FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Life Sciences Enterprise Capital Monitor – Europe 06/2022”. The Monitor is a month-to-month revealed overview of enterprise...

Capital One had extra tech job openings in June than Amazon. Can tech employees discover job safety in finance? | Fortune

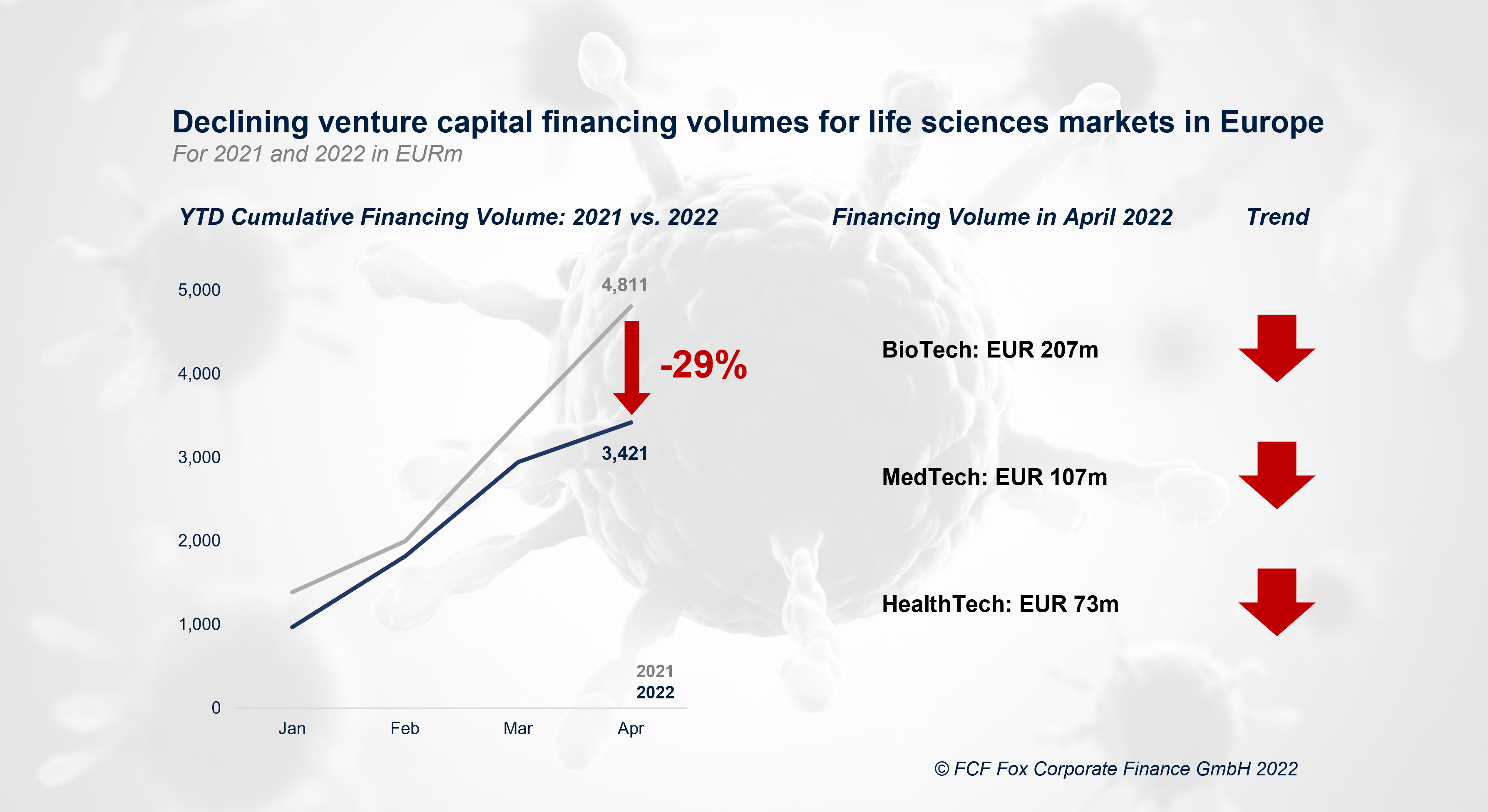

Enterprise capital deal volumes within the European life sciences sector reached a record-breaking stage in 2021. Nonetheless, financing volumes decreased considerably by 29% within the first 4 months of...

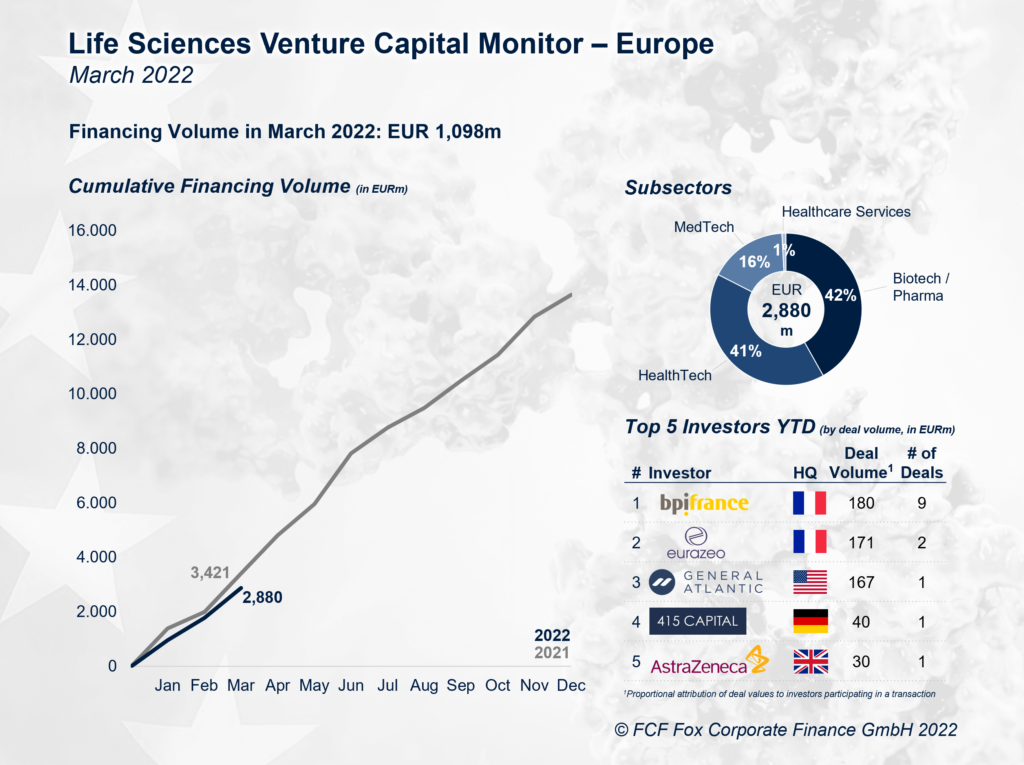

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Life Sciences Enterprise Capital Monitor – Europe 04/2022”. The Monitor is a month-to-month printed overview of enterprise...

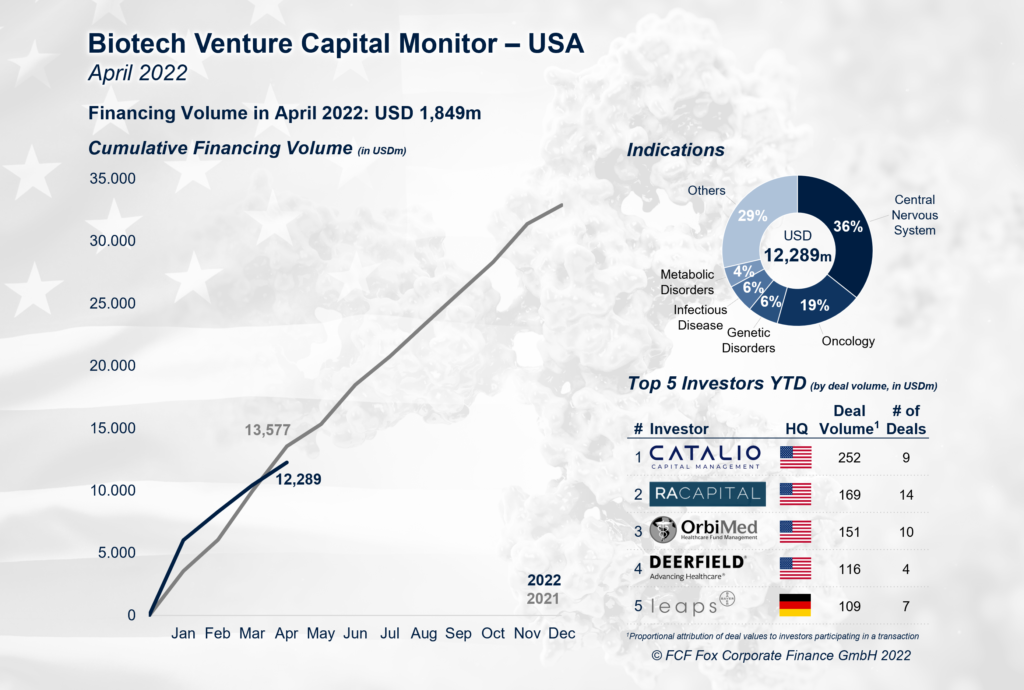

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Biotech Enterprise Capital Monitor – USA 05/2022”. The Monitor is a month-to-month printed overview of enterprise...

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Biotech Enterprise Capital Monitor – USA 05/2022”. The Monitor is a month-to-month printed overview of enterprise...

Cherry Bekaert, a High 25 Agency based mostly in Richmond, Virginia, grew to become the most recent accounting agency to obtain non-public fairness funding, with a strategic funding Thursday...

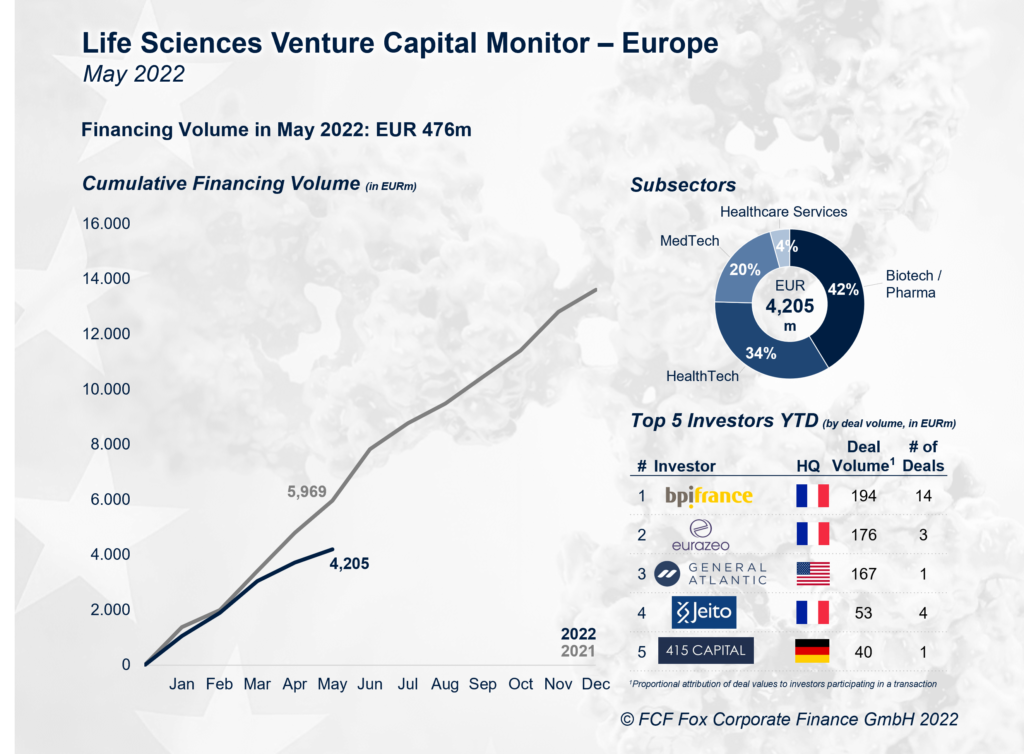

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Life Sciences Enterprise Capital Monitor – Europe 05/2022”. The Monitor is a month-to-month printed overview of enterprise...

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Life Sciences Enterprise Capital Monitor – Europe 05/2022”. The Monitor is a month-to-month revealed overview of enterprise...

FCF Fox Company Finance GmbH is delighted to publish the brand new “FCF Biotech Enterprise Capital Monitor – USA 04/2022”. The Monitor is a month-to-month printed overview of enterprise...