CFOs at main firms expect to pay far more cash for expertise subsequent yr, in line with a current survey from Deloitte.

The agency’s fourth-quarter CFO Sign survey, launched earlier this month, discovered that 97% of the 130 CFOs polled at Fortune 500 firms count on their investments in expertise and labor to considerably improve in 2022. CFOs additionally raised their year-over-year expectations for capital spending, home wages and salaries, and home hiring from the third quarter.

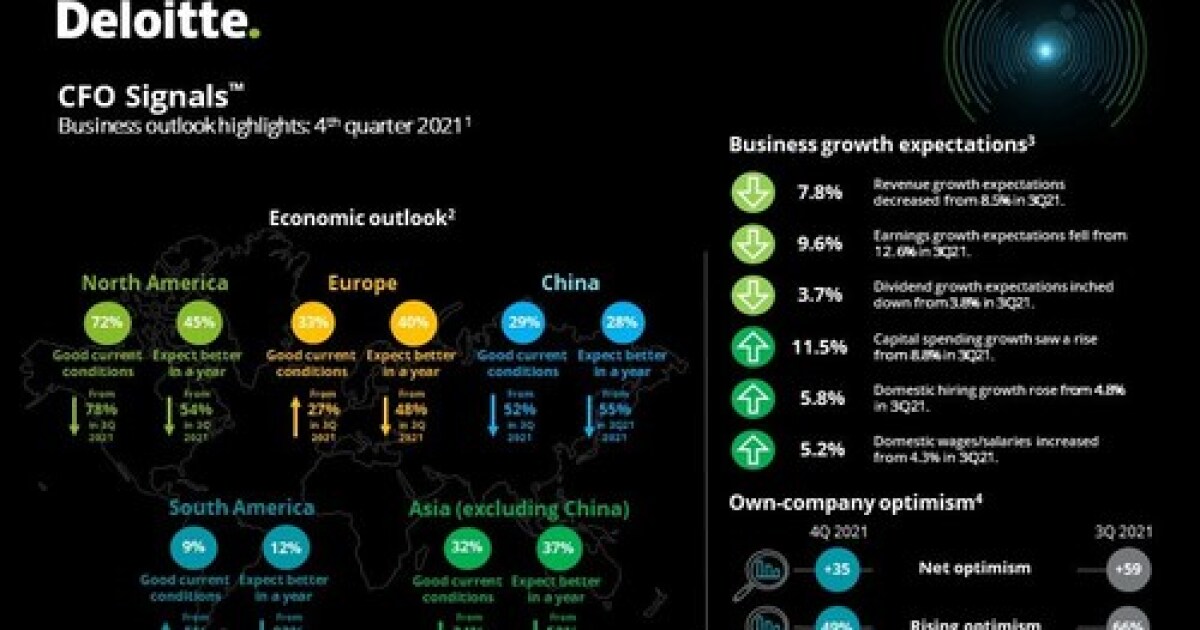

Almost three-quarters (72%) of the CFOs polled by Deloitte rated the present North American financial system nearly as good, down barely from 78% in 3Q21. Slightly below half of CFOs (45%) understand North America’s financial system as higher in a yr, in comparison with 54% within the third quarter of this yr.

“CFOs are barely much less optimistic this quarter, each about their very own firm’s efficiency and for the financial system,” mentioned Steve Gallucci, Deloitte’s North America chief of the CFO Program, in a press release. “Expertise considerations, together with rising labor prices, will seemingly be a defining problem of 2022. Heading into the brand new yr, the organizations that crack the code on attracting and retaining expertise on this turbulent labor market ought to be primed for fulfillment.”

CFO Alerts enterprise outlook highlights for the fourth quarter of 2021

Deloitte

Three-quarters of the CFOs surveyed anticipate the goal rate of interest for U.S. federal funds to extend in 2022 and to vary between 0.26% and 0.5% or 0.51% and 1.0%. Almost half (46%) of finance executives imagine the speed improve will happen within the second quarter, whereas 23% of CFOs every count on the rise to happen in both the primary or third quarter.

“CFOs anticipate that the U.S. Federal Reserve will elevate rates of interest in 2022 however stay divided on simply how excessive the rise shall be,” mentioned Ira Kalish, Deloitte International’s chief international economist, in a press release. “Finally, financial and tax coverage, and the place inflation finally ends up, will play a key function in CFOs’ strategic calculus in 2022.”

Almost all (96%) of the respondents mentioned that the worldwide tax settlement spearheaded by the Group for Financial Co-operation and Growth, which set a minimal company tax charge of 15%, would don’t have any influence on their present offshoring preparations, nor would they make adjustments because of this settlement.

CFOs ranked their relationship with the CEO as an important one for his or her private success. 1 / 4 of CFOs indicated they want to enhance their relationship with enterprise unit leaders essentially the most.