Dallas, Texas, Aug. 15, 2022 (GLOBE NEWSWIRE) — At a projected CAGR of 15.0% in the course of the forecast interval, the dimensions of the worldwide E-learning Company Compliance...

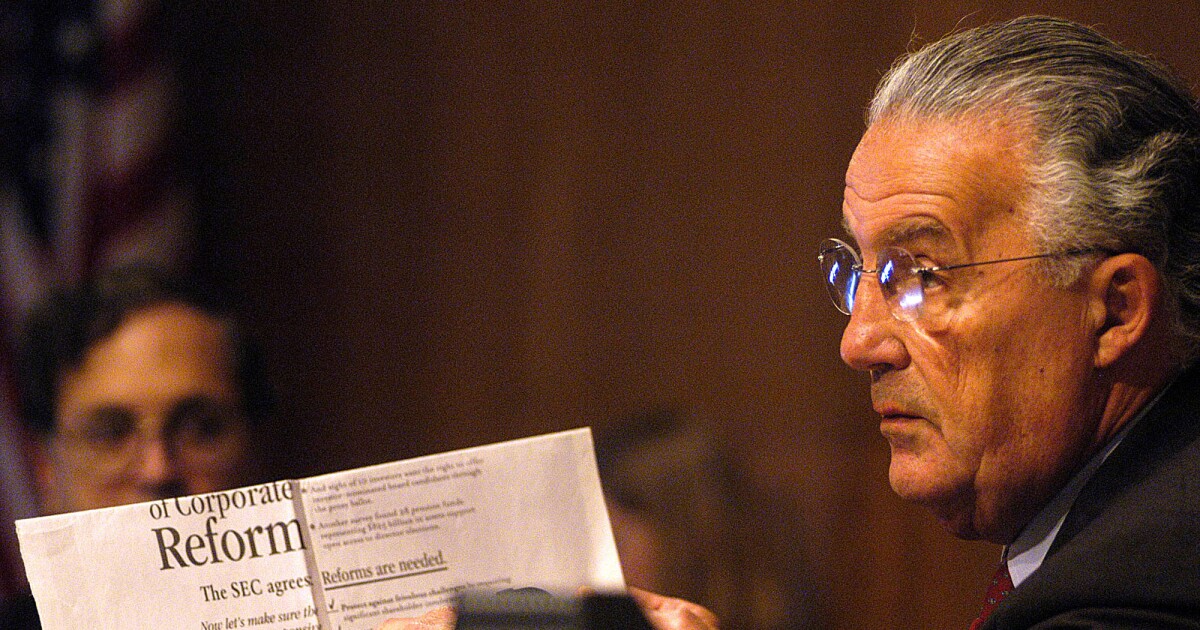

The Sarbanes-Oxley Act of 2002 required public firms to arrange inside controls over monetary reporting and have them audited by accounting companies, however with prices rising as a consequence...

The World E-learning Company Compliance Coaching Market report focuses on a complete evaluation of the latest and future prospects of the E-learning Company Compliance Coaching business. An in-depth evaluation...

The International E-learning Company Compliance Coaching Market report focuses on a complete evaluation of the latest and future prospects of the E-learning Company Compliance Coaching business. An in-depth evaluation...

With tax groups much less and fewer concerned in routine compliance features, the fashionable tax skilled and their atmosphere is more and more outlined by know-how, which necessitates the...

Newest revealed market examine on E-learning Company Compliance Coaching Market gives an outline of the present market dynamics within the E-learning Company Compliance Coaching area, in addition to what...

Tax practitioners must be prepared for growing compliance and enforcement efforts by tax authorities. These abated considerably because of the pandemic, however at the moment are on the rise,...

20 years after passage of the Sarbanes-Oxley Act, public firms are spending extra money and time making an attempt to adjust to SOX necessities, regardless of the growing use...

The Inside Income Service’s Worker Plans perform is pilot-testing a brand new pre-examination retirement plan compliance program, beginning this month, as a option to shorten the size of time...

Congress gave billions of {dollars} in tax credit to employers in response to the COVID-19 pandemic that helped pay for offering paid sick and household go away and retaining...