The American Institute of CPAs desires the Inside Income Service to choose up the telephone quicker on its so-called Practitioner Precedence Service for tax professionals and make different fixes,...

The Sarbanes-Oxley Act of 2002 required public firms to arrange inside controls over monetary reporting and have them audited by accounting companies, however with prices rising as a consequence...

Donald Trump stated he is declining to reply questions by the New York legal professional normal, invoking his Fifth Modification proper in opposition to self-incrimination as he sits for...

Draft of the brand new 1040; the wealthy get caught, too; tips on how to communicate accounting; and different highlights from our favourite tax bloggers. Drilling down Institute on...

Former President Donald Trump’s tax returns should be turned over to a congressional committee, a federal appeals courtroom dominated. The U.S. Court docket of Appeals for the District of...

New York-based High 20 Agency CohnReznick LLP and Guidepost Options LLC, a world safety monitoring firm, are serving as integrity screens for the $18 billion John F. Kennedy Worldwide...

The Xero Australia Awards are again for an additional yr! That’s proper, this can be a probability to showcase your achievements, benchmark your online business in opposition to the...

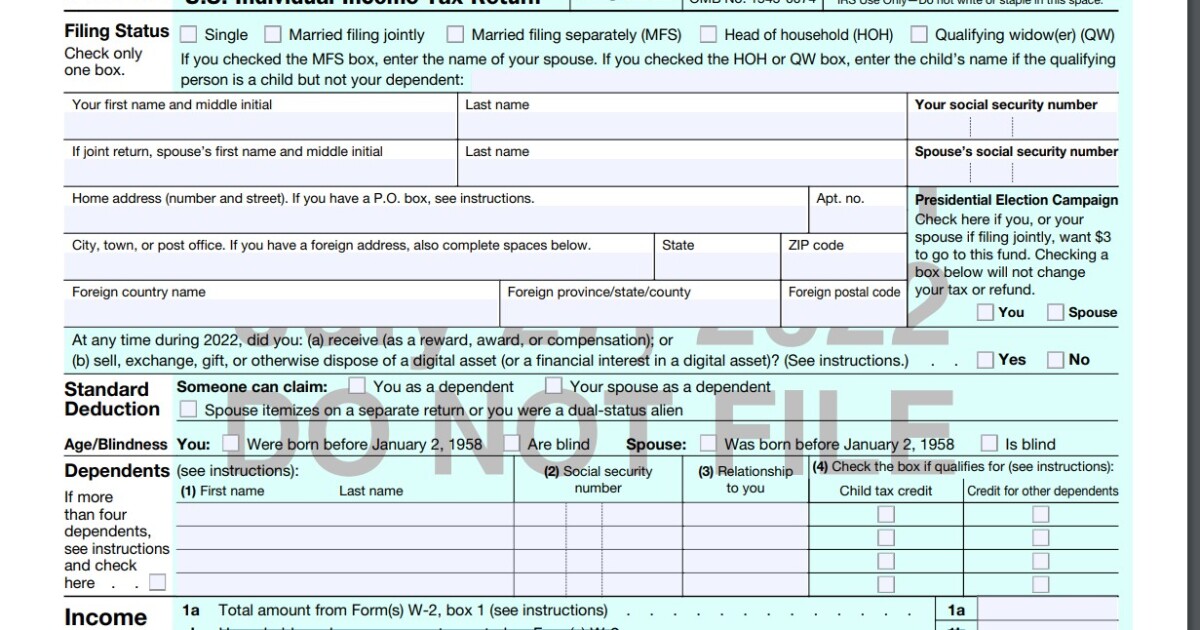

The Inner Income Service has launched a draft model of the Kind 1040 for subsequent tax season, with an expanded query about digital currencies, now known as digital property,...

The Inner Income Service has launched a pattern information safety plan to assist tax professionals develop and implement ones of their very own. All skilled tax preparers are required...

The Home Democrats who had threatened to dam President Joe Biden’s tax and local weather plan until it additionally expanded the deduction for state and native taxes are actually...