Small companies are extra involved about inflation than ever earlier than, with 90% sharing that they worry the affect of inflation on their enterprise, in keeping with a brand...

The Part 179D Vitality Environment friendly Business Constructing Deduction supplies a deduction of as much as $1.88 per sq. foot for each constructing homeowners who assemble new or renovate...

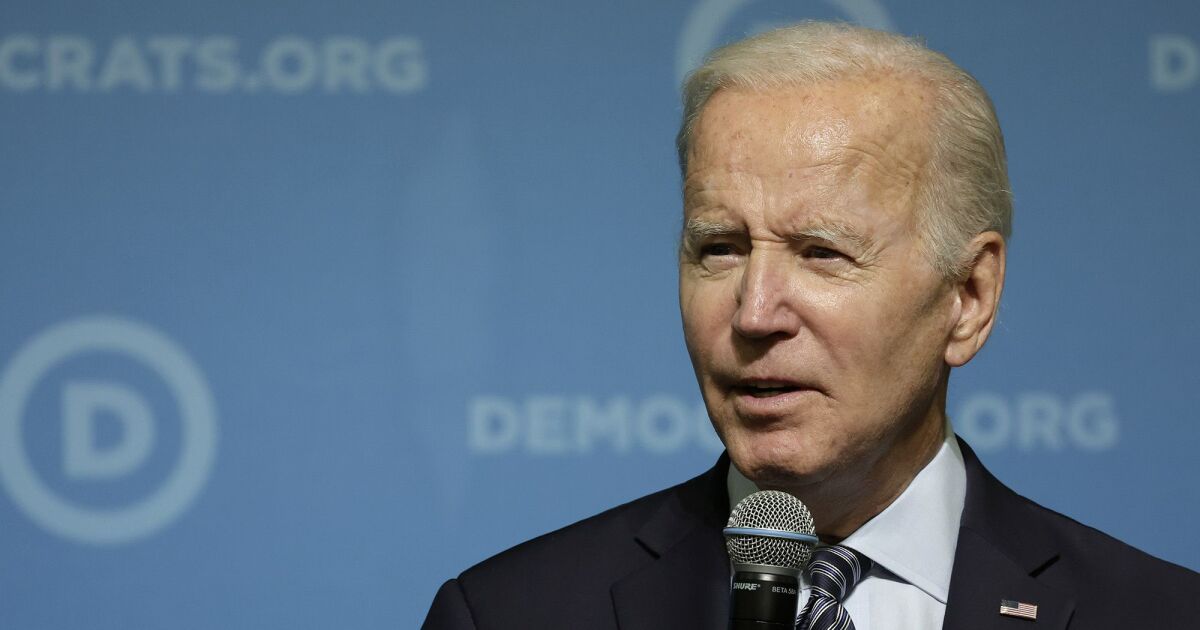

President Joe Biden ignored worse-than-expected U.S. inflation knowledge that roiled markets throughout a deliberate celebration for his signature climate-and-tax legislation. The legislation Biden celebrated Tuesday is known as the...

The best inflation price in many years is more likely to produce main will increase on some tax gadgets, in accordance with predictions from Bloomberg Tax. The corporate launched...

Xero has launched a report with insights from the worldwide small enterprise expertise platform on U.S. small companies’ financial efficiency and the way inflation has impacted them since 2017. ...

In an effort to increase the affordability of energy-efficient automobiles for U.S. customers, the Inflation Discount Act made modifications to the tax credit score for all-electric vehicles and hybrid...

The Inflation Discount Act that President Biden signed into regulation this week has a lesser recognized provision that would profit many small enterprise startups, permitting them to doubtlessly double...

Part 45L of the Inner Income Code supplies each single and multifamily homebuilders with a $2,000 tax credit score for assembly sure power saving necessities. Nevertheless, the 45L tax...

Underneath the Inflation Discount Act, each present and expired power effectivity tax incentives for business and multifamily constructing homeowners, buyers, builders and homebuilders have been expanded considerably. Enhance and...

Like all companies, accounting companies are confronting the pressures of inflation. A number of the inflationary value will increase could be handed by way of fully, some could be...