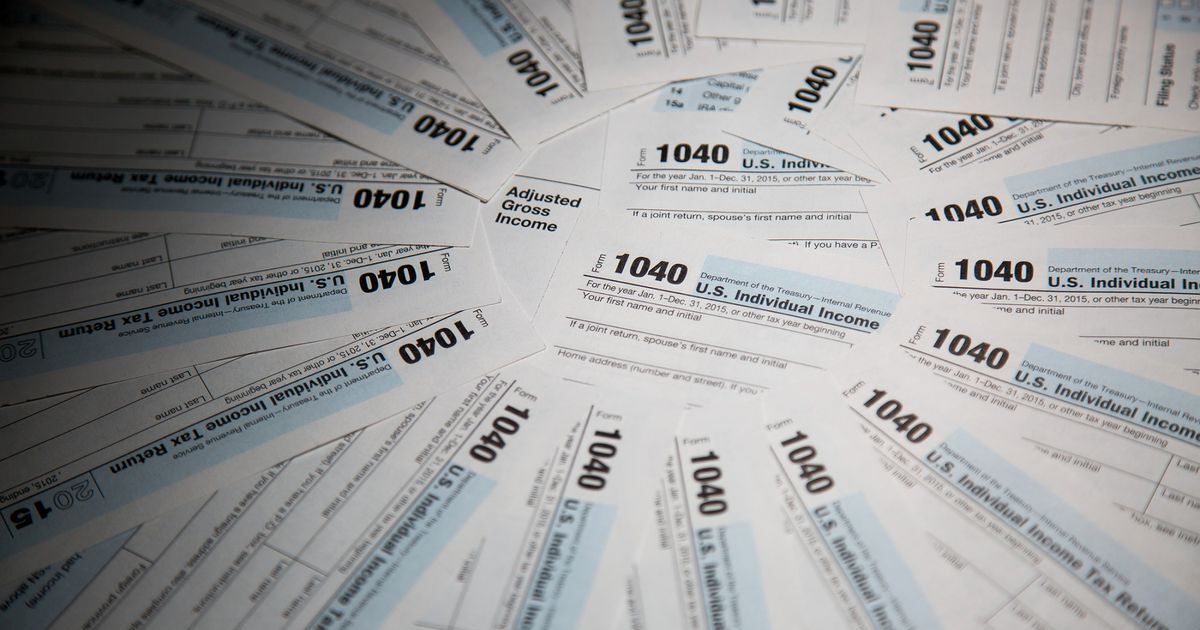

Tax preparers really thought this 12 months’s submitting season went just a little smoother than anticipated. That’s the consensus from a current survey from the Nationwide Affiliation of Tax...

Congress gave billions of {dollars} in tax credit to employers in response to the COVID-19 pandemic that helped pay for offering paid sick and household go away and retaining...

Pupil athletes who at the moment are allowed to attain profitable endorsement offers for his or her identify, picture and likeness could nicely encounter shock tax payments. Final July,...

The hospitality business is not any stranger to new challenges. From pandemic restrictions to Making Tax Digital (MTD), hospitality companies have needed to keep agile and adapt to many...

It’s laborious to overstate how damaging the worldwide pandemic was for native pubs. Many of those companies are establishments – not merely a spot to get a chilly pint,...

As a small enterprise proprietor attending to grips with what’s wanted to adjust to Making Tax Digital (MTD) for VAT, you’d be forgiven for feeling somewhat overwhelmed by the...

Worldwide tax officers have recognized greater than 50 results in potential crypto tax crimes which will result in official investigations within the coming weeks, together with one case that...

Victims of wildfires and straight-line winds that started in New Mexico on April 5 now have till late summer time to file varied federal particular person and enterprise returns...

Making Tax Digital for Earnings Tax Self Evaluation (MTD for ITSA) requires that landlords incomes greater than £10,000 use MTD-compatible software program to maintain information and make submissions to...

Royal ache; cashing out; midnight on the Oasis; and different highlights of current tax instances. Dallas: Tax advisor Steven Jalloul, a Liberian nationwide who orchestrated a scheme to safe...