars} can come instantly by exports of products or remittance, each of that are already displaying declining developments.

Nonetheless, exports of providers supply some hope. A further few hundred million {dollars} could begin pouring in each month by providers export if the federal government and the SBP take all stakeholders into confidence, devise a “{dollars} influx technique”, and implement it religiously.

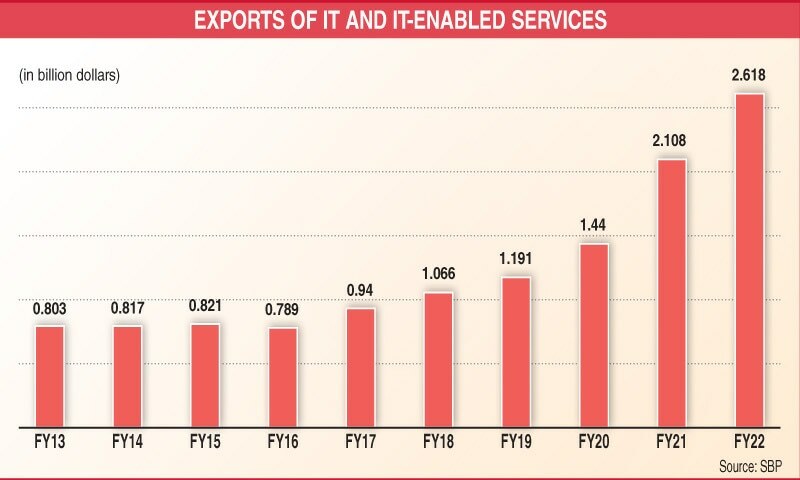

Regardless of inadequate assist from the federal government, IT and ITeS exports tripled to $2.618bn within the final ten years

A medium-term model of the identical technique can assist enhance non-debt-creating foreign exchange inflows within the years to come back. Exports of IT and IT-enabled providers have big potential, which may be tapped instantly by providing no matter incentives this sector requires.

The federal government has lengthy been providing tens of billions of rupees yearly to exporters of textiles and different conventional export gadgets with out linking this largesse with verifiable precise foreign exchange good points. Little surprise that our conventional export sectors, together with textiles, lag behind their opponents.

Their lack of resilience is uncovered every time critical challenges emerge within the world financial system and our export earnings fall. That’s precisely what Pakistan is witnessing now.

What’s extra lamentable is that the successive governments not solely selected to patronise conventional export sectors with out making certain precise foreign exchange returns but in addition ignored providers exports. This stunted development of providers exports.

Again in FY13, Pakistan had managed to earn $6.724bn by service exports. That had raised hopes that within the subsequent ten years, the earnings would no less than double. However sadly, providers exports stay under $7bn — $6.95bn in FY22.

One massive purpose the providers sector exports have suffered prior to now and proceed to endure is that, not like our conventional merchandise export sectors, they’re maybe politically much less necessary. Or that’s what our short-sighted politicians suppose.

Exports of IT and IT-enabled providers (which can be a part of the general providers exports) have big potential, and realising that potential within the short-term may be very a lot attainable. Regardless of inadequate assist from the federal government, exports of telecommunication, pc and data providers — the technical time period used for IT and ITeS exports — stood at $803 million in FY13. Ten years later, in FY22, they greater than tripled to $2.618bn.

For additional development, exports of IT and IT-es want little financial incentives in comparison with what conventional export sectors proceed to get. However a agency political and administrative will to handle the true points is a should.

Launching a free laptop computer distribution scheme — and that too with a number of politics (and sure, corruption) concerned in it might not enhance exports. The federal government should assist educate Pakistani youths financially and technically in establishing name centres, software program improvement homes and software program consultancy providers. And in so doing, it should rise above politics and maintain strict checks on corruption/irregularities.

Concurrently, it additionally should run nationwide ability enhancement programmes to make sure a gentle provide of expert employees. Regardless of all of the lip service rendered on this regard by successive governments, ability improvement stays wanting on many counts and in lots of areas.

Converse to any man or girl who has been working a large name centre in Karachi, and the very first thing they’ll say about their enterprise is that it’s too arduous to seek out younger boys or ladies who can converse English or another overseas language with some confidence. And most of them additionally complain that it’s equally too arduous to seek out individuals who know how you can use their pc/IT schooling on the office.

Ought to this stuff be an issue? Why can’t the federal government launch mass e-learning programmes in affiliation with world educators for these desirous about talking English/ French/German/Chinese language, and Arabic? And what prevents the federal and provincial governments from initiating programmes for younger girls and boys in liaison with tech firms to coach them within the sensible utility of IT information? Such issues may be simply achieved. Can’t they?

Printed in Daybreak, The Enterprise and Finance Weekly, December 26th, 2022