This above is a simple-math calculation of the capital achieve. However, can also dive even deeper to cut back the quantity of capital beneficial properties you’ll declare in your...

So, if you’re unsure of the worth on the time of your acquisition, you can usually decide this from the deceased’s closing tax return or property info return for...

The result’s that whenever you promote or switch your cottage, or upon the latter of your or your partner’s loss of life, capital positive factors tax could also be...

Is there GST on land gross sales? First, whenever you promote actual property, together with vacant land, Devon, there could also be earnings tax implications, like capital positive aspects...

Accordingly, capital features tax might not apply on the time of switch. Although the properties might have been legally held collectively by the 2 of you, the properties might...

What are capital positive aspects? A capital acquire happens while you promote an asset or funding at a better worth than its authentic buy value, which means you earn...

Capital features tax when separating or divorcing When spouses separate or divorce, there’s typically an equalization of internet household property and a switch of property between them. Spousal or...

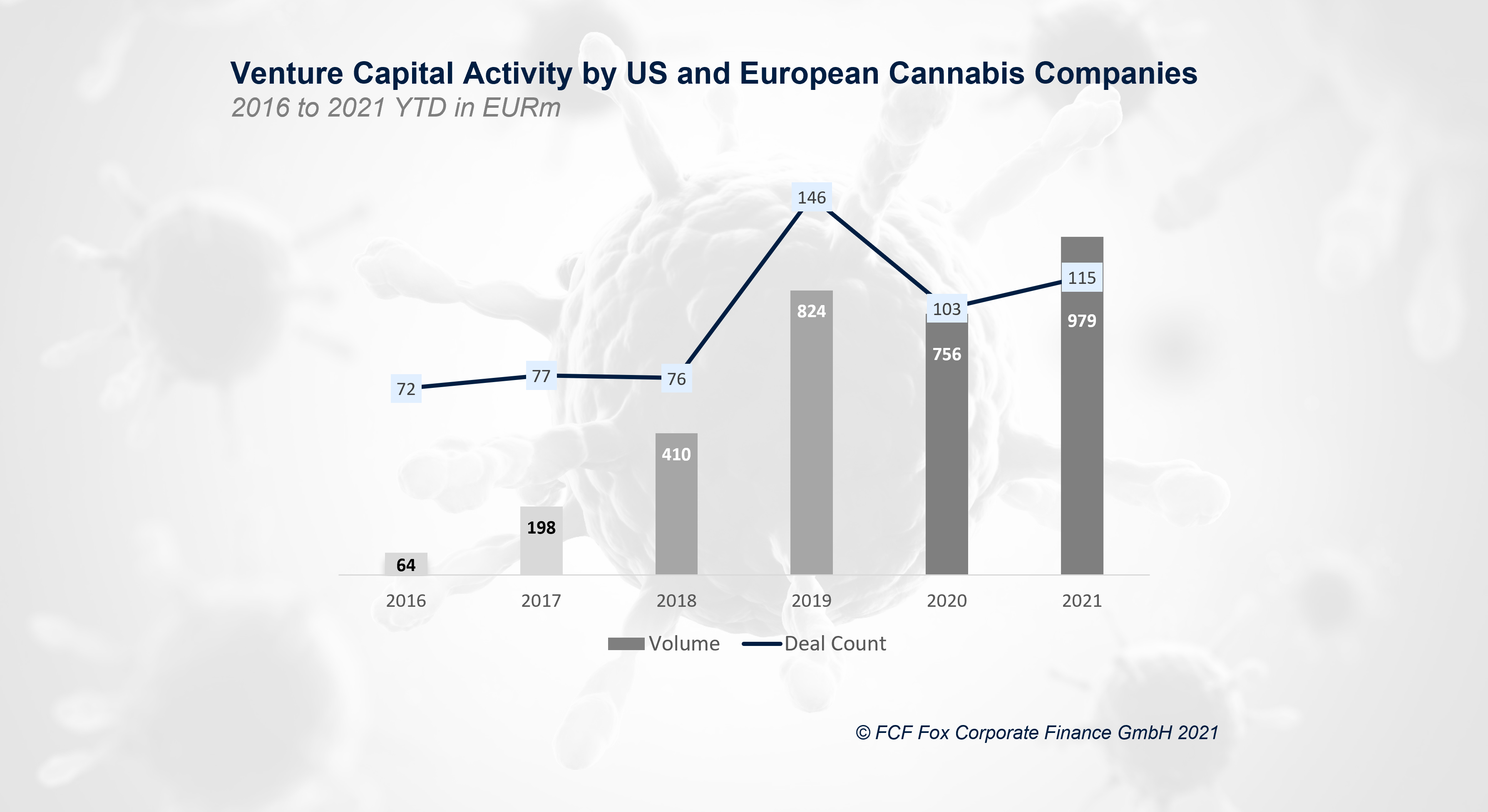

Funding into US and European hashish corporations have been constantly growing over the previous years. Whereas 72 enterprise capital transactions had been performed in 2016, the variety of transactions...