When you’re a VAT-registered small enterprise proprietor, you might have heard the delicate thwump of a letter touchdown in your doormat this previous week, emblazoned with 4 acquainted letters:...

Funds companies had been lengthy supplied to corporations and people by banks, however up to now 20 years devoted and specialised suppliers drastically expanded the market. In 2020, world...

Slightly below two years seems like fairly a very long time. However then time hasn’t precisely flowed to its pure rhythm over the previous couple of years. With lockdowns...

In case you’re a landlord, you’ll seemingly have felt the rumblings round Making Tax Digital for Earnings Tax Self Evaluation (MTD for ITSA). A part of the federal government’s...

Main Out-of-Dwelling media firm JCDecaux in the present day introduced the official launch of e-learning course JCDecaux ACADEMY, an industry-first, market-leading, supplier-agnostic program, designed to foster understanding and consciousness...

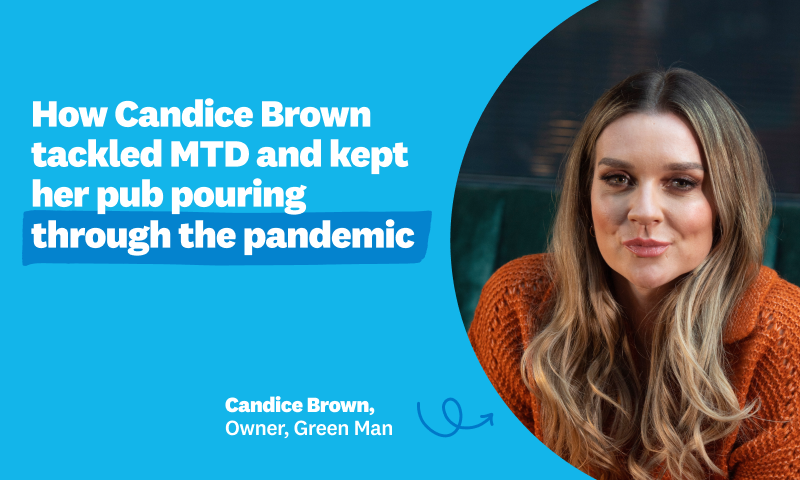

The hospitality business is not any stranger to new challenges. From pandemic restrictions to Making Tax Digital (MTD), hospitality companies have needed to keep agile and adapt to many...

It’s laborious to overstate how damaging the worldwide pandemic was for native pubs. Many of those companies are establishments – not merely a spot to get a chilly pint,...

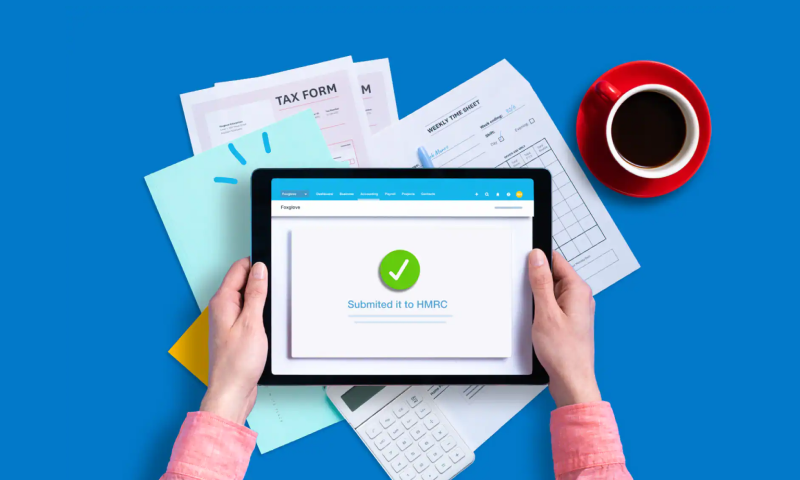

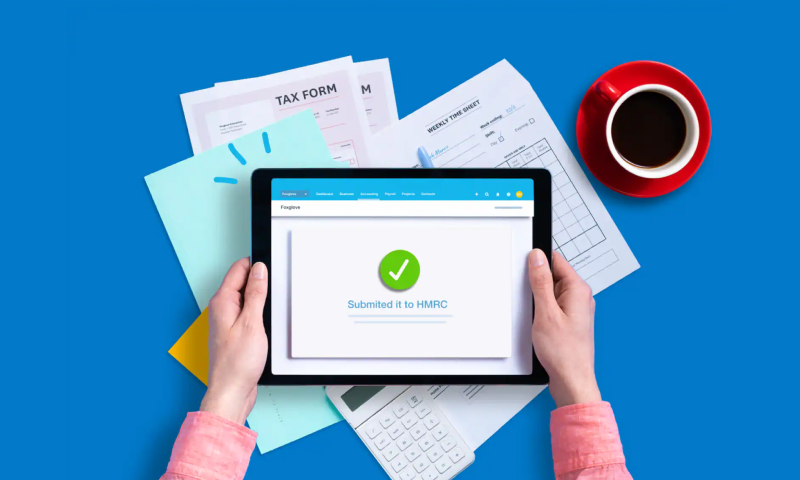

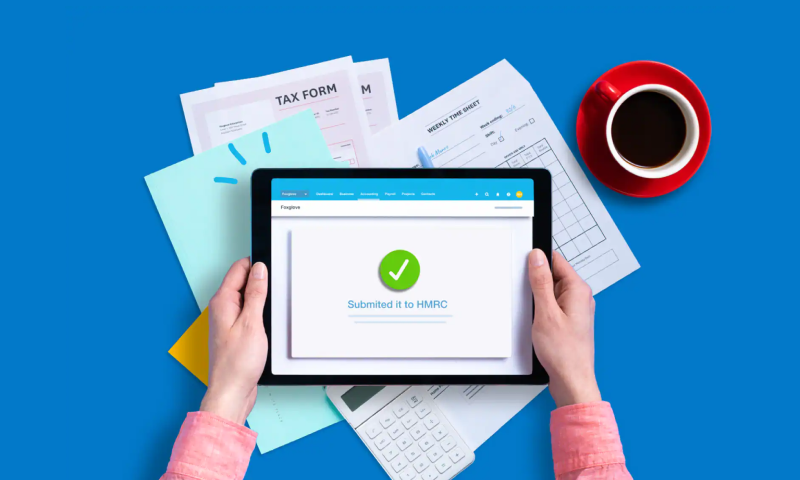

As a small enterprise proprietor attending to grips with what’s wanted to adjust to Making Tax Digital (MTD) for VAT, you’d be forgiven for feeling somewhat overwhelmed by the...

The Monetary Accounting Requirements Board voted so as to add a undertaking to its technical agenda to enhance the accounting for and disclosure of sure digital belongings, similar to...

Making Tax Digital for Earnings Tax Self Evaluation (MTD for ITSA) requires that landlords incomes greater than £10,000 use MTD-compatible software program to maintain information and make submissions to...