The American Institute of CPAs desires the Inside Income Service to choose up the telephone quicker on its so-called Practitioner Precedence Service for tax professionals and make different fixes,...

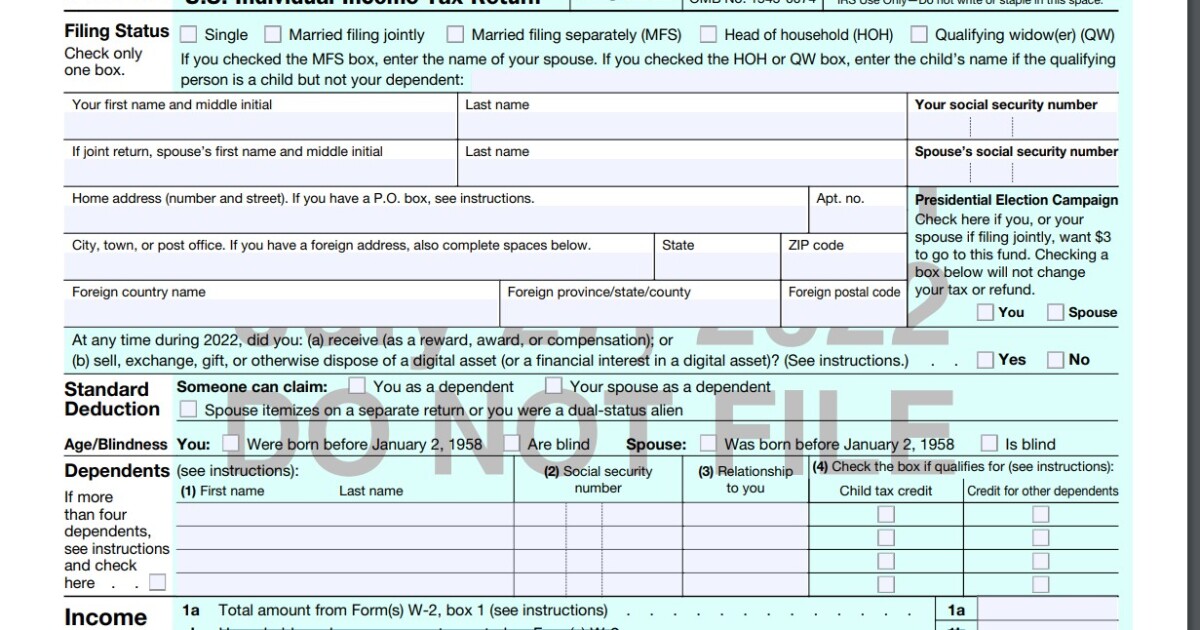

The Inner Income Service has launched a draft model of the Kind 1040 for subsequent tax season, with an expanded query about digital currencies, now known as digital property,...

The Inner Income Service has launched a pattern information safety plan to assist tax professionals develop and implement ones of their very own. All skilled tax preparers are required...

Those that have registered or should register massive vans and buses have till Aug. 31 to file their 2290, “Heavy Freeway Car Use Tax Return,” for autos first utilized in...

Nationwide Taxpayer Advocate Erin Collins is protesting a choice by Inner Income Service officers to postpone implementation of scanning expertise by subsequent tax season to cope with a backlog...

The IRS is constant to hone its filters to catch enterprise identification theft and tax fraud, utilizing 84 choice filters final 12 months to determine enterprise tax returns claiming...

The Inside Income Service needed to work shortly final 12 months to arrange a web-based portal for the expanded Youngster Tax Credit score to permit dad and mom to...

The Inner Income Service admitted that some married {couples} obtained inaccurate steadiness due notices for his or her 2021 tax returns. The IRS added that no fast response to...

The IRS is at the moment issuing Letters 226J assessing penalties for the 2019 reporting 12 months to employers it believes didn’t adjust to Reasonably priced Care Act reporting...

The Inside Income Service is coming underneath fireplace in Congress once more, this time for lax oversight of fraudulent charities that utilized for tax-exempt standing and acquired approval. Home...