The credit score lets residence house owners declare 15% of the renovation price as much as a most of $50,000, doubtlessly permitting them to subtract as a lot as...

What’s a naked belief? The Revenue Tax Act doesn’t particularly outline a naked belief, Chander. The Canada Income Company (CRA) says: “A naked belief for earnings tax functions is...

However when unicorns and hearts make an merchandise costlier than one with dinosaurs or area ships, her mom attracts a line. “I began shopping for extra gender-neutral colors for...

A tax deduction is usually higher than a tax credit score as a result of it reduces your taxable earnings. While you lower your taxable earnings, it’s possible you’ll...

As an investor, reaching market-beating returns won’t all the time be potential, however enhancing your returns via strategic tax discount is a sensible method that Playbook simplifies. A technique...

It seems like you’re conscious you could carry again capital losses, Ramesh. When you have a web capital loss in your 2023 tax return, you’ll be able to carry...

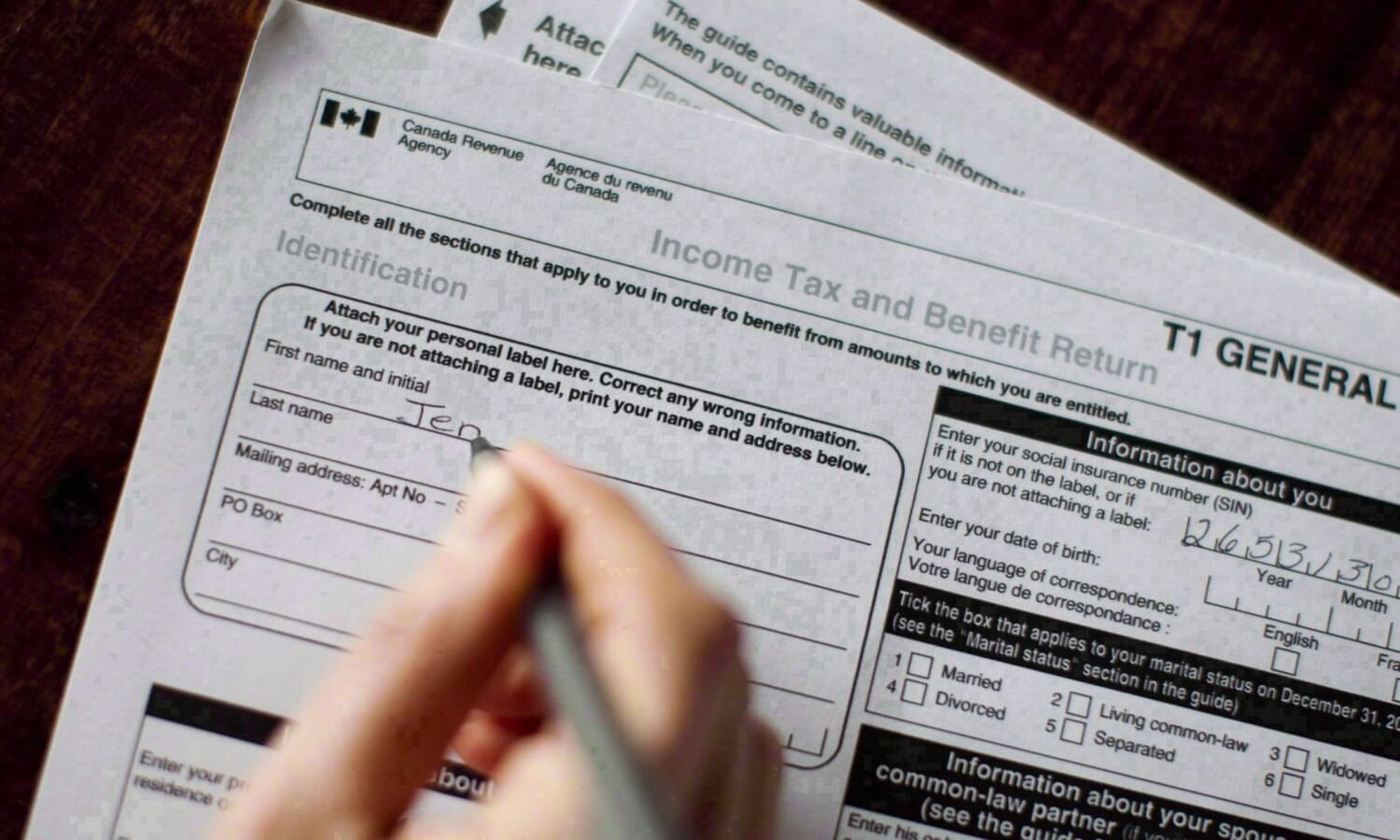

Return to prime. Prepping your taxes, together with the 2022 tax brackets Even when another person does your taxes, you continue to have some prep to do. You’ll have...

They’re locked in as a result of they’re supposed to offer earnings all through your retirement, so you might be restricted in how a lot you’ll be able to...

The fundamental private quantity The age quantity Quantities for partner and dependents Adoption bills CPP and/or QPP contributions Employment insurance coverage premiums Dwelling consumers and residential accessibility quantities Digital...

Main residences vs. secondary properties The tax remedy of actual property in Canada will depend on its use. The house you reside in—your major residence—is generally exempt from capital...