This yr, the best way you handle Single Contact Payroll (STP) will begin to look slightly totally different as we transition to STP Part 2. It will develop how employers report particulars about their workers and their pay to the ATO. With a compliance deadline for Xero prospects set for the tip of this yr, we’ve been busy working to prepare for the transition in Xero Payroll.

The modifications will likely be rolled out in three levels all year long, with the primary stage beginning later this month by way of an opt-in restricted launch. So what’s coming and how are you going to prepare? Let’s take a deeper look.

Remind me, how are the STP Part 2 modifications being put in place this yr?

The modifications are being rolled out in levels to provide you extra time to regulate and get acquainted with STP Part 2. Right here’s when you’ll be able to anticipate to see them go dwell and what will likely be concerned:

- Stage one: The primary stage will begin changing into obtainable inside Xero from later this month (April) onwards by way of a restricted launch earlier than being rolled out over the next months. It will embody updates to the best way new worker information are arrange in payroll.

- Stage two: The second stage will start rolling out inside Xero within the new monetary yr. It will prolong the arrange course of to allow the transition of present worker payroll information to STP Part 2 compliance.

- Stage three: The ultimate stage will likely be obtainable within the second half of this yr. It is going to see the brand new pay objects and depart from STP Part 2 finalised inside Xero, with product help to evaluate present pay objects and depart that will have to be modified to these stipulated by STP Part 2.

Will this variation how I report back to the ATO proper now?

Not but – it’s necessary to notice that each one Xero payroll prospects will proceed to report STP Part 1 in the intervening time. The rollout of STP Part 2 pay objects and updates to the worker setup course of in Xero Payroll is not going to have an effect on reporting or any YTD values despatched to the ATO.

Xero Payroll will proceed to report pay as gross till prospects have accomplished the complete transition later this yr. There are not any impacts or modifications to the STP finalisation course of in July 2022. In the meantime, many of those new pay objects are already obtainable in Xero Payroll, so you will get acquainted with them earlier than the compliance date.

Don’t fear – we’ll be offering help by way of every of the transition levels (each inside your Xero account and thru academic assets). For those who run a small enterprise, your advisor will be capable of present help right now.

What modifications are coming as a part of stage one? And what does it imply for a way I add new workers?

With stage one, the best way you add new workers into Xero will likely be slightly totally different. To be STP Part 2 compliant, each new worker arrange in payroll might want to have extra element on the parts that make up their pay. These embody:

Employment kind – whether or not the person is an worker or contractor.

Revenue kind – components of how the person is paid. These embody:

- Wage and wages (this tends to be most workers, relying on what you are promoting)

- Carefully held payee

- Working vacation maker

- Non-employee (contractor)

- Labour rent (contractor from a labour rent company)

Employment foundation – whether or not the person is full-time, part-time or informal.

Tax scale – you have to to appoint the suitable PAYG tax scale class that determines how a lot tax must be withheld for an worker. These tax scales embody:

- Common

- Actors, selection artists and different entertainers*

- Horticulturalists and shearers*

- Seniors and pensioners

- Working Vacation Maker

*Withholding tax for seniors and pensioners, actors, selection artists and different entertainers, in addition to horticulturalists and shearers will have to be calculated manually (as is the present course of). Xero doesn’t at the moment help the distinctive withholding tax guidelines for these tax scales.

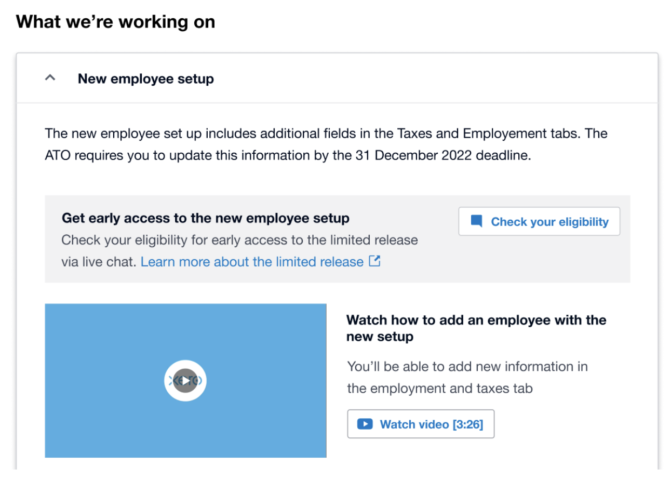

On this video, we present you how you can add an worker with the brand new Single Contact Payroll Part 2 worker arrange:

You talked about intently held payees – what are these once more?

Good query. Carefully held payees (in any other case often known as a intently held worker) are people straight associated to the entity from which they obtain funds. For instance, this would come with kinfolk in a household enterprise or beneficiaries of a belief fund.

Final yr, STP pointers have been up to date so that each one companies should embody intently held payees salaries or wages by way of STP – irrespective of how sometimes they’re included in a pay run.

With STP Part 2, you’ll have to point whether or not an worker is intently held or one of many different earnings varieties. Because of this in case you’ve simply employed your youngster or different relative, like a nephew, for a part-time job, you’ll have to pick them as intently held when setting them up in Xero as soon as stage one kicks in.

What’s a restricted launch and the way do I decide in?

STP Part 2 is necessary and we need to get it proper. Which is why we’re beginning with a restricted launch for stage one and permitting time to check and refine the payroll expertise. This implies a restricted variety of Xero prospects will be capable of enroll and use the brand new STP Part 2 worker setup course of earlier than we roll it out extra broadly. Why? All in order that we are able to make your entire expertise higher for everybody concerned.

That is an opt-in course of – that means it’s important to signal as much as entry it. Head to the worker part of our STP Part 2 Data hub and comply with the directions and it’ll let you recognize in case you’re eligible.

How will I do know after I’ll be capable of use the STP Part 2 new worker arrange?

For those who meet the standards, you’ll be able to register and your account will change over within the following weeks. For everybody else, we’ll begin to transfer you throughout over the following few months. This course of will occur regularly and also you’ll comprehend it’s time when the brand new fields can be found in your worker arrange course of.

Will there be a deadline for opting in?

No, you’ll be able to register at any time, up till the broader launch of stage one.

What if I’m not planning on including a brand new worker any time quickly although?

No want to fret – in case you’re not including any new workers, you won’t even discover the change. It’s helpful to pay attention to this up to date course of, nevertheless, for whenever you do have somebody new becoming a member of the staff.

I’m confused about including contractors into my payroll. What ought to I be doing?

There are just a few alternative ways to handle contractors in Xero. First, a fast refresher on what counts as a contractor. They run their very own enterprise and promote their time and ability as a service to others, not like workers who work inside a enterprise.

Contractors – generally referred to as impartial contractors, sub-contractors or subbies – typically use their very own processes, instruments and strategies to finish the work. They often negotiate their very own charges and dealing preparations, and might work for a couple of shopper at a time.

Inside Xero, contractors could be arrange as a payee at your discretion. For instance, you may do that in the event that they submit timesheets or are entitled to be paid superannuation. In the event that they’re arrange as a payee in Xero Payroll, you’ll have to comply with the brand new STP Part 2 course of.

https://www.youtube.com/watch?v=Qka_oLiXTFA

For extra info on how contractors are outlined, go to the Fairwork web site. For those who’re after recommendation particular to what you are promoting, please attain out to your advisor.

What STP Part 2 updates are already obtainable in Xero?

Most of the pay objects from STP Part 2 are already dwell and able to go in Xero, like bonuses and commissions, new allowance varieties and a wide range of lump sum funds. Whilst you don’t want to make use of these simply but, they’re obtainable in case you’d wish to get a head begin in your STP Part 2 compliance.

For the complete particulars, go to the STP Part 2 Data Hub by way of the Single Contact Payroll part of your Xero account. We’ll proceed to share the standing of latest capabilities as they’re added.

The place can I discover extra info on STP Part 2?

We’ve bought you lined. You possibly can check out the Xero information to STP Part 2 and this useful guidelines. You too can go to Xero Central, or confer with the ATO’s employer reporting pointers.

Maintain an eye fixed out for extra updates from us – we’ll let you recognize what’s altering at each step of the best way. And, after all, don’t hesitate to ask in case you have any questions – we’re all the time right here to assist.